3 Asian Growth Companies With High Insider Ownership Growing Revenues At 17%

Reviewed by Simply Wall St

As global markets navigate through a period of mixed performance, with concerns about elevated valuations and artificial intelligence spending affecting growth stocks, the Asian market presents unique opportunities for investors. In this context, companies with strong insider ownership often signal confidence in their future prospects and can be particularly appealing when they demonstrate robust revenue growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

We're going to check out a few of the best picks from our screener tool.

Jiangxi Chenguang New Materials (SHSE:605399)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Chenguang New Materials Company Limited is a special chemical company that develops, produces, and sells functional silane basic raw materials, intermediates, and downstream products both in China and internationally, with a market cap of approximately CN¥5.50 billion.

Operations: The company generates revenue from the development, production, and sale of functional silane basic raw materials, intermediates, and downstream products in both domestic and international markets.

Insider Ownership: 35.1%

Revenue Growth Forecast: 27.6% p.a.

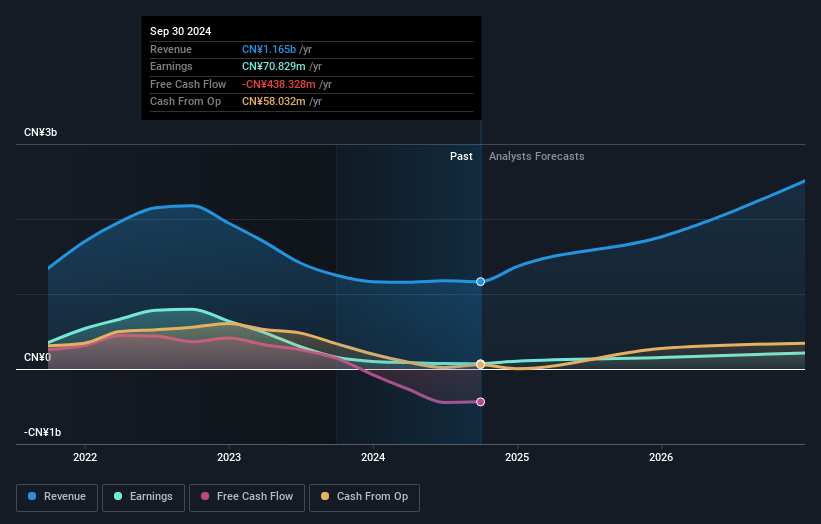

Jiangxi Chenguang New Materials is anticipated to achieve significant revenue growth of 27.6% annually, outpacing the Chinese market average. Despite a current net loss of CNY 33.79 million for the first nine months of 2025, the company is projected to become profitable within three years, suggesting strong future potential. However, its return on equity is expected to remain low at 4.1%. There has been no substantial insider trading activity recently.

- Get an in-depth perspective on Jiangxi Chenguang New Materials' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Jiangxi Chenguang New Materials' shares may be trading at a premium.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. specializes in the research, design, development, production, and sale of fiber optic devices both in China and internationally with a market cap of CN¥26.32 billion.

Operations: The company generates revenue of CN¥1.26 billion from its Optoelectronic Devices and Other Electronic Devices segment.

Insider Ownership: 31.8%

Revenue Growth Forecast: 25.3% p.a.

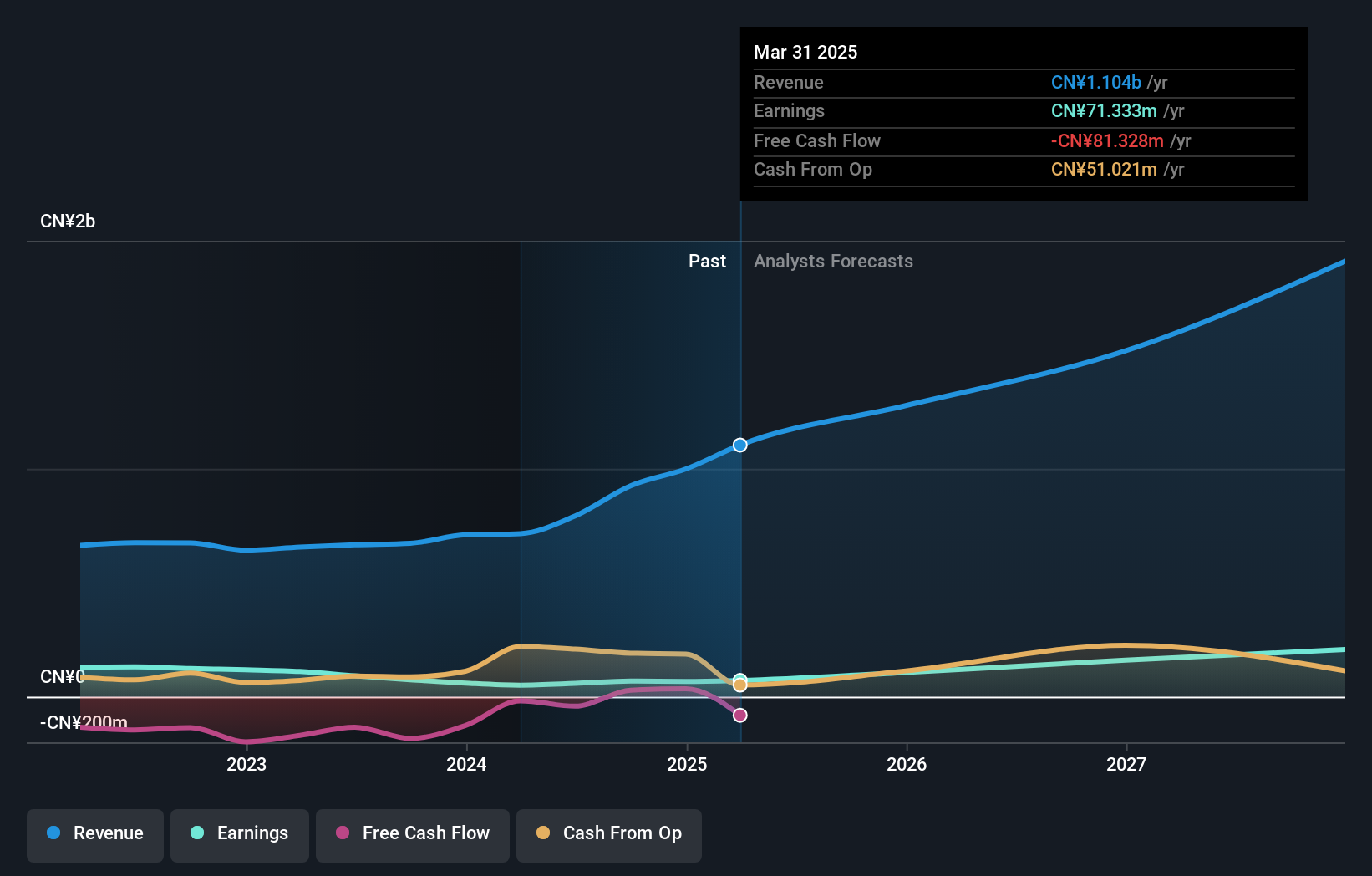

Advanced Fiber Resources (Zhuhai) is poised for significant earnings growth of 33% annually, surpassing the Chinese market average. The company's revenue for the first nine months of 2025 reached CNY 998.41 million, a substantial increase from CNY 738.95 million in the previous year, with net income doubling to CNY 115.31 million. Despite high volatility in its share price and low forecasted return on equity at 10.2%, insider ownership remains strong without recent significant trading activity.

- Navigate through the intricacies of Advanced Fiber Resources (Zhuhai) with our comprehensive analyst estimates report here.

- Our valuation report here indicates Advanced Fiber Resources (Zhuhai) may be overvalued.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products in China and internationally, with a market cap of CN¥14.11 billion.

Operations: The company's revenue segments are not provided in the available text.

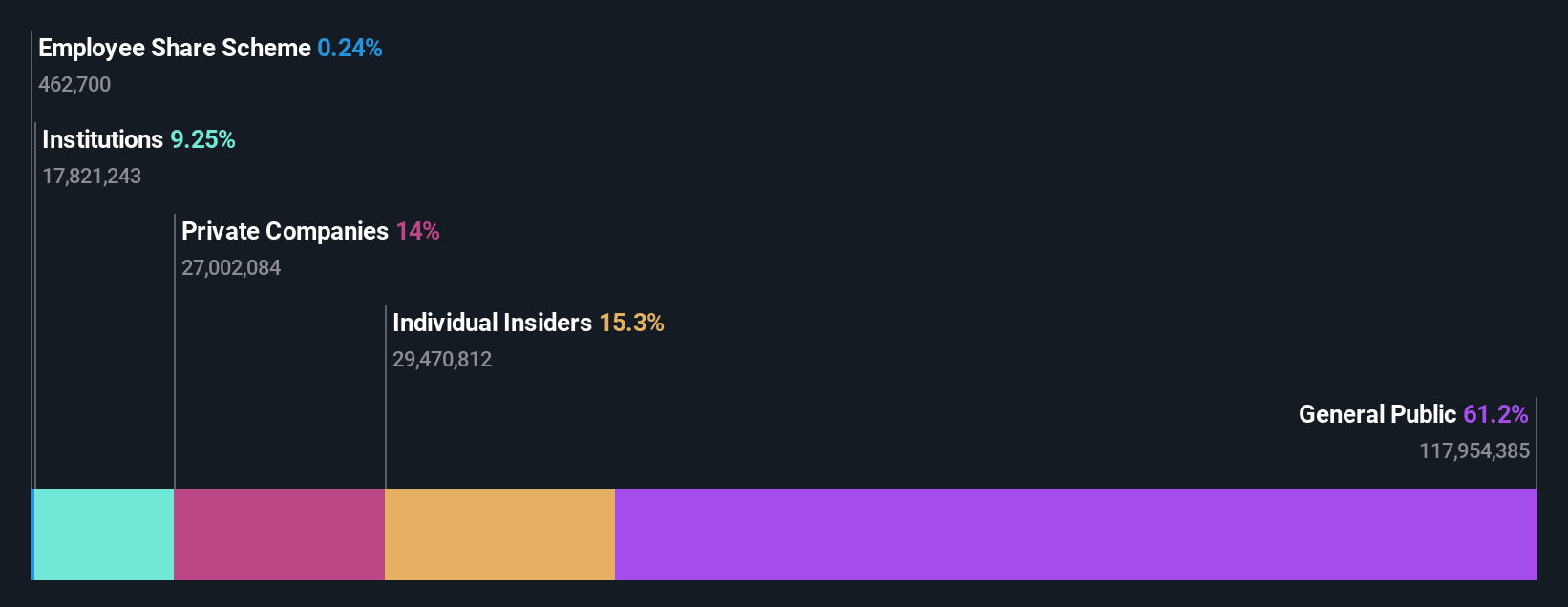

Insider Ownership: 15.3%

Revenue Growth Forecast: 17.8% p.a.

Wondershare Technology Group is expected to achieve profitability within three years, with revenue growth forecasted at 17.8% annually, outpacing the Chinese market. Despite a current net loss of CNY 61.59 million for the first nine months of 2025, recent product innovations like EdrawMind V13 and participation in GITEX GLOBAL highlight its commitment to AI-driven solutions and expanding market presence. Insider ownership remains substantial without significant recent trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Wondershare Technology Group.

- According our valuation report, there's an indication that Wondershare Technology Group's share price might be on the expensive side.

Seize The Opportunity

- Reveal the 616 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605399

Jiangxi Chenguang New Materials

A special chemical company, develops, produces, and sells functional silane basic raw materials, intermediates, and downstream products in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives