Discovering Hidden Opportunities In Undiscovered Gems December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the S&P 600 for small-cap stocks joining its peers in unprecedented territory, investors are keenly observing how geopolitical developments and economic indicators impact market sentiment. Amidst this backdrop, discovering hidden opportunities in less prominent stocks can be particularly rewarding, as these "undiscovered gems" often possess unique attributes that align well with current market conditions—such as resilience to trade tensions or strong fundamentals despite broader manufacturing slumps.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.88% | -13.58% | 13.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Harbin Pharmaceutical Group (SHSE:600664)

Simply Wall St Value Rating: ★★★★☆☆

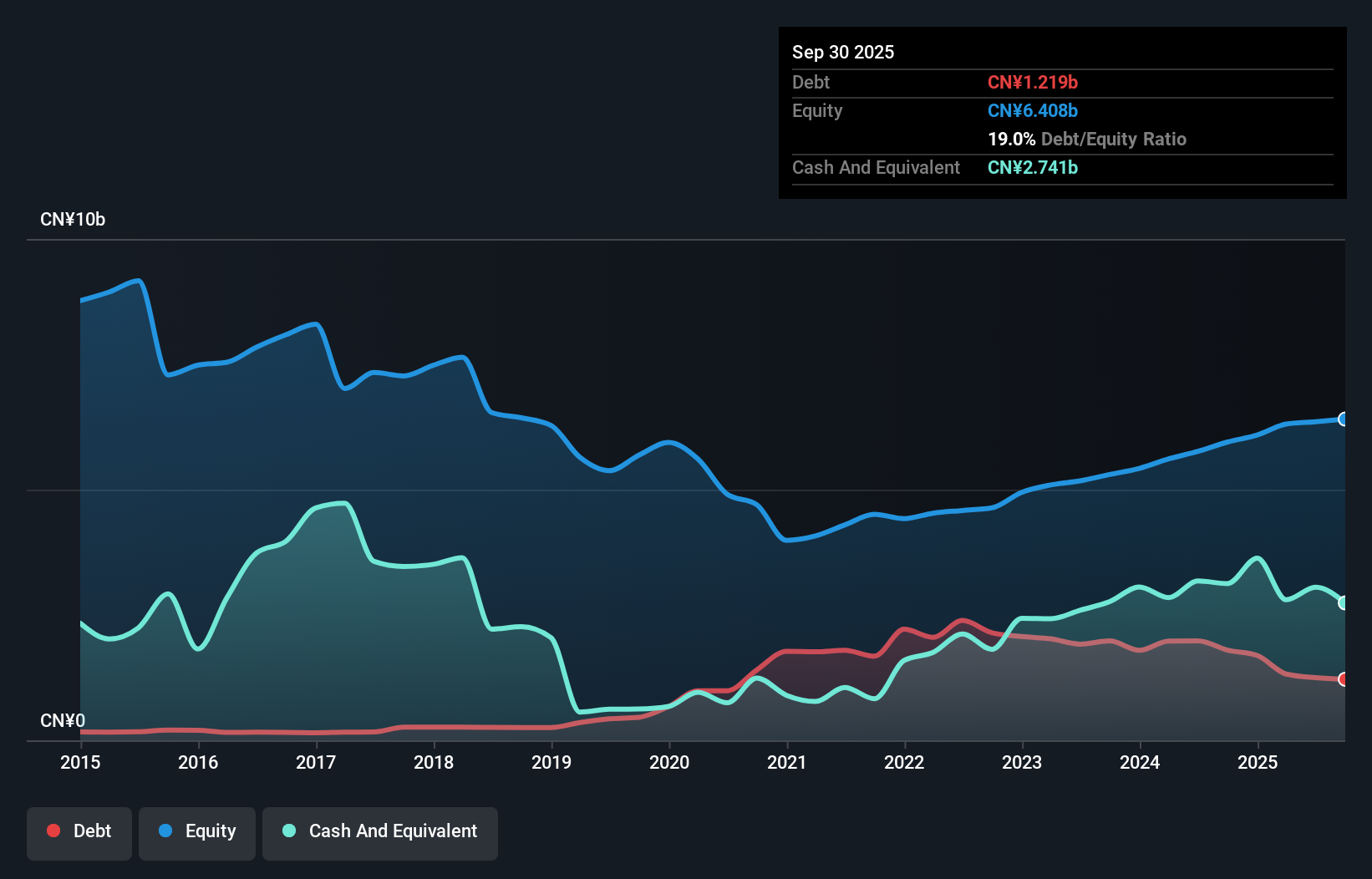

Overview: Harbin Pharmaceutical Group Co., Ltd. is involved in the research, development, manufacture, and trading of pharmaceuticals both in China and internationally, with a market cap of approximately CN¥9.70 billion.

Operations: Harbin Pharmaceutical Group generates revenue primarily through the sale of pharmaceuticals. The company's financial performance is influenced by its cost structure, where raw material costs and manufacturing expenses play significant roles. Gross profit margin trends provide insights into the company's pricing strategies and cost management effectiveness over time.

Harbin Pharma, a smaller player in the pharmaceutical sector, offers an intriguing profile with its earnings growth of 2.3% over the past year, outpacing the industry's -2.5%. Its price-to-earnings ratio of 15.8x is notably below China's market average of 36.3x, indicating potential undervaluation. Despite a rise in its debt-to-equity ratio from 8.1% to 30.2% over five years, Harbin holds more cash than total debt and boasts strong interest coverage at 146x EBIT to interest payments—a robust indicator of financial health with high-quality earnings contributing to this stability.

- Dive into the specifics of Harbin Pharmaceutical Group here with our thorough health report.

Gain insights into Harbin Pharmaceutical Group's past trends and performance with our Past report.

Yunnan Nantian Electronics InformationLtd (SZSE:000948)

Simply Wall St Value Rating: ★★★★☆☆

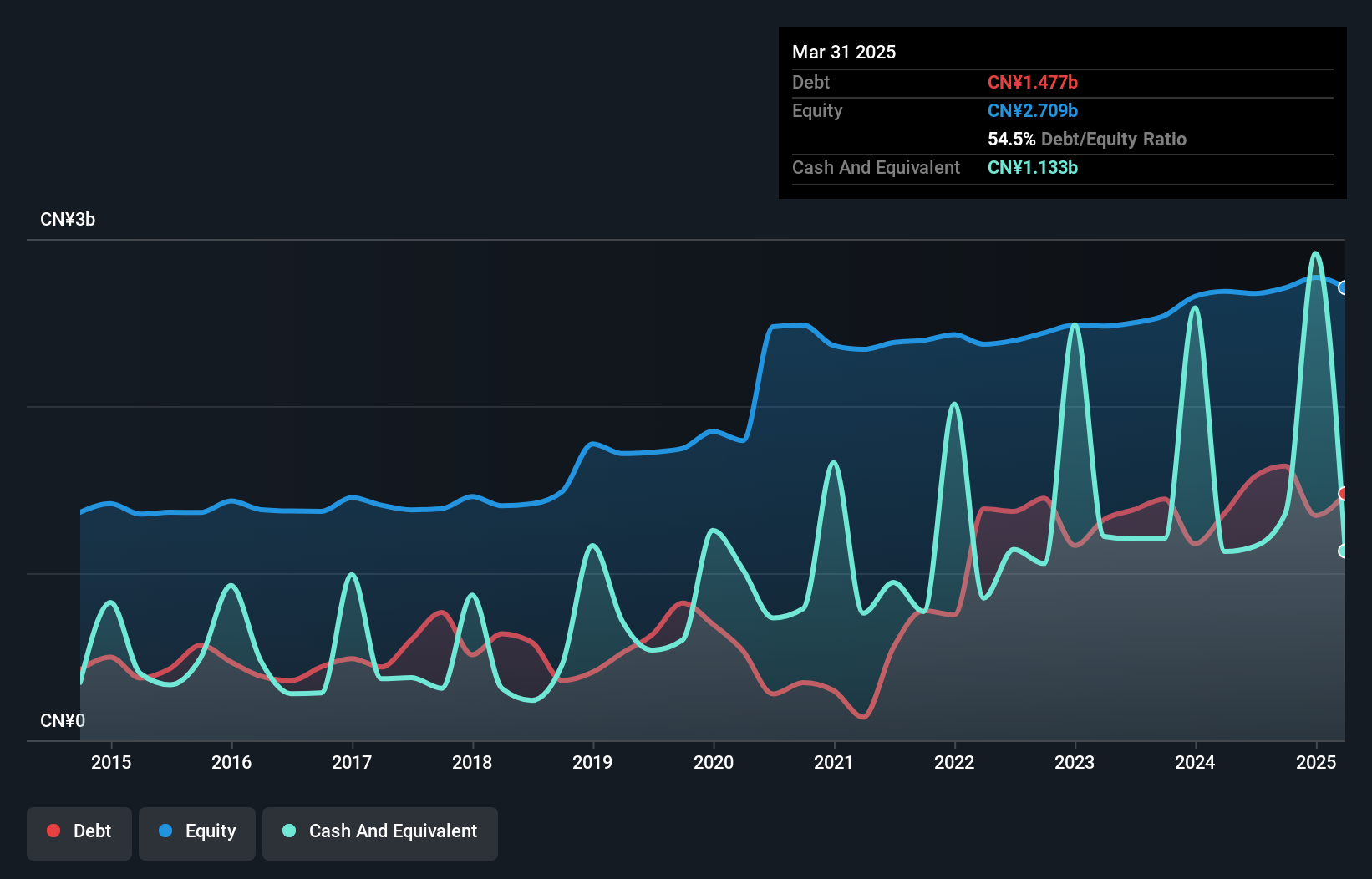

Overview: Yunnan Nantian Electronics Information Co., Ltd. operates in the software and information technology services sector, with a market capitalization of approximately CN¥7.54 billion.

Operations: The company generates revenue primarily from its software and information technology services segment, amounting to approximately CN¥9.28 billion.

Yunnan Nantian Electronics Information Ltd. seems to be making strides in the IT sector, with earnings growth of 7.9% over the past year, outpacing an industry decline of 8.1%. The company's debt profile shows a net debt to equity ratio at a satisfactory 10.5%, although its overall debt to equity has risen from 47% to 60.6% over five years. Despite recent share price volatility, it offers good value with a price-to-earnings ratio of 47.3x, notably lower than the industry average of 75.3x, and interest payments are well-covered by EBIT at a multiple of nearly sixteen times coverage.

- Delve into the full analysis health report here for a deeper understanding of Yunnan Nantian Electronics InformationLtd.

Understand Yunnan Nantian Electronics InformationLtd's track record by examining our Past report.

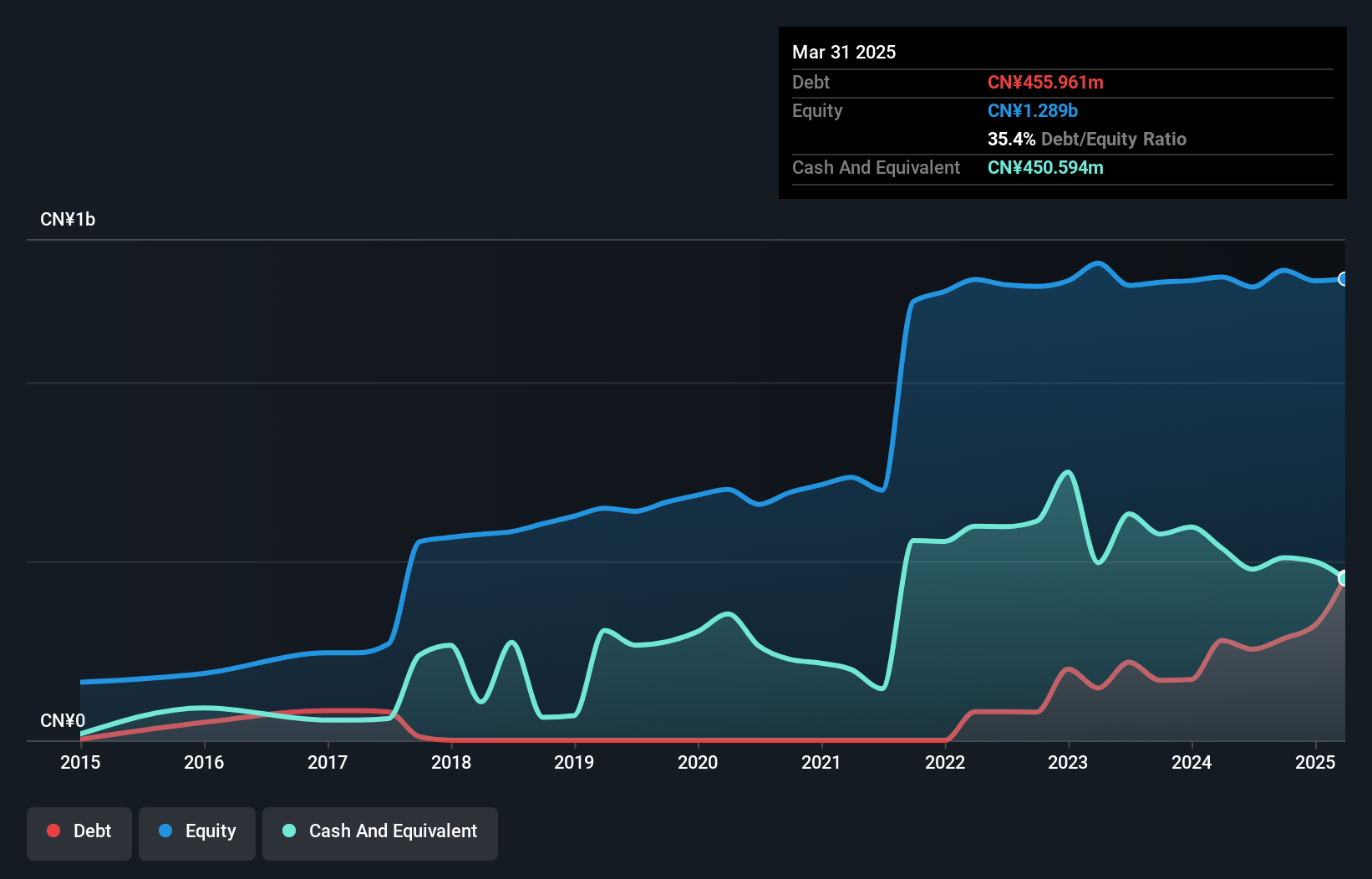

Keli Motor Group (SZSE:002892)

Simply Wall St Value Rating: ★★★★★☆

Overview: Keli Motor Group Co., Ltd. focuses on the research, development, manufacture, and sale of micro motors in China with a market capitalization of CN¥9.63 billion.

Operations: Keli Motor Group generates revenue primarily from the sale of micro motors. The company's financial performance is influenced by its cost structure, with a focus on managing production expenses to optimize profitability.

Keli Motor Group, a compact player in the automotive sector, has seen its earnings grow by 28.5% over the past year, outpacing the broader electrical industry’s 1.1%. Despite this growth, its debt-to-equity ratio climbed to 21.7% from zero over five years, indicating a shift in financial strategy. The company recently repurchased shares worth CNY 9.99 million as part of a buyback program aimed at employee incentives. Keli's net income for the first nine months of 2024 was CNY 70.71 million compared to CNY 42.4 million last year, showcasing improved profitability despite previous declines averaging 12.2% annually over five years.

Next Steps

- Get an in-depth perspective on all 4626 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000948

Yunnan Nantian Electronics InformationLtd

Yunnan Nantian Electronics Information Co.,Ltd.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives