Pulling back 6.0% this week, Jiangsu Eastern ShenghongLtd's SZSE:000301) five-year decline in earnings may be coming into investors focus

It hasn't been the best quarter for Jiangsu Eastern Shenghong Co.,Ltd. (SZSE:000301) shareholders, since the share price has fallen 14% in that time. But that doesn't change the fact that the returns over the last five years have been pleasing. It has returned a market beating 69% in that time. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 19% drop, in the last year.

Since the long term performance has been good but there's been a recent pullback of 6.0%, let's check if the fundamentals match the share price.

See our latest analysis for Jiangsu Eastern ShenghongLtd

While Jiangsu Eastern ShenghongLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

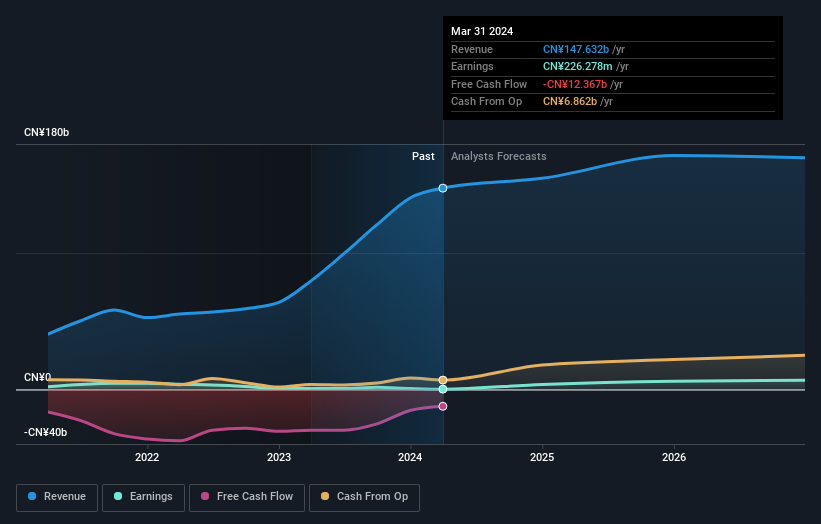

In the last 5 years Jiangsu Eastern ShenghongLtd saw its revenue grow at 39% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 11% per year is good, it's not unreasonable given the strong revenue growth. If the strong revenue growth continues, we'd hope to see the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Jiangsu Eastern ShenghongLtd stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Jiangsu Eastern ShenghongLtd's TSR for the last 5 years was 80%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Jiangsu Eastern ShenghongLtd shareholders are down 19% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Jiangsu Eastern ShenghongLtd has 4 warning signs (and 1 which is potentially serious) we think you should know about.

We will like Jiangsu Eastern ShenghongLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000301

Jiangsu Eastern ShenghongLtd

Engages in the research, development, production, and sale of polyester filament, petrochemical, and new chemical materials.

Slight and fair value.