As global markets navigate through a landscape marked by tariff uncertainties and fluctuating economic indicators, small-cap stocks have experienced mixed reactions, with indices like the S&P 600 reflecting broader market sentiments. Amidst these dynamics, investors are keenly observing sectors that demonstrate resilience and potential growth opportunities despite external pressures such as trade policies and cooling labor markets. In this context, identifying undiscovered gems involves looking for companies that exhibit strong fundamentals, adaptability to changing conditions, and unique value propositions that can thrive even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Value Rating: ★★★★★★

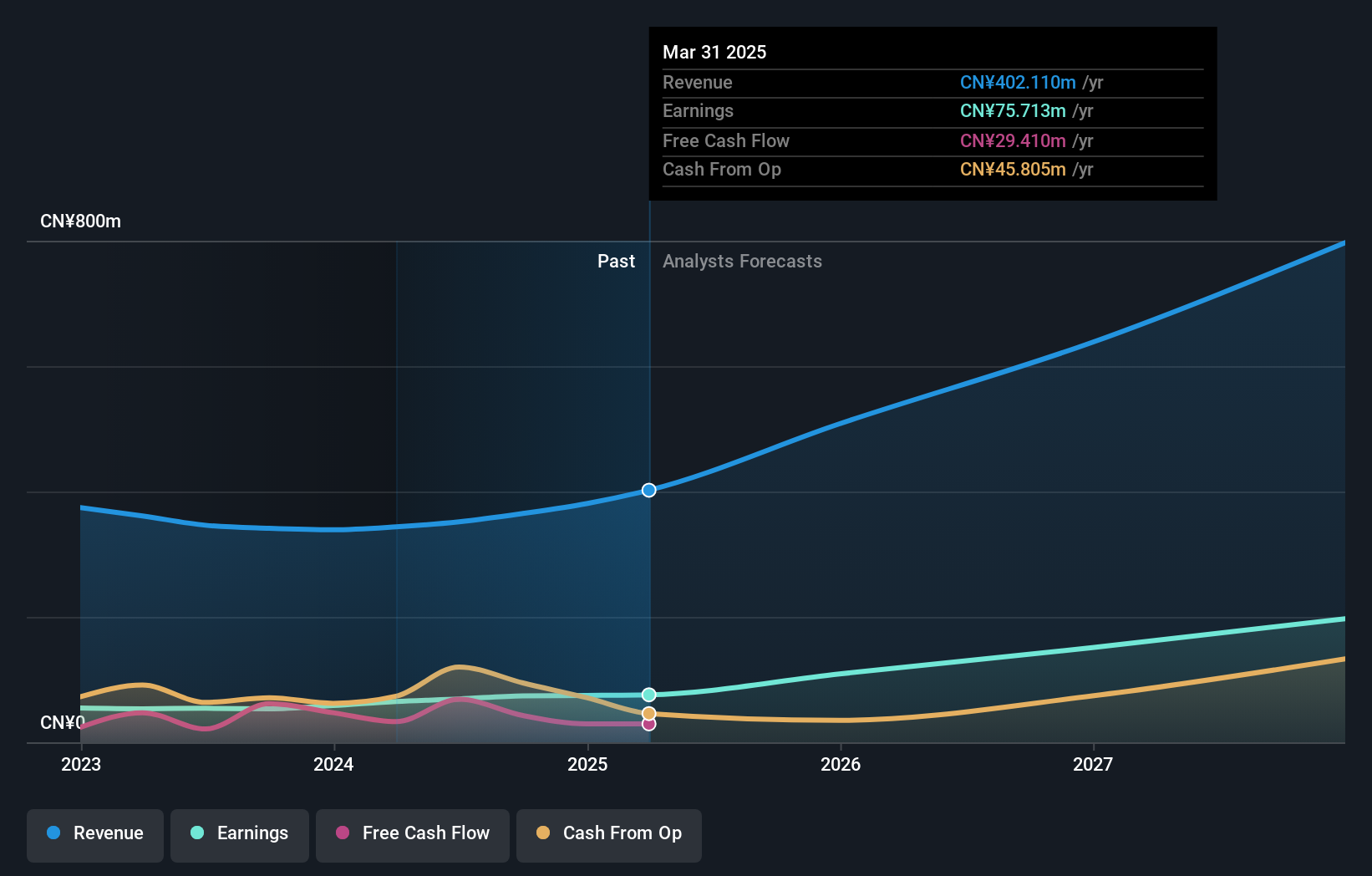

Overview: Guangdong Skychem Technology Co., Ltd. is involved in the research, development, and manufacturing of electronic materials for industries such as printed circuit boards, semiconductors and packaging, and touch screens with a market cap of CN¥6.45 billion.

Operations: Skychem Technology's revenue primarily comes from its specialty chemicals segment, generating CN¥364.94 million.

Skychem, a nimble player in the chemicals sector, showcases impressive earnings growth of 38.6% over the past year, outpacing the industry's -5.4%. Despite its highly volatile share price recently, the company remains debt-free with no interest coverage concerns. Over five years, Skychem has maintained this debt-free status while achieving high-quality earnings and positive free cash flow of CNY 42.62 million as of February 2025. A recent buyback completed with CNY 37.77 million spent on repurchasing shares highlights a commitment to shareholder value amid forecasts predicting further annual earnings growth of nearly 40%.

Shenzhen Soling IndustrialLtd (SZSE:002766)

Simply Wall St Value Rating: ★★★★★★

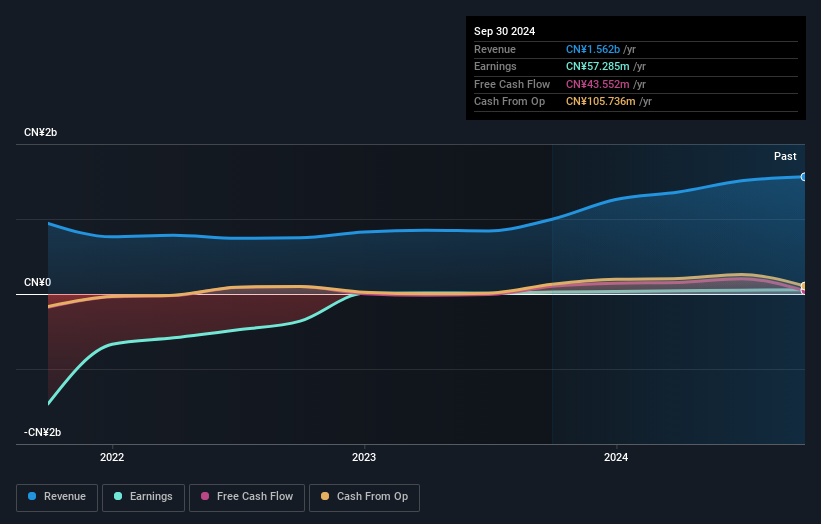

Overview: Shenzhen Soling Industrial Co., Ltd specializes in offering car-road-cloud solutions and has a market capitalization of CN¥5.75 billion.

Operations: Shenzhen Soling Industrial Co., Ltd generates revenue primarily from its car-road-cloud solutions. The company has a market capitalization of CN¥5.75 billion.

Shenzhen Soling Industrial Ltd. is making waves with its impressive earnings growth of 125% over the past year, outpacing the Auto Components industry's 11%. This debt-free company has significantly improved its financial health, shedding a debt to equity ratio of 138% from five years ago. Its high-quality earnings and positive free cash flow underscore a robust operational framework. With no interest payments to worry about, Soling seems well-positioned in its sector. The company's focus on profitability and strategic investments likely contributes to its promising trajectory in the competitive auto components market.

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Value Rating: ★★★★☆☆

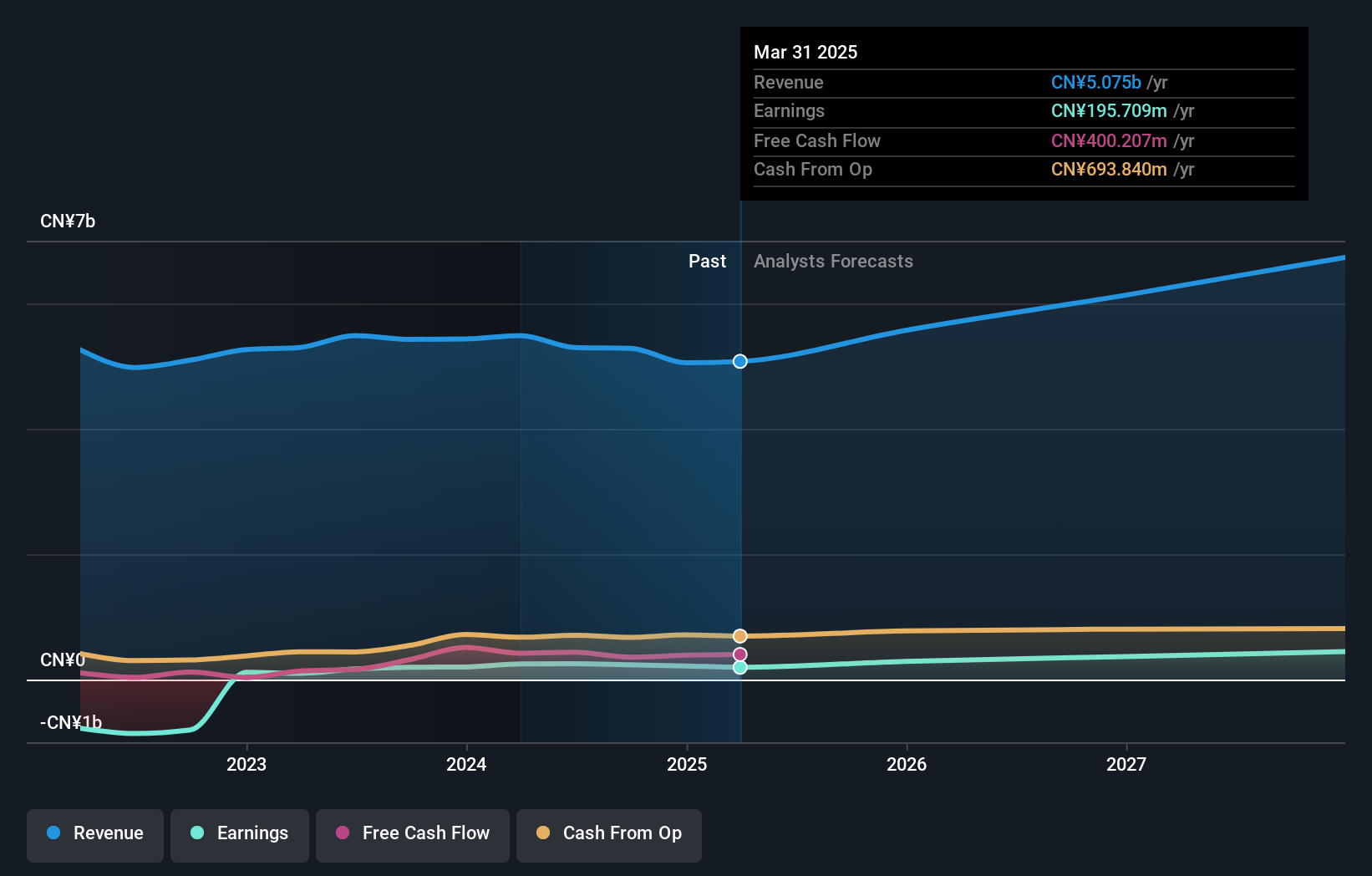

Overview: Nanfang Zhongjin Environment Co., Ltd., with a market cap of CN¥7.03 billion, operates in the general equipment manufacturing sector through its subsidiaries.

Operations: The company generates revenue primarily from its general equipment manufacturing activities. It has a market capitalization of CN¥7.03 billion, indicating its scale within the sector.

Nanfang Zhongjin Environment, a smaller player in the machinery sector, is trading at 47% below its estimated fair value, suggesting potential undervaluation. The company's earnings grew by 19.8% over the past year, outpacing the industry average of -0.06%. However, it carries a high net debt to equity ratio of 63.3%, up from 60.3% five years ago, which could be concerning for some investors. A notable CN¥75M one-off gain has impacted recent financial results, highlighting non-recurring income elements that might skew performance perception temporarily. Recent board changes include Li Qian’s appointment as an independent director following a shareholder meeting in January 2025.

Where To Now?

- Gain an insight into the universe of 4721 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanfang Pump Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300145

Nanfang Pump Industry

Through its subsidiaries, engages in the general equipment manufacturing business.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives