Shaanxi Xinghua ChemistryLtd (SZSE:002109) adds CN¥523m to market cap in the past 7 days, though investors from three years ago are still down 28%

It is a pleasure to report that the Shaanxi Xinghua Chemistry Co.,Ltd (SZSE:002109) is up 45% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 32% in the last three years, significantly under-performing the market.

The recent uptick of 13% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Shaanxi Xinghua ChemistryLtd

Shaanxi Xinghua ChemistryLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Shaanxi Xinghua ChemistryLtd grew revenue at 8.6% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 10% per year, for three years. This implies the market had higher expectations of Shaanxi Xinghua ChemistryLtd. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

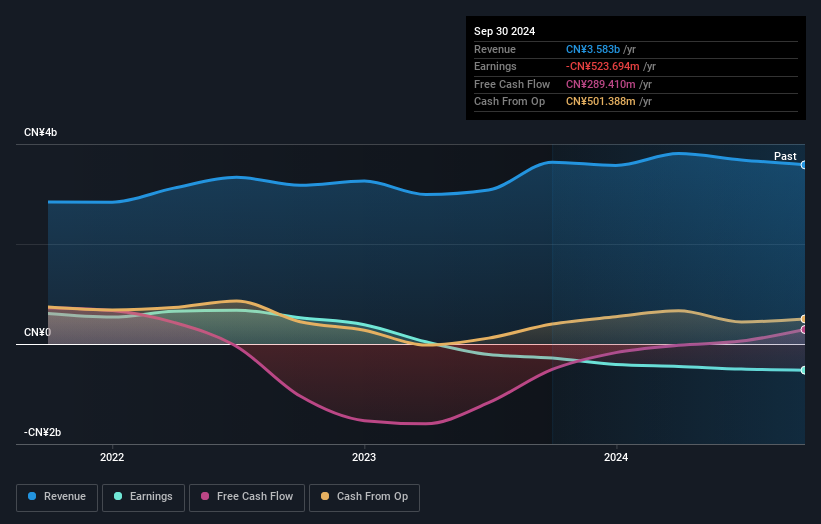

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Shaanxi Xinghua ChemistryLtd's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Shaanxi Xinghua ChemistryLtd's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Shaanxi Xinghua ChemistryLtd shareholders, and that cash payout explains why its total shareholder loss of 28%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in Shaanxi Xinghua ChemistryLtd had a tough year, with a total loss of 27%, against a market gain of about 4.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Shaanxi Xinghua ChemistryLtd better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Shaanxi Xinghua ChemistryLtd (including 2 which are significant) .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002109

Shaanxi Xinghua ChemistryLtd

Produces and sells ammonium nitrate products primarily in China.

Low and overvalued.