Is Now The Time To Put Novoray (SHSE:688300) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Novoray (SHSE:688300). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Novoray

Novoray's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Novoray managed to grow EPS by 11% per year, over three years. That's a pretty good rate, if the company can sustain it.

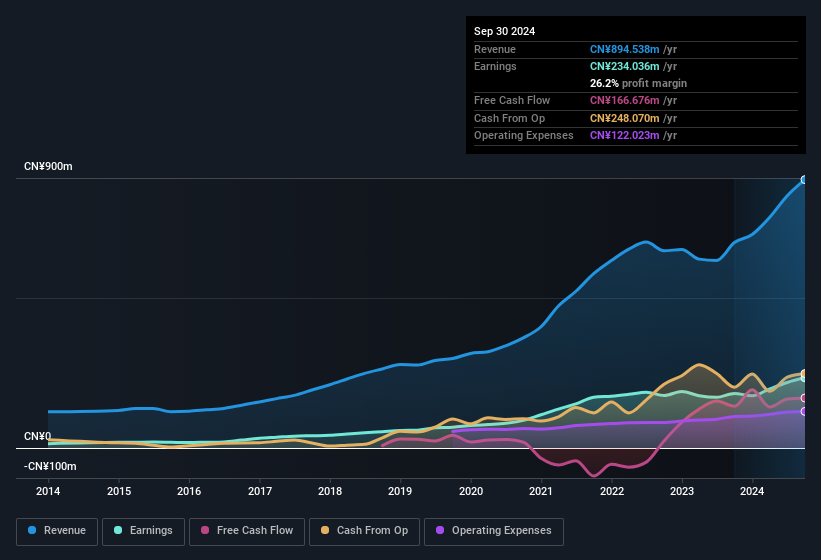

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Novoray is growing revenues, and EBIT margins improved by 4.3 percentage points to 27%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Novoray's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Novoray Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Novoray will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 41% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. This insider holding amounts to That level of investment from insiders is nothing to sneeze at.

Does Novoray Deserve A Spot On Your Watchlist?

One positive for Novoray is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. Of course, just because Novoray is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Novoray certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Novoray might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688300

Novoray

Provides industrial powder materials in China and internationally.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives