- China

- /

- Metals and Mining

- /

- SZSE:000426

Should You Be Adding Inner Mongolia Xingye Silver &Tin MiningLtd (SZSE:000426) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Inner Mongolia Xingye Silver &Tin MiningLtd (SZSE:000426), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Inner Mongolia Xingye Silver &Tin MiningLtd with the means to add long-term value to shareholders.

See our latest analysis for Inner Mongolia Xingye Silver &Tin MiningLtd

How Fast Is Inner Mongolia Xingye Silver &Tin MiningLtd Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Inner Mongolia Xingye Silver &Tin MiningLtd to have grown EPS from CN¥0.069 to CN¥0.64 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

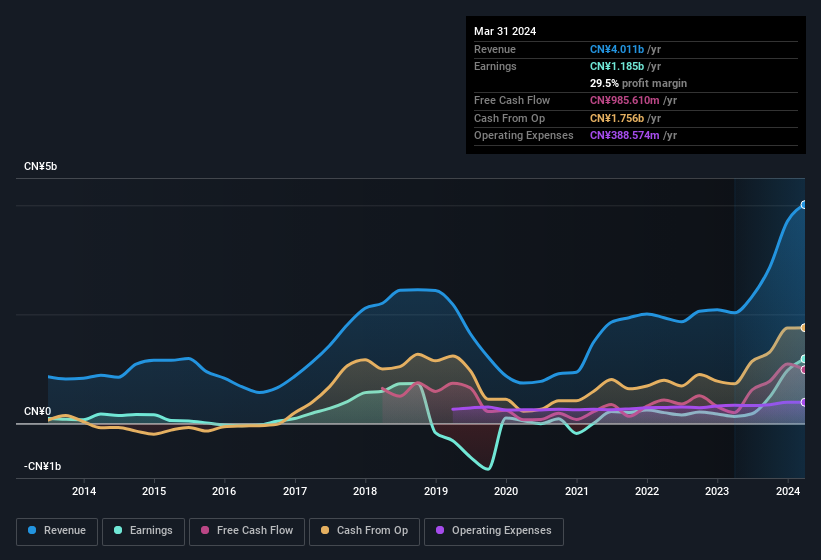

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Inner Mongolia Xingye Silver &Tin MiningLtd shareholders can take confidence from the fact that EBIT margins are up from 20% to 39%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Inner Mongolia Xingye Silver &Tin MiningLtd's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Inner Mongolia Xingye Silver &Tin MiningLtd Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Inner Mongolia Xingye Silver &Tin MiningLtd followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have CN¥214m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.8%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Inner Mongolia Xingye Silver &Tin MiningLtd with market caps between CN¥14b and CN¥46b is about CN¥1.5m.

Inner Mongolia Xingye Silver &Tin MiningLtd offered total compensation worth CN¥909k to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Inner Mongolia Xingye Silver &Tin MiningLtd Deserve A Spot On Your Watchlist?

Inner Mongolia Xingye Silver &Tin MiningLtd's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Inner Mongolia Xingye Silver &Tin MiningLtd is worth considering carefully. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Inner Mongolia Xingye Silver &Tin MiningLtd is trading on a high P/E or a low P/E, relative to its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000426

Inner Mongolia Xingye Silver&Tin MiningLtd

Engages in mining and smelting non-ferrous and precious metals in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives