Spotlight On 3 Promising Penny Stocks With Over US$500M Market Cap

Reviewed by Simply Wall St

Global markets have been experiencing a wave of optimism, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, despite geopolitical tensions and tariff concerns. In this context, penny stocks—though an outdated term—remain a relevant investment area for those interested in smaller or newer companies that may offer unexpected opportunities. By focusing on financial strength and potential growth trajectories, investors can uncover promising prospects among these lesser-known equities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.19 | £825.11M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.275 | £425.17M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.69 | £70.37M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$6.85 billion.

Operations: The company's revenue is primarily generated from its Peripheral Vascular Diseases Business at CN¥725.13 million, followed by the Structural Heart Diseases Business at CN¥523.01 million, and the Cardiac Pacing and Electrophysiology Business contributing CN¥32.36 million.

Market Cap: HK$6.85B

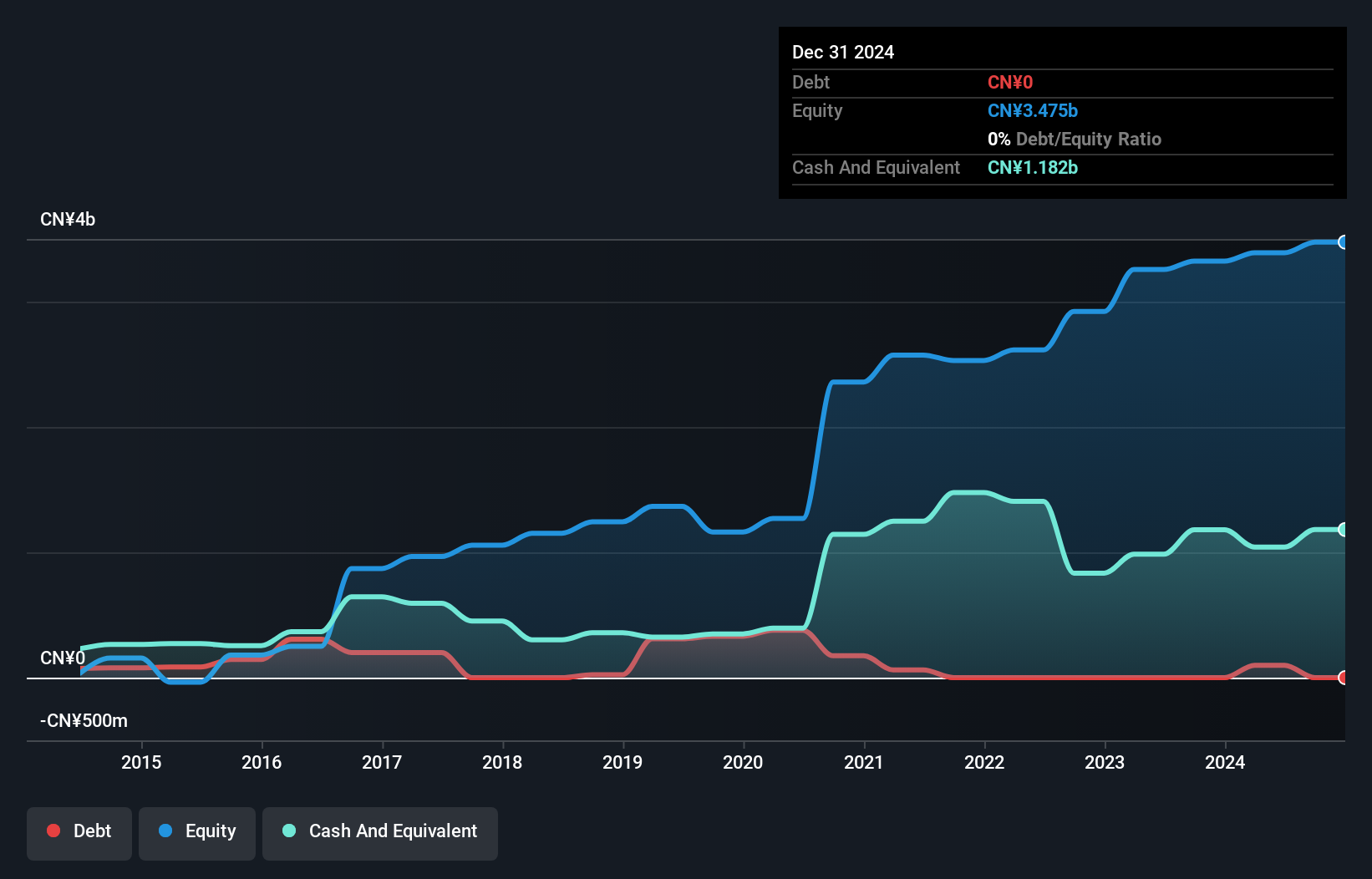

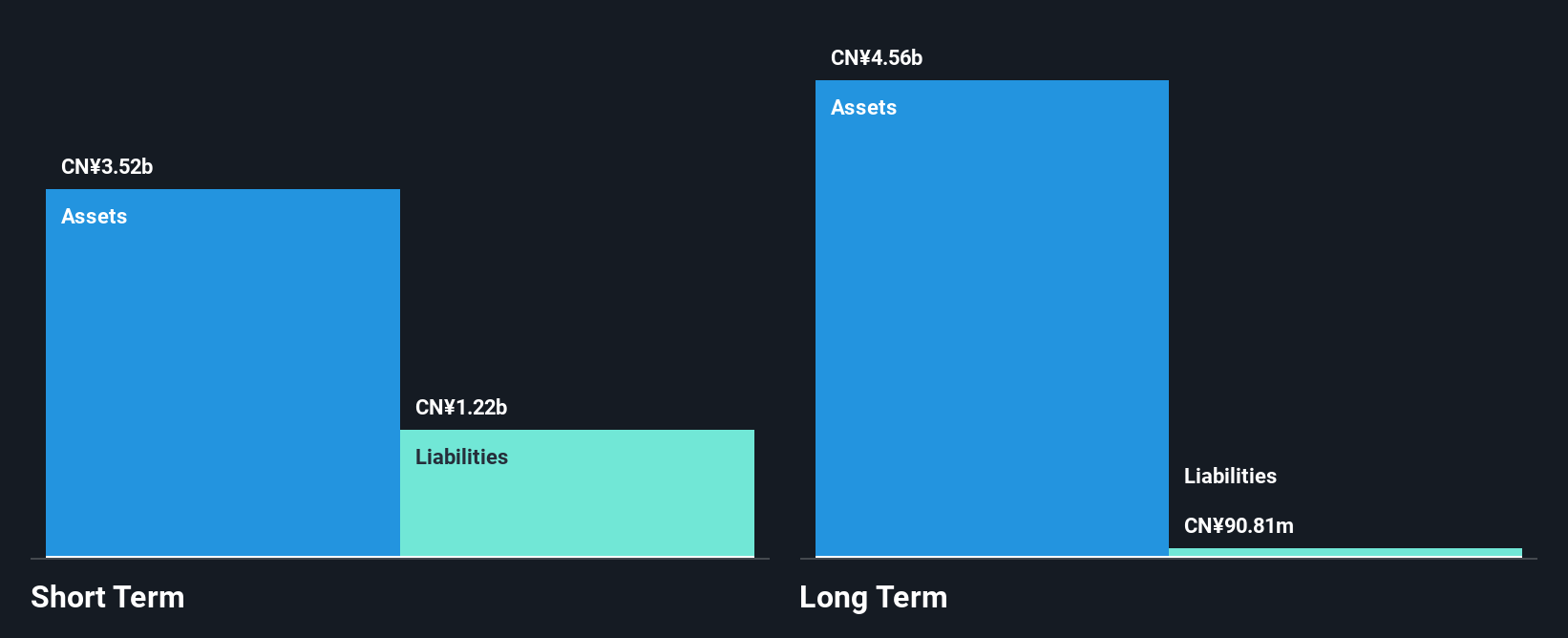

LifeTech Scientific Corporation's financial health is underscored by its strong cash position, exceeding total debt, and operating cash flow that comfortably covers its debt obligations. Despite a one-off loss of CN¥139.3 million impacting recent results, the company maintains robust short-term asset coverage over liabilities and has reduced its debt-to-equity ratio significantly over five years. However, negative earnings growth last year contrasts with a 14.1% annual profit increase over five years, indicating volatility in performance. The seasoned board provides stability amidst challenges such as declining profit margins and low return on equity at 2.4%.

- Click here and access our complete financial health analysis report to understand the dynamics of LifeTech Scientific.

- Explore LifeTech Scientific's analyst forecasts in our growth report.

Shenzhen Jinjia GroupLtd (SZSE:002191)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Jinjia Group Co., Ltd. is involved in the research, development, and production of packaging materials in China, with a market cap of CN¥6.46 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥3.18 billion.

Market Cap: CN¥6.46B

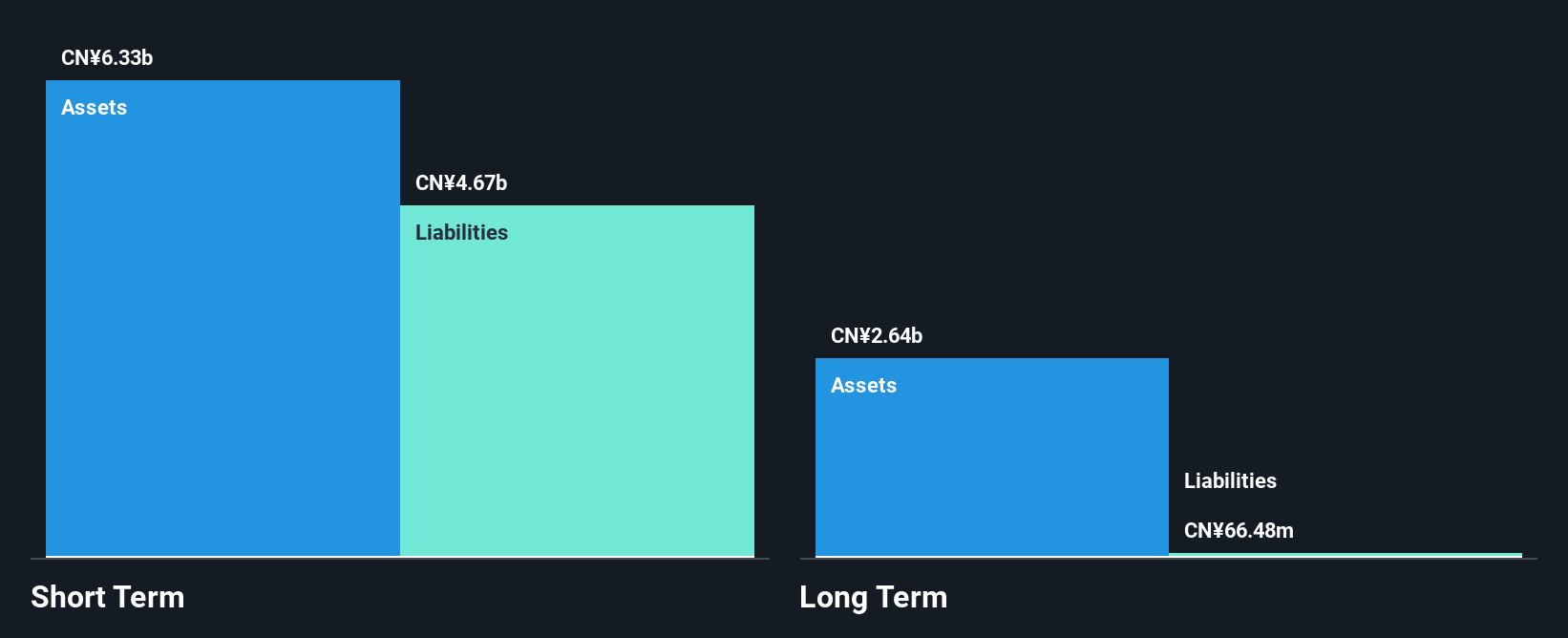

Shenzhen Jinjia Group Co., Ltd. has maintained a stable financial position with cash exceeding total debt and short-term assets of CN¥3.9 billion surpassing both short- and long-term liabilities. Despite becoming profitable recently, the company reported declining earnings over the past five years, impacted by a significant one-off loss of CN¥244.9 million in recent financial results. The dividend yield of 6.56% is not well supported by earnings or free cash flow, raising sustainability concerns. While its board is experienced, the company's return on equity remains low at 0.3%, reflecting challenges in generating shareholder value amidst stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of Shenzhen Jinjia GroupLtd.

- Gain insights into Shenzhen Jinjia GroupLtd's future direction by reviewing our growth report.

Puyang Refractories Group (SZSE:002225)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Puyang Refractories Group Co., Ltd. operates in the research, development, production, and sales of shaped, unshaped, and functional refractory products both in China and internationally with a market cap of CN¥4.31 billion.

Operations: No specific revenue segments are reported for Puyang Refractories Group Co., Ltd.

Market Cap: CN¥4.31B

Puyang Refractories Group Co., Ltd. faces challenges with declining earnings, reporting a net income of CN¥122.9 million for the first nine months of 2024, down from CN¥207.65 million the previous year. Despite trading significantly below estimated fair value, its financial health is strained by a high debt-to-equity ratio of 54.7% and low return on equity at 4.6%. The company's interest payments are adequately covered by EBIT, and short-term assets exceed liabilities, providing some financial stability. However, profit margins have decreased to 3%, impacted by large one-off items in recent results, complicating profitability assessments amidst industry headwinds.

- Click to explore a detailed breakdown of our findings in Puyang Refractories Group's financial health report.

- Gain insights into Puyang Refractories Group's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Discover the full array of 5,705 Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002225

Puyang Refractories Group

Engages in the research, development, production, and sales of shaped, unshaped, and functional refractory products in China and internationally.

Slight risk with moderate growth potential.

Market Insights

Community Narratives