ADAMA (SZSE:000553) Faces Rising Losses Despite Strategic Alliances and Product Innovations

Reviewed by Simply Wall St

ADAMA (SZSE:000553) has recently reported its financial results for the nine months ending September 30, 2024, revealing a decline in sales and an increase in net losses compared to the previous year. Despite these challenges, the company is strategically positioned with a forecasted annual earnings growth of 123.66% over the next three years, driven by product innovation and strategic alliances. Investors should watch for insights on how ADAMA plans to navigate its current financial constraints and leverage its growth potential in the upcoming earnings discussion.

Click to explore a detailed breakdown of our findings on ADAMA.

Core Advantages Driving Sustained Success for ADAMA

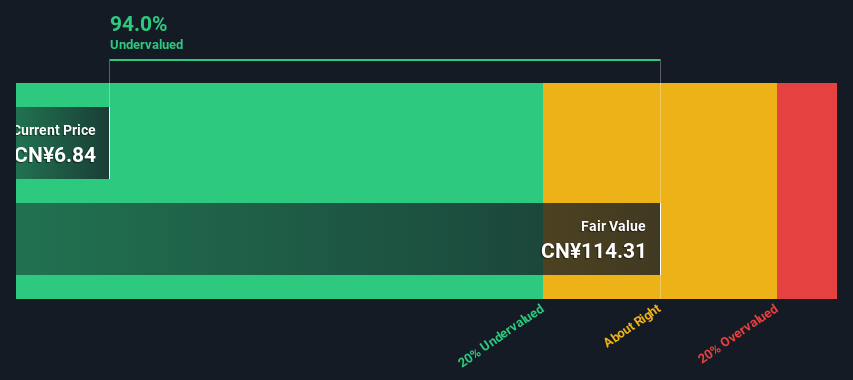

ADAMA's forecasted profitability within three years, with earnings expected to grow at 123.66% annually, positions it favorably in the market. The company's strategic focus on product innovation, as highlighted by CEO Steve Hawkins, who noted the successful launch of three new products capturing 10% market share, underscores its competitive edge. Additionally, strong customer relationships and strategic alliances, as mentioned by COO Florian Wagner, enhance distribution efficiency and market penetration. Furthermore, the company's current trading price of CN¥6.84, significantly below its SWS fair ratio estimated value of CN¥114.29, suggests potential undervaluation, indicating a strategic opportunity for investors.

To dive deeper into how ADAMA's valuation metrics are shaping its market position, check out our detailed analysis of ADAMA's Valuation.Internal Limitations Hindering ADAMA's Growth

ADAMA faces challenges with increasing losses at 60.1% annually over the past five years. CFO Efrat Nagar's acknowledgment of an 8% rise in the cost of goods sold impacting gross margins highlights inefficiencies in production or supply chain management. The negative return on equity of -12.14%, with a forecast of only 2.4% in three years, further underscores financial constraints. Additionally, the management team's average tenure of 1.2 years may impact strategic continuity and execution.

Potential Strategies for Leveraging Growth and Competitive Advantage

ADAMA's projected 9% annual revenue growth, though below the market average, presents opportunities for strategic expansion and profitability improvements. The company's focus on product-related announcements, as evidenced by recent launches, and strategic alliances can enhance its market position. By capitalizing on these opportunities, ADAMA can strengthen its competitive advantage and financial health.

To gain deeper insights into ADAMA's historical performance, explore our detailed analysis of past performance.External Factors Threatening ADAMA

ADAMA's high debt level, with a 59% net debt to equity ratio, poses significant financial risks. Market skepticism, reflected in analyst target prices below the current share price, could affect investor confidence. Furthermore, economic headwinds and regulatory hurdles, as highlighted by COO Florian Wagner, present external challenges that require strategic risk management to mitigate potential impacts on profitability and market share.

See what the latest analyst reports say about ADAMA's future prospects and potential market movements. Explore the current health of ADAMA and how it reflects on its financial stability and growth potential.Conclusion

ADAMA's strategic focus on product innovation and strong alliances positions it for significant earnings growth of 123.66% annually over the next three years, suggesting a favorable market position. However, internal challenges such as rising costs and a high debt level, coupled with a negative return on equity, may hinder this growth unless addressed through improved supply chain efficiencies and strategic risk management. The company's current trading price of CN¥6.84, significantly below the estimated fair value of CN¥114.29, presents a compelling opportunity for investors who believe in the company's potential to overcome its limitations and capitalize on its market opportunities.

Next Steps

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SZSE:000553

Undervalued with moderate growth potential.