Xiangtan Electrochemical ScientificLtd's (SZSE:002125) five-year total shareholder returns outpace the underlying earnings growth

The Xiangtan Electrochemical Scientific Co.,Ltd (SZSE:002125) share price has had a bad week, falling 15%. Looking further back, the stock has generated good profits over five years. After all, the share price is up a market-beating 88% in that time.

While the stock has fallen 15% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Xiangtan Electrochemical ScientificLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

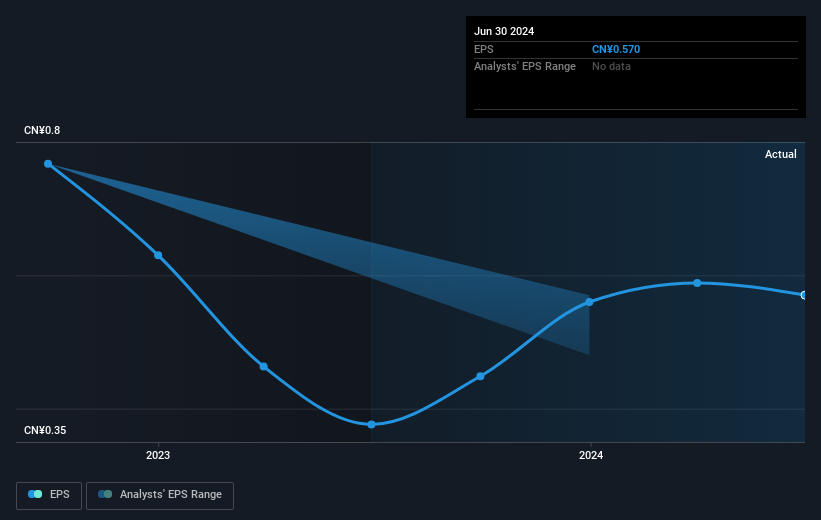

During five years of share price growth, Xiangtan Electrochemical ScientificLtd achieved compound earnings per share (EPS) growth of 28% per year. The EPS growth is more impressive than the yearly share price gain of 13% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Xiangtan Electrochemical ScientificLtd's key metrics by checking this interactive graph of Xiangtan Electrochemical ScientificLtd's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Xiangtan Electrochemical ScientificLtd's TSR for the last 5 years was 94%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 0.6% in the twelve months, Xiangtan Electrochemical ScientificLtd shareholders did even worse, losing 7.8% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 14% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Xiangtan Electrochemical ScientificLtd you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002125

Xiangtan Electrochemical ScientificLtd

Engages in the research and development, production, and sale of battery materials.

Flawless balance sheet with solid track record.