- China

- /

- Semiconductors

- /

- SHSE:688170

February 2025's Leading Growth Stocks With Significant Insider Stakes

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and consumer spending concerns, investors are closely watching the impact of these factors on economic indicators like the U.S. Services PMI, which has recently entered contraction territory. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, potentially providing a buffer against market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's take a closer look at a couple of our picks from the screened companies.

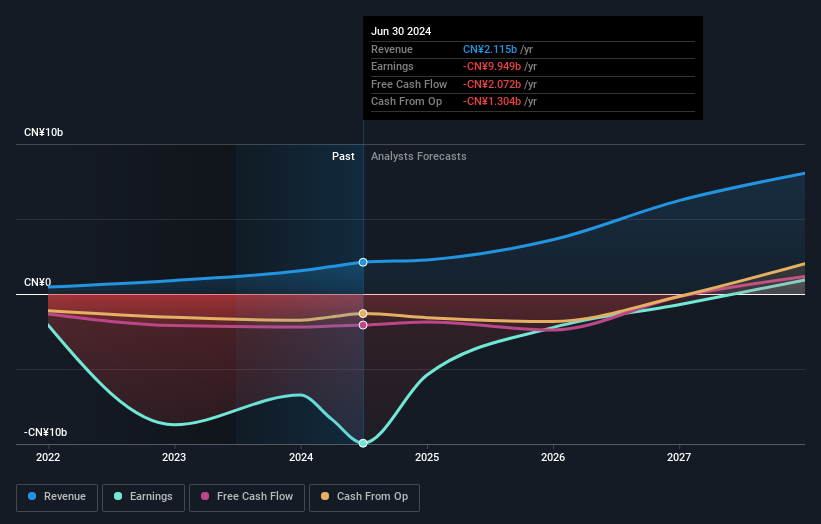

Horizon Robotics (SEHK:9660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Horizon Robotics is an investment holding company that offers automotive solutions for passenger vehicles in China, with a market cap of HK$122.50 billion.

Operations: The company's revenue segments include CN¥2.04 billion from automotive solutions and CN¥76.26 million from non-automotive solutions.

Insider Ownership: 17.4%

Revenue Growth Forecast: 32.7% p.a.

Horizon Robotics is positioned for significant growth, with revenue expected to increase by 32.7% annually, outpacing the Hong Kong market's 7.9%. Earnings are projected to grow at 82.35% per year, with profitability anticipated within three years. Despite a volatile share price and low forecasted return on equity (0.1%), the company shows robust past revenue growth of 72.5%. Recent address changes in Hong Kong reflect ongoing corporate developments but do not impact insider ownership trends directly.

- Dive into the specifics of Horizon Robotics here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Horizon Robotics is priced higher than what may be justified by its financials.

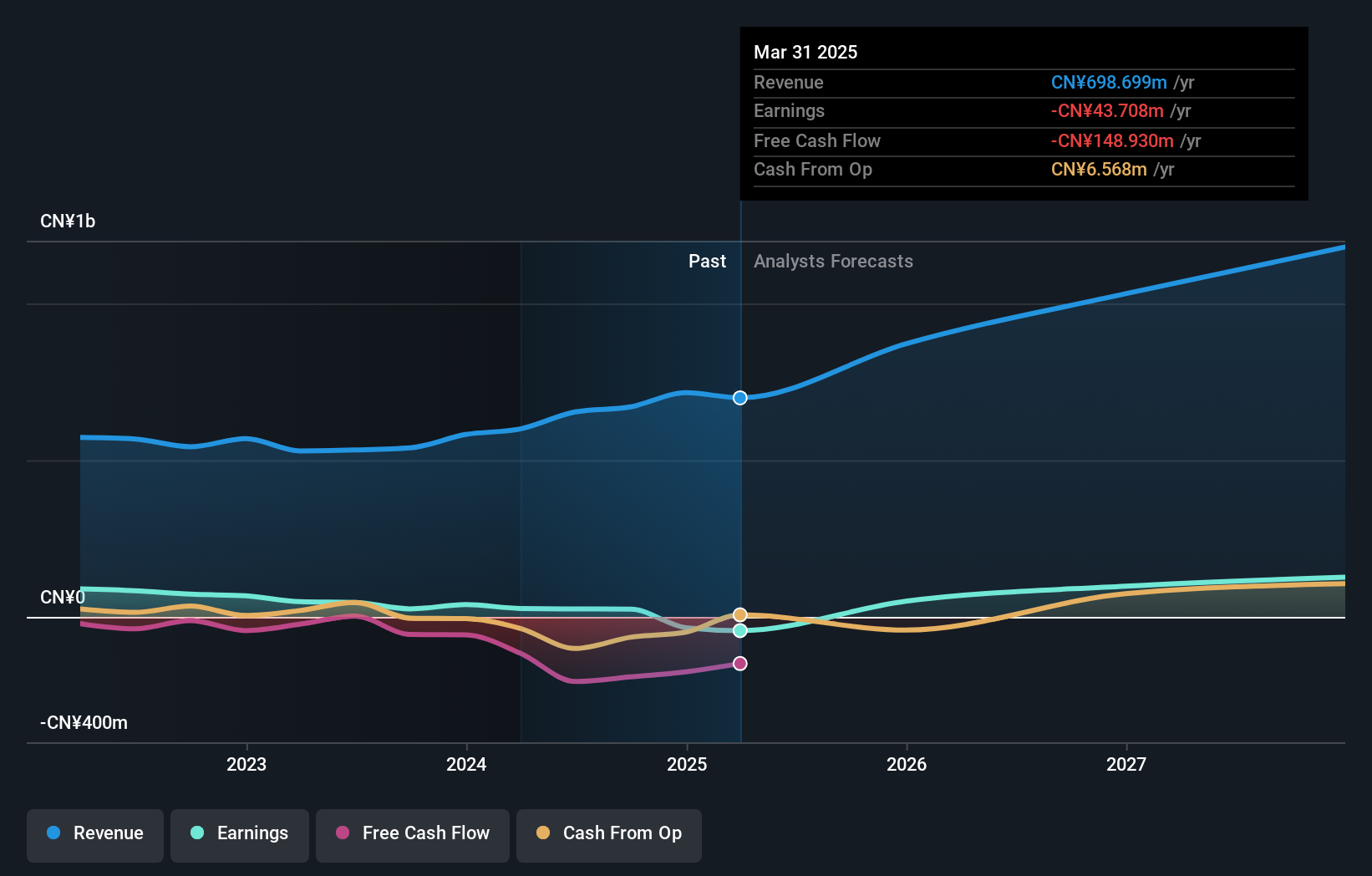

Suzhou Delphi Laser (SHSE:688170)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Delphi Laser Co., Ltd. specializes in the research, development, manufacture, and sale of precision laser processing equipment and lasers both in China and internationally, with a market cap of CN¥2.49 billion.

Operations: The company's revenue segments include precision laser processing equipment and lasers, contributing significantly to its operations both domestically and internationally.

Insider Ownership: 28.2%

Revenue Growth Forecast: 18.5% p.a.

Suzhou Delphi Laser is projected to experience significant earnings growth at 46% annually, surpassing the Chinese market average of 25.4%. Revenue is expected to grow at 18.5% per year, outpacing the market's 13.4%. Despite a low forecasted return on equity of 7.6%, the company benefits from high-quality earnings. A recent extraordinary shareholders meeting indicates active corporate governance but does not directly affect insider ownership trends or trading activities in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Suzhou Delphi Laser.

- Our expertly prepared valuation report Suzhou Delphi Laser implies its share price may be too high.

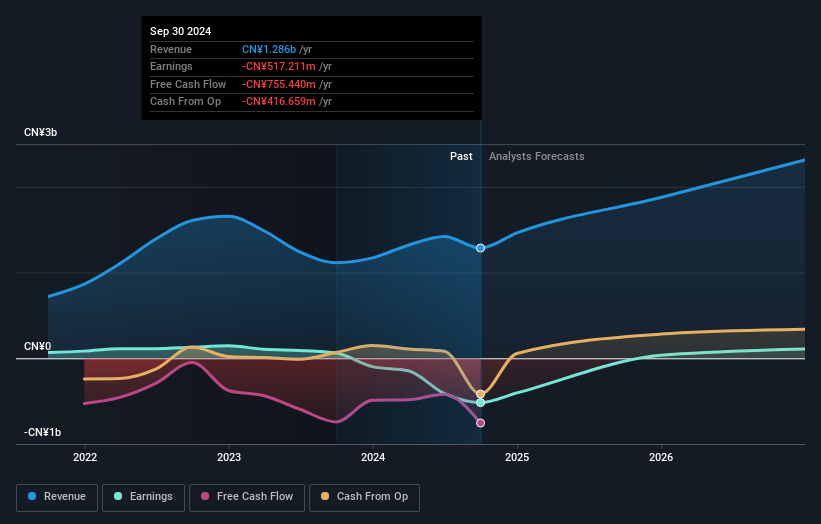

Zhejiang Power New Energy (SHSE:688184)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Power New Energy Co., Ltd. specializes in the research, development, production, and sale of lithium-ion battery ternary cathode material precursors in China, with a market cap of CN¥2.22 billion.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to CN¥1.29 billion.

Insider Ownership: 34%

Revenue Growth Forecast: 25.7% p.a.

Zhejiang Power New Energy is forecasted to achieve profitability within three years, with earnings expected to grow at 108.43% annually and revenue growth projected at 25.7%, outpacing the Chinese market average of 13.4%. Despite a low future return on equity of 3.3%, the company recently completed a share buyback worth CNY 34.45 million, indicating efforts to stabilize stock value and enhance shareholder rights, although no significant insider trading activity has been reported recently.

- Navigate through the intricacies of Zhejiang Power New Energy with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Zhejiang Power New Energy's current price could be inflated.

Next Steps

- Click this link to deep-dive into the 1450 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688170

Suzhou Delphi Laser

Engages in the research and development, manufacture, and sale of precision laser processing equipment and its components, and lasers in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives