Asian Growth Companies With High Insider Ownership For October 2025

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, investors are increasingly turning their attention to growth opportunities within Asia. In this environment, companies with high insider ownership can be particularly appealing, as they often signal strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 31% | 87.1% |

Let's take a closer look at a couple of our picks from the screened companies.

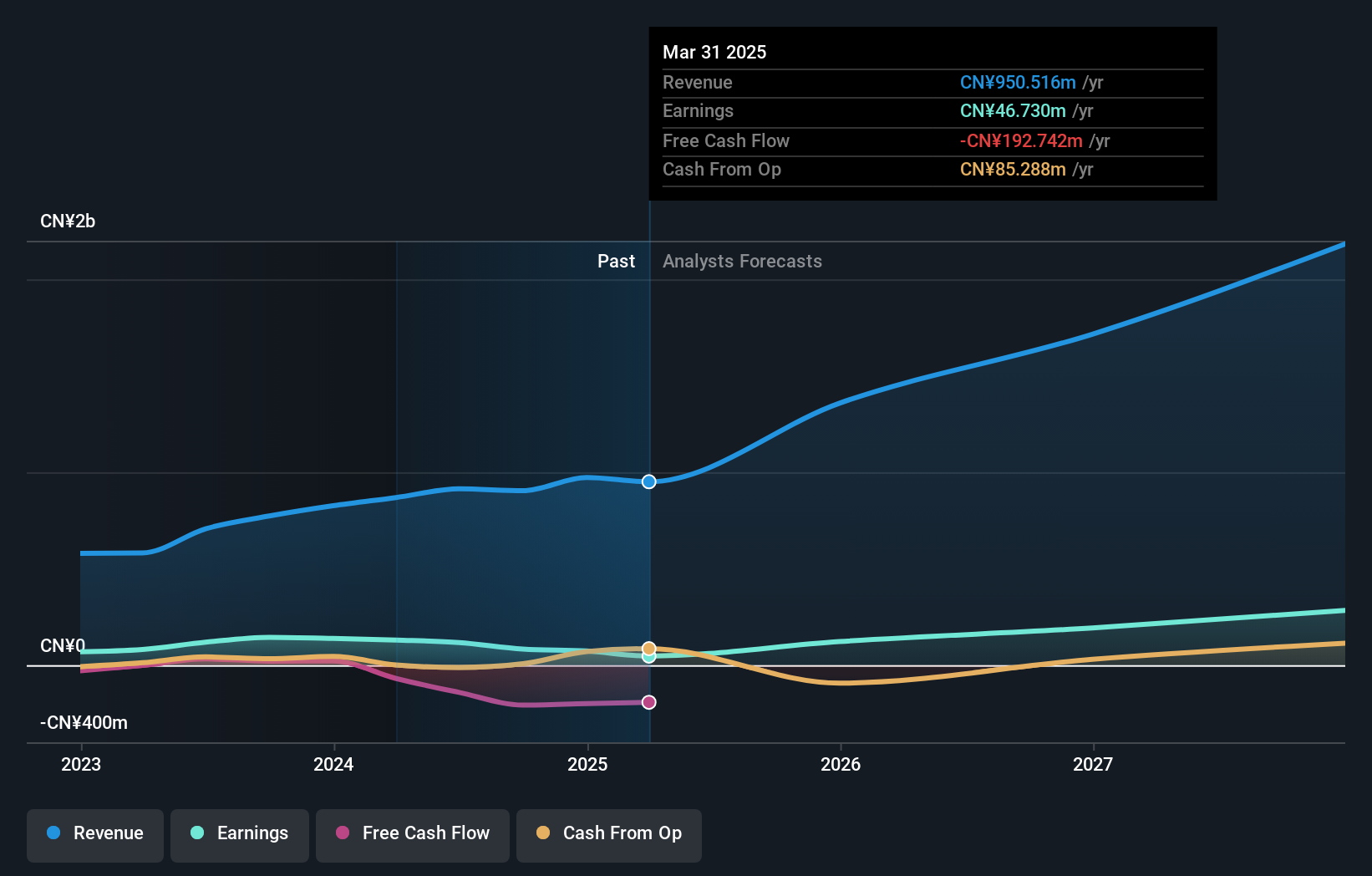

Jinhong GasLtd (SHSE:688106)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jinhong Gas Co., Ltd. is involved in the production and sale of bulk, special, and natural gas products in China, with a market cap of CN¥10.37 billion.

Operations: The company's revenue is derived from its operations in producing and selling bulk, special, and natural gas products within China.

Insider Ownership: 35.1%

Revenue Growth Forecast: 18.3% p.a.

Jinhong Gas Ltd. shows potential with forecasted earnings growth of 44.31% annually, outpacing the Chinese market's 26.4%. Despite a decline in net profit margin from 12.4% to 4.7%, revenue grew to CNY 1.31 billion in H1 2025, up from CNY 1.23 billion the previous year. However, operating cash flow does not cover debt well and Return on Equity is projected at a modest 10.7% over three years, reflecting mixed financial health indicators amidst its growth trajectory.

- Unlock comprehensive insights into our analysis of Jinhong GasLtd stock in this growth report.

- Upon reviewing our latest valuation report, Jinhong GasLtd's share price might be too optimistic.

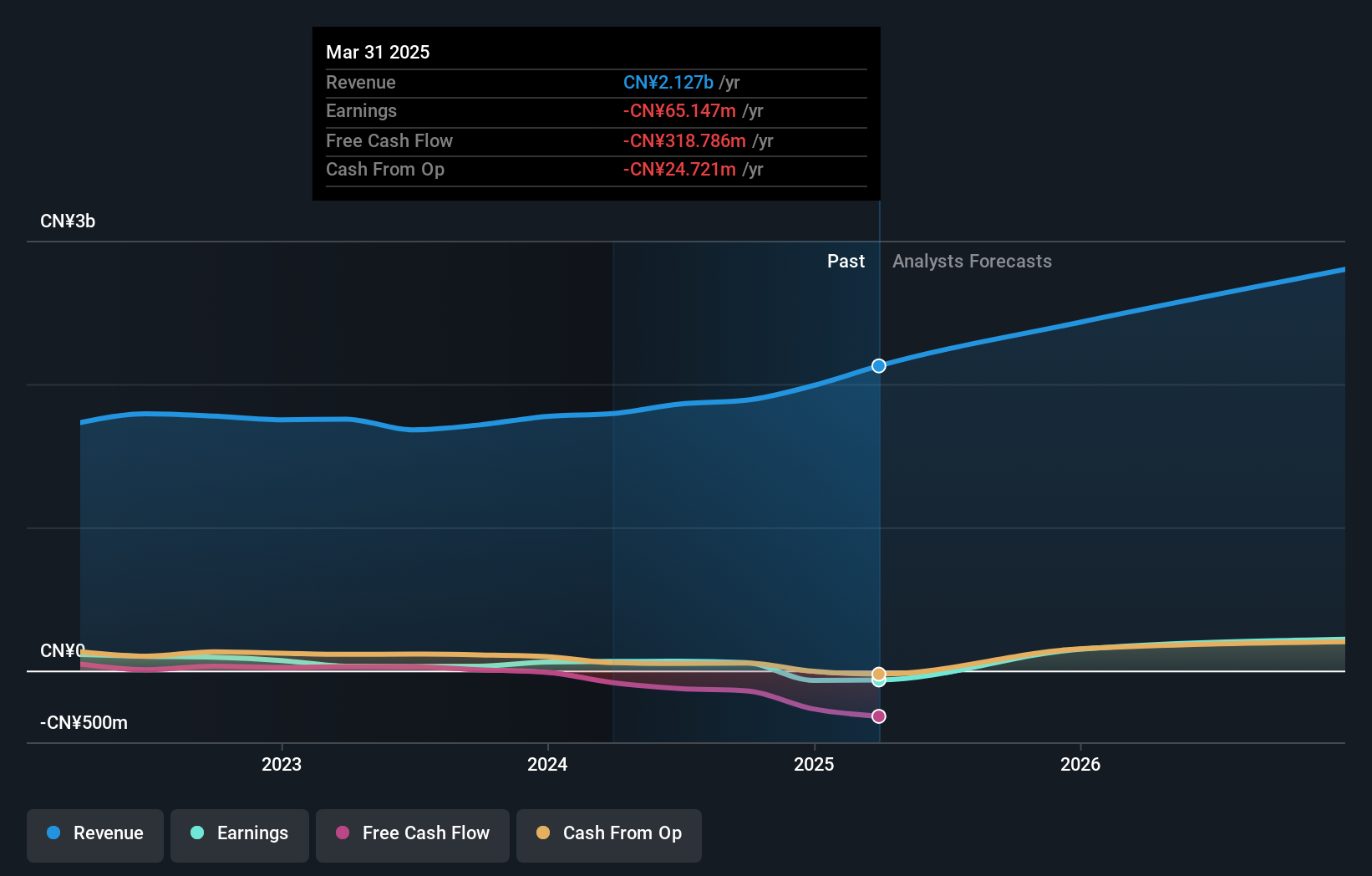

Xi'an Actionpower Electric (SHSE:688719)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Actionpower Electric Co., Ltd. focuses on the research, development, production, and sale of power supply and quality control equipment in China, with a market cap of CN¥5.47 billion.

Operations: Xi'an Actionpower Electric Co., Ltd. generates its revenue primarily through the research, development, production, and sale of power supply and quality control equipment in China.

Insider Ownership: 28.2%

Revenue Growth Forecast: 28.9% p.a.

Xi'an Actionpower Electric is set for significant growth, with earnings expected to rise 63.9% annually, surpassing the Chinese market's average. Revenue is projected to grow at 28.9% per year, also outpacing the market. Despite this, recent financials show a net loss of CNY 17.22 million for H1 2025 and a decrease in profit margins from last year’s 12.8% to 2.3%. The stock has experienced high volatility recently.

- Delve into the full analysis future growth report here for a deeper understanding of Xi'an Actionpower Electric.

- Our expertly prepared valuation report Xi'an Actionpower Electric implies its share price may be lower than expected.

Shenzhen Prince New MaterialsLtd (SZSE:002735)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Prince New Materials Co., Ltd. produces and sells packaging materials in China and has a market cap of CN¥6.44 billion.

Operations: The company's revenue is derived from three main segments: Plastic Packaging (CN¥1.28 billion), Electronic Components (CN¥523.95 million), and Military Electronics (CN¥198.59 million).

Insider Ownership: 35.3%

Revenue Growth Forecast: 17.4% p.a.

Shenzhen Prince New Materials Ltd. demonstrates potential for growth, with earnings forecasted to increase by 119.08% annually and revenue expected to grow at 17.4% per year, outpacing the Chinese market's average of 13.9%. Recent financials show an improvement in net income to CNY 15.7 million for H1 2025 from CNY 11.75 million a year prior, despite its highly volatile share price and lack of recent insider trading activity data.

- Navigate through the intricacies of Shenzhen Prince New MaterialsLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Shenzhen Prince New MaterialsLtd valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Gain an insight into the universe of 621 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688106

Jinhong GasLtd

Produces and sells bulk, special, and natural gas products in China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives