3 Growth Companies With High Insider Ownership Seeing Up To 33% Revenue Growth

Reviewed by Simply Wall St

In a week marked by volatile trading and geopolitical tensions, global markets have experienced mixed performances, with the U.S. Federal Reserve holding rates steady and the European Central Bank cutting interest rates to boost investor sentiment. Amidst these fluctuations, growth companies with high insider ownership can offer a unique advantage as they often align management interests with those of shareholders, potentially driving robust revenue growth even in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 10.1% | 86% |

Let's review some notable picks from our screened stocks.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional devices, serving both the People's Republic of China and international markets, with a market cap of HK$3.68 billion.

Operations: The company generates revenue of CN¥663.61 million from the sale of its interventional surgical devices for neurovascular and peripheral-vascular applications.

Insider Ownership: 19.4%

Revenue Growth Forecast: 33.8% p.a.

Zylox-Tonbridge Medical Technology is expected to see significant revenue growth of 33.8% annually, outpacing the Hong Kong market's 7.7%. Earnings are projected to grow at a substantial rate of 64.1% per year, despite low forecasted return on equity at 6.5%. Analysts predict a potential stock price increase of 32.2%, although recent financial results were impacted by large one-off items. No recent insider trading activity has been reported in the past three months.

- Click to explore a detailed breakdown of our findings in Zylox-Tonbridge Medical Technology's earnings growth report.

- The analysis detailed in our Zylox-Tonbridge Medical Technology valuation report hints at an inflated share price compared to its estimated value.

Guangdong Huate Gas (SHSE:688268)

Simply Wall St Growth Rating: ★★★★★☆

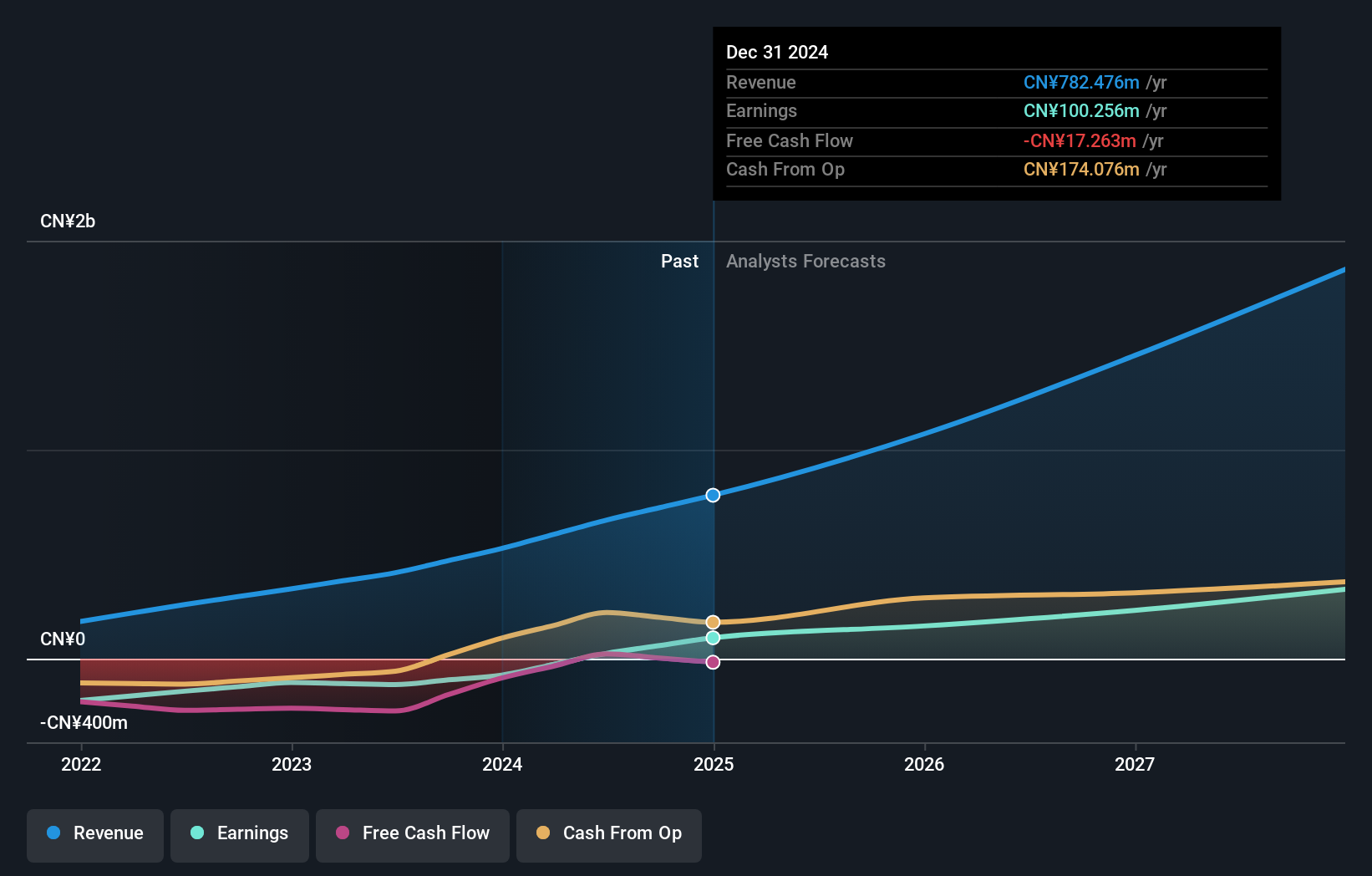

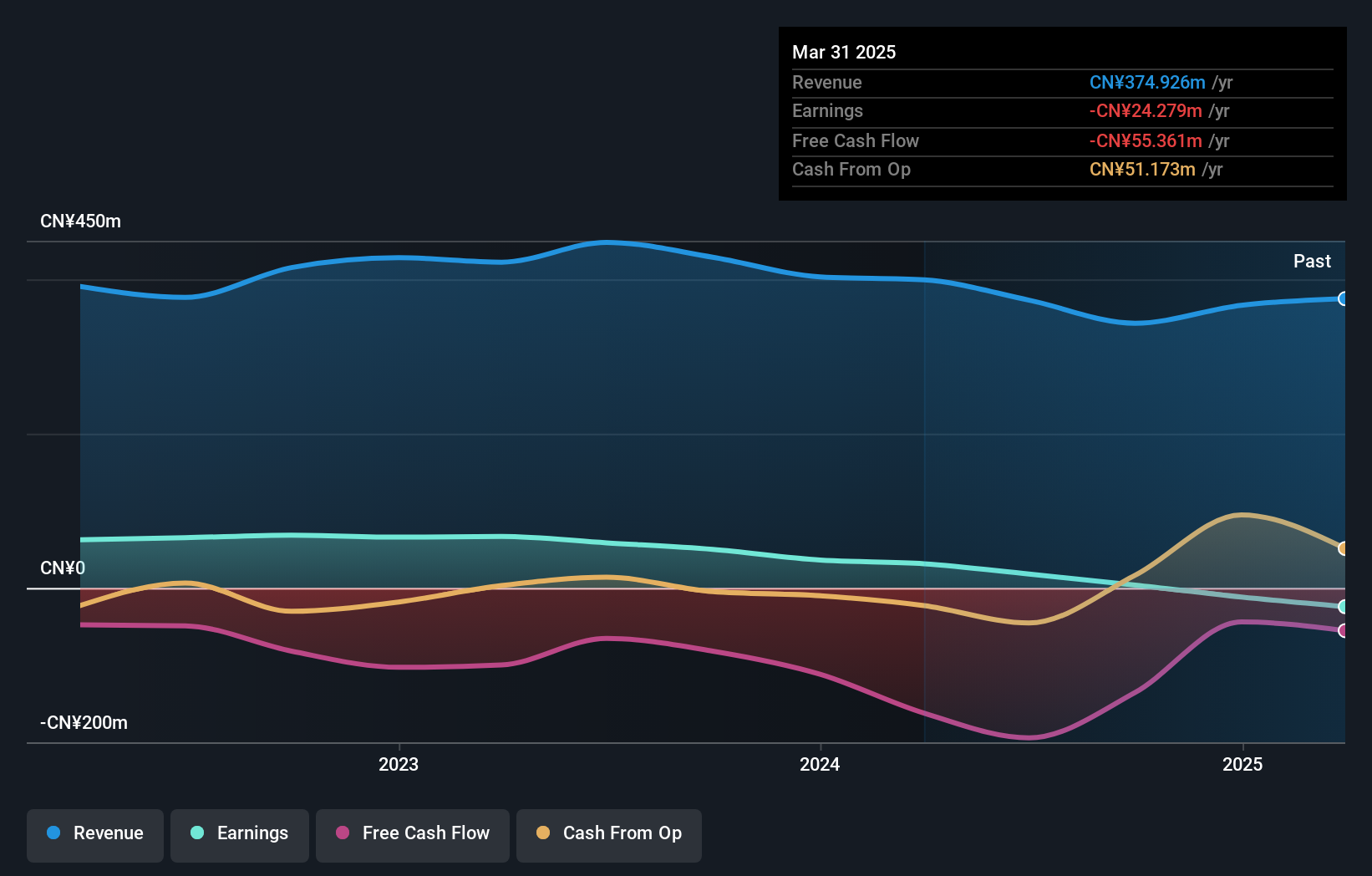

Overview: Guangdong Huate Gas Co., Ltd is engaged in the production and supply of gas and gas equipment both within China and internationally, with a market cap of CN¥5.49 billion.

Operations: Guangdong Huate Gas Co., Ltd generates revenue through the production and distribution of gas and gas equipment across domestic and international markets.

Insider Ownership: 22%

Revenue Growth Forecast: 27.4% p.a.

Guangdong Huate Gas is positioned for strong growth with earnings projected to rise by 35.69% annually, surpassing the Chinese market's average of 25.3%. Revenue is also expected to grow at a robust rate of 27.4% per year, significantly outpacing the market's 13.5%. The stock trades below analyst price targets, and its price-to-earnings ratio of 30.4x offers good value compared to the broader CN market at 35.8x, despite a low forecasted return on equity of 15.2%.

- Take a closer look at Guangdong Huate Gas' potential here in our earnings growth report.

- The analysis detailed in our Guangdong Huate Gas valuation report hints at an deflated share price compared to its estimated value.

Ningbo Joy Intelligent Logistics TechnologyLtd (SZSE:301198)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Joy Intelligent Logistics Technology Co., Ltd. operates in the logistics technology sector and has a market cap of CN¥1.85 billion.

Operations: The company's revenue from the Packaging & Containers segment is CN¥343.05 million.

Insider Ownership: 13.6%

Revenue Growth Forecast: 19.1% p.a.

Ningbo Joy Intelligent Logistics Technology Ltd. is set for significant earnings growth, forecasted at 52.65% annually, outpacing the Chinese market's average of 25.3%. However, its revenue growth projection of 19.1% per year lags behind the ideal benchmark of 20%. Recent volatility in share price and low profit margins (1.1%) compared to last year's 11.7% are concerns, alongside a dividend not well supported by earnings or cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Ningbo Joy Intelligent Logistics TechnologyLtd.

- Upon reviewing our latest valuation report, Ningbo Joy Intelligent Logistics TechnologyLtd's share price might be too optimistic.

Where To Now?

- Explore the 1462 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688268

Guangdong Huate Gas

Produces and supplies gas and gas equipment in China, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives