- China

- /

- Metals and Mining

- /

- SZSE:002171

Potential Upside For Anhui Truchum Advanced Materials and Technology Co., Ltd. (SZSE:002171) Not Without Risk

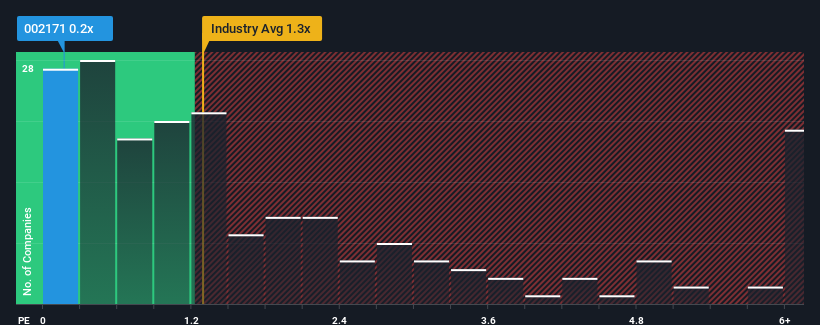

Anhui Truchum Advanced Materials and Technology Co., Ltd.'s (SZSE:002171) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Metals and Mining industry in China have P/S ratios greater than 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Anhui Truchum Advanced Materials and Technology

What Does Anhui Truchum Advanced Materials and Technology's P/S Mean For Shareholders?

Anhui Truchum Advanced Materials and Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anhui Truchum Advanced Materials and Technology.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Anhui Truchum Advanced Materials and Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Pleasingly, revenue has also lifted 61% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 11% over the next year. Meanwhile, the rest of the industry is forecast to expand by 13%, which is not materially different.

In light of this, it's peculiar that Anhui Truchum Advanced Materials and Technology's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Anhui Truchum Advanced Materials and Technology's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Anhui Truchum Advanced Materials and Technology remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Anhui Truchum Advanced Materials and Technology (at least 1 which is concerning), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Anhui Truchum Advanced Materials and Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002171

Anhui Truchum Advanced Materials and Technology

Anhui Truchum Advanced Materials and Technology Co., Ltd.

Proven track record and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success