- China

- /

- Metals and Mining

- /

- SHSE:605158

Zhejiang Huada New Materials Co., Ltd. (SHSE:605158) Held Back By Insufficient Growth Even After Shares Climb 36%

Those holding Zhejiang Huada New Materials Co., Ltd. (SHSE:605158) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

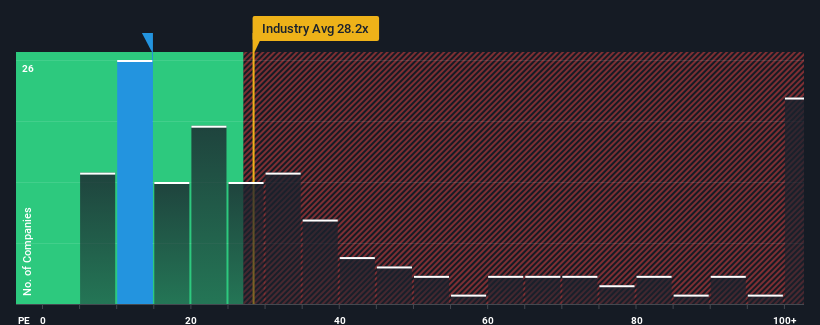

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Zhejiang Huada New Materials as a highly attractive investment with its 14.7x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Zhejiang Huada New Materials as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Zhejiang Huada New Materials

Is There Any Growth For Zhejiang Huada New Materials?

The only time you'd be truly comfortable seeing a P/E as depressed as Zhejiang Huada New Materials' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 78% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 20% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Zhejiang Huada New Materials' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Zhejiang Huada New Materials' P/E?

Even after such a strong price move, Zhejiang Huada New Materials' P/E still trails the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhejiang Huada New Materials maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Zhejiang Huada New Materials that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huada New Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605158

Zhejiang Huada New Materials

Engages in the research, development, production, and sale of multifunctional color coated sheets, hot-dip galvanized aluminum sheets, and related substrates in China and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives