Inner Mongolia Yuan Xing Energy Company Limited (SZSE:000683) Could Be Riskier Than It Looks

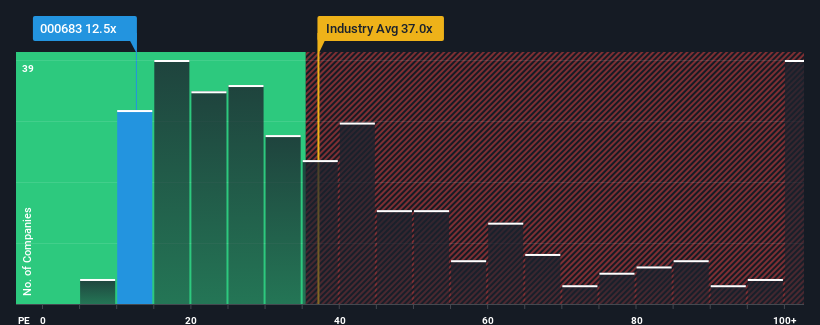

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 38x, you may consider Inner Mongolia Yuan Xing Energy Company Limited (SZSE:000683) as a highly attractive investment with its 12.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Inner Mongolia Yuan Xing Energy as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Inner Mongolia Yuan Xing Energy

How Is Inner Mongolia Yuan Xing Energy's Growth Trending?

In order to justify its P/E ratio, Inner Mongolia Yuan Xing Energy would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 8.4% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 53% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 64% as estimated by the five analysts watching the company. With the market only predicted to deliver 38%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Inner Mongolia Yuan Xing Energy's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Inner Mongolia Yuan Xing Energy currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Inner Mongolia Yuan Xing Energy.

You might be able to find a better investment than Inner Mongolia Yuan Xing Energy. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000683

Inner Mongolia Berun Chemical

Engages in the soda ash, methanol, fertilizer and agricultural production materials, and other businesses in China.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives