Earnings Tell The Story For Shaanxi Huaqin Technology Industry Co.,Ltd. (SHSE:688281) As Its Stock Soars 44%

Shaanxi Huaqin Technology Industry Co.,Ltd. (SHSE:688281) shareholders would be excited to see that the share price has had a great month, posting a 44% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.4% over the last year.

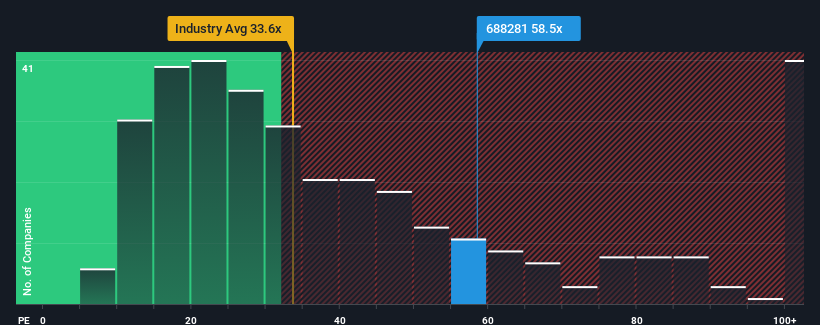

After such a large jump in price, Shaanxi Huaqin Technology IndustryLtd's price-to-earnings (or "P/E") ratio of 58.5x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 33x and even P/E's below 20x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Shaanxi Huaqin Technology IndustryLtd has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Shaanxi Huaqin Technology IndustryLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Shaanxi Huaqin Technology IndustryLtd would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 16% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 33% per annum over the next three years. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

In light of this, it's understandable that Shaanxi Huaqin Technology IndustryLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shaanxi Huaqin Technology IndustryLtd's P/E

Shares in Shaanxi Huaqin Technology IndustryLtd have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shaanxi Huaqin Technology IndustryLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Shaanxi Huaqin Technology IndustryLtd.

If these risks are making you reconsider your opinion on Shaanxi Huaqin Technology IndustryLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688281

Shaanxi Huaqin Technology IndustryLtd

Shaanxi Huaqin Technology Industry Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives