As of May 2024, the Chinese stock market has shown signs of recovery, buoyed by optimistic holiday spending and positive trade data. This resurgence presents an interesting backdrop for investors looking to explore dividend stocks in China, which can offer potential income in addition to capital appreciation opportunities. In this context, understanding what constitutes a good dividend stock involves considering not only the yield but also the stability and growth prospects of the company within these improving market conditions.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 5.66% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.32% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.30% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.64% | ★★★★★★ |

| Jiangsu Yanghe Brewery (SZSE:002304) | 4.86% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.37% | ★★★★★★ |

| Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327) | 5.33% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.28% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.56% | ★★★★★★ |

Click here to see the full list of 178 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Xiamen Xiangyu (SHSE:600057)

Simply Wall St Dividend Rating: ★★★★☆☆

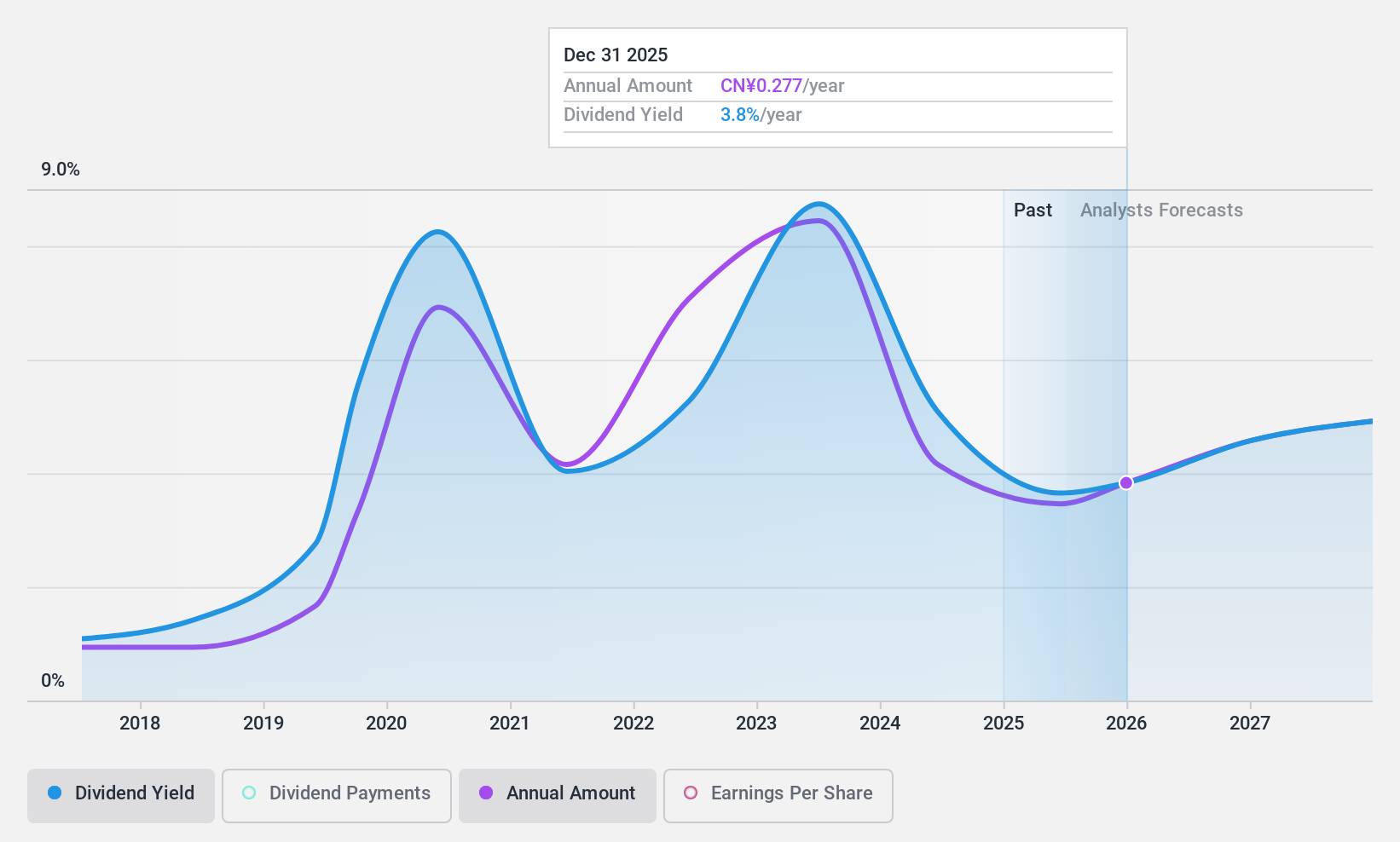

Overview: Xiamen Xiangyu Co., Ltd. operates in the supply chain services sector within the People's Republic of China and has a market capitalization of approximately CN¥16.65 billion.

Operations: Xiamen Xiangyu Co., Ltd. generates its revenue primarily from supply chain services across various sectors in China.

Dividend Yield: 4.1%

Xiamen Xiangyu has increased its dividend payments over the past 7 years, despite a short history of dividend distribution and volatility in payments. The company's dividends are well-covered by earnings with a payout ratio of 54% and by cash flows with a cash payout ratio of 3.6%. However, recent financial reports show declining revenue and net income, with sales dropping from CNY 536.61 billion in the previous year to CNY 457.41 billion in 2023, and net income decreasing from CNY 2.64 billion to CNY 1.57 billion over the same period, indicating potential challenges ahead for sustaining dividends amidst financial pressures.

- Click to explore a detailed breakdown of our findings in Xiamen Xiangyu's dividend report.

- Upon reviewing our latest valuation report, Xiamen Xiangyu's share price might be too pessimistic.

Bank of Chengdu (SHSE:601838)

Simply Wall St Dividend Rating: ★★★★☆☆

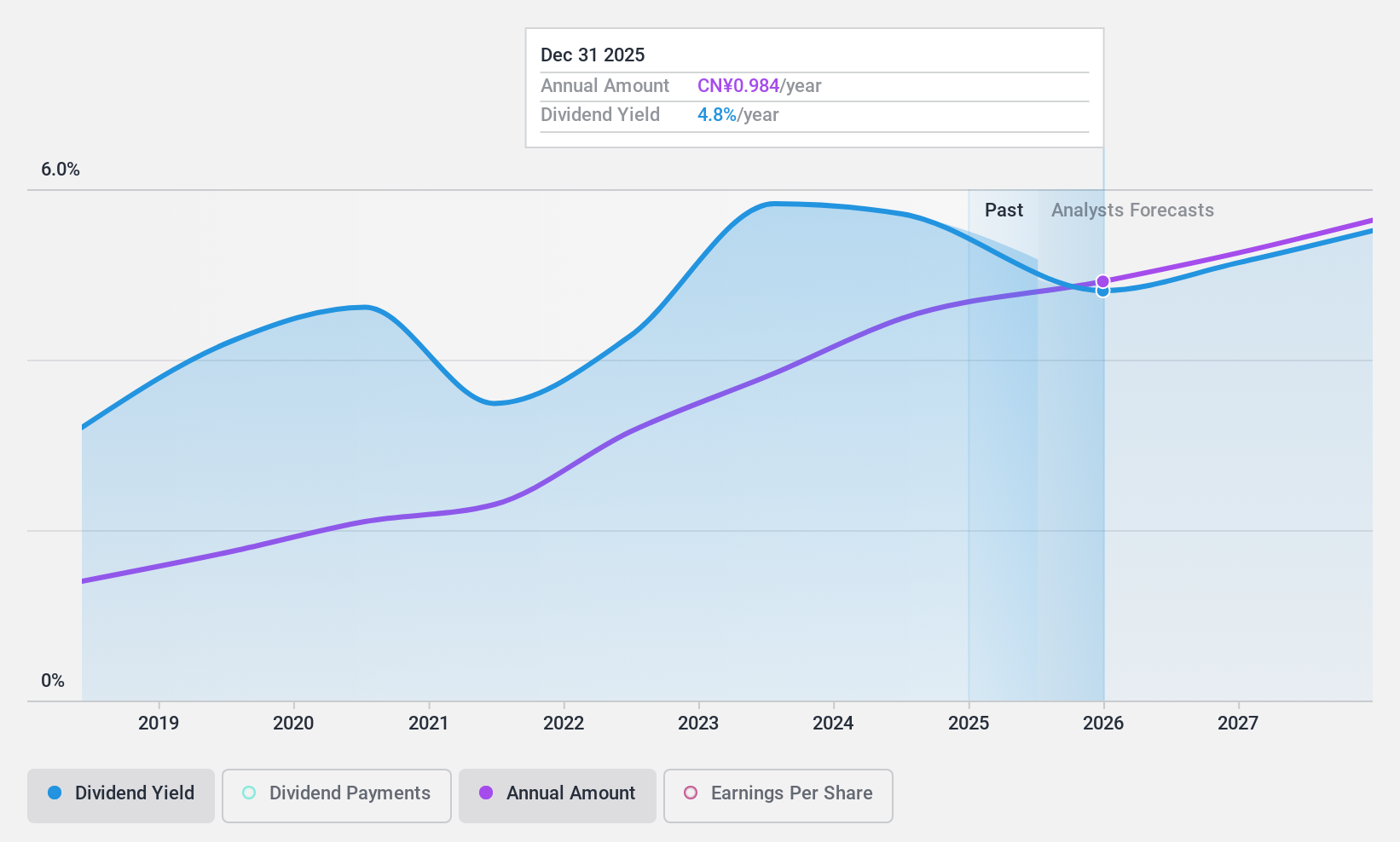

Overview: Bank of Chengdu Co., Ltd. offers a range of commercial banking products and services across China, with a market capitalization of approximately CN¥61.33 billion.

Operations: Bank of Chengdu Co., Ltd. generates its revenue primarily through various commercial banking products and services across China.

Dividend Yield: 5.6%

Bank of Chengdu reported a robust first quarter in 2024, with net interest income and net income rising to CNY 4.63 billion and CNY 2.85 billion respectively, reflecting solid year-over-year growth. The company's dividends are currently well-covered by earnings with a payout ratio of 29.1%, indicating sustainability over the near term. Although dividend payments have shown growth, the bank has a relatively short history of dividend distribution, having initiated payments just six years ago. This factor may affect perceptions of long-term reliability despite current stability and coverage metrics.

- Unlock comprehensive insights into our analysis of Bank of Chengdu stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Bank of Chengdu is priced lower than what may be justified by its financials.

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★★☆

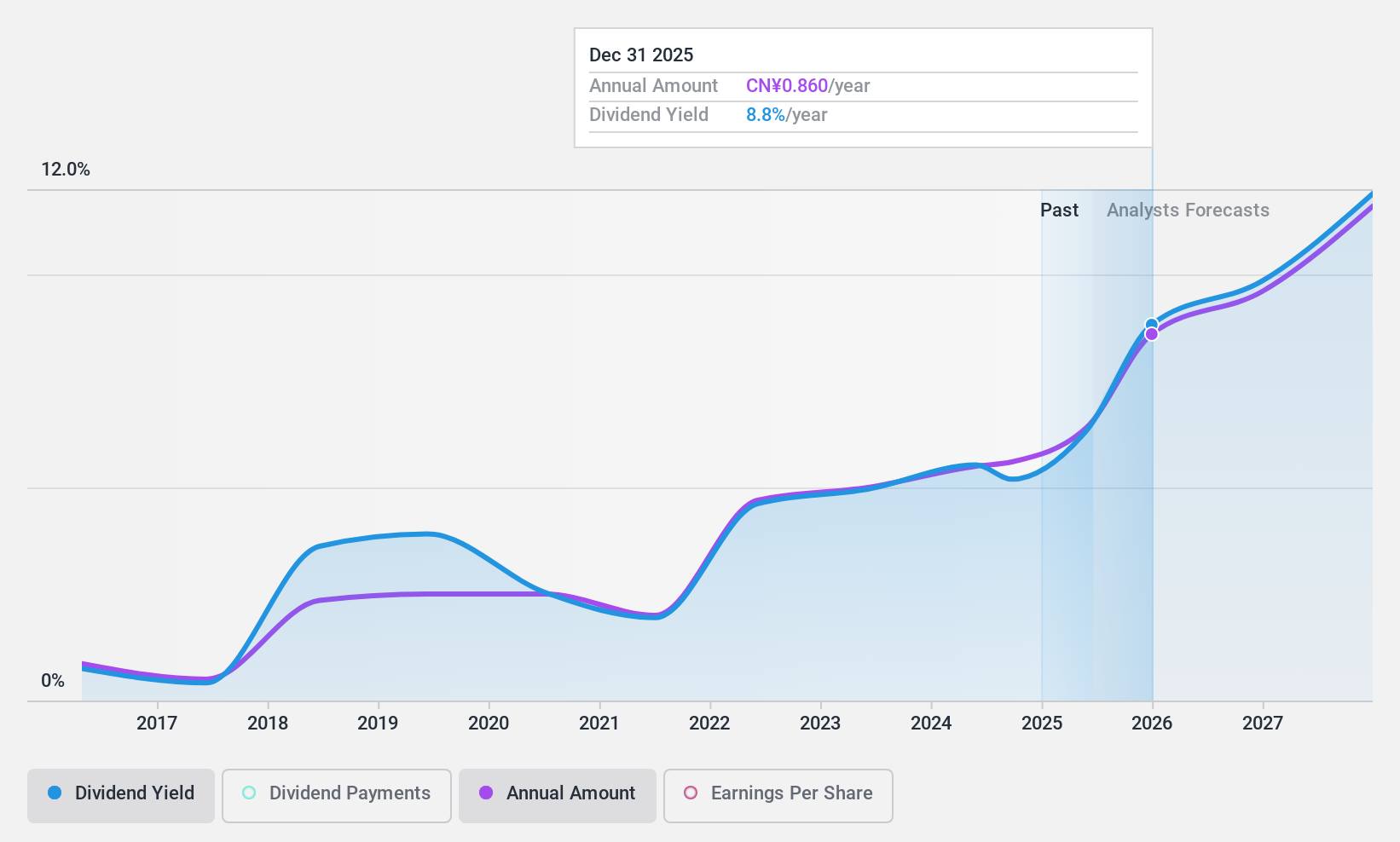

Overview: DeHua TB New Decoration Material Co., Ltd specializes in the production and sale of environmentally friendly furniture panels, serving both domestic and international markets, with a market capitalization of approximately CN¥9.67 billion.

Operations: DeHua TB New Decoration Material Co., Ltd generates its revenues primarily through the production and sales of environmentally friendly furniture panels across both domestic and international sectors.

Dividend Yield: 4.7%

DeHua TB New Decoration Material Co., Ltd recently proposed a dividend of CNY 5.50 per 10 shares for 2023, following a solid first quarter with sales rising to CNY 1.48 billion from CNY 1.11 billion year-over-year and net income increasing to CNY 88.55 million. Despite its top-tier dividend yield of 4.71%, the company's dividend history has been marked by volatility over the past decade, making its reliability questionable even though both earnings and cash flows currently cover payouts well, with payout ratios at 63% and cash payout ratios at 57.5% respectively.

- Click here to discover the nuances of DeHua TB New Decoration MaterialLtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that DeHua TB New Decoration MaterialLtd's current price could be quite moderate.

Taking Advantage

- Get an in-depth perspective on all 178 Top Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600057

Xiamen Xiangyu

Provides supply chain services in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.