Zhejiang Yonghe Refrigerant Co., Ltd.'s (SHSE:605020) Stock Retreats 25% But Earnings Haven't Escaped The Attention Of Investors

To the annoyance of some shareholders, Zhejiang Yonghe Refrigerant Co., Ltd. (SHSE:605020) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

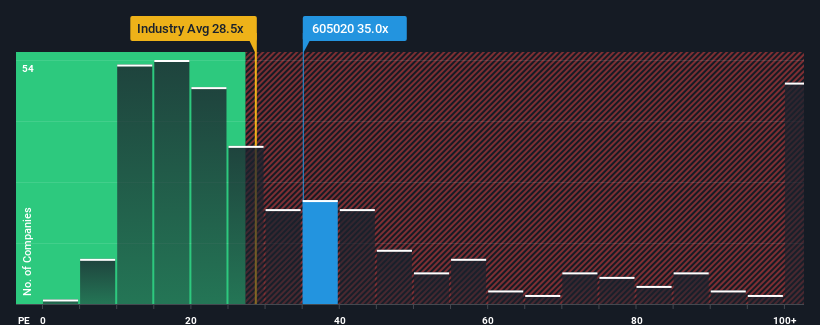

In spite of the heavy fall in price, Zhejiang Yonghe Refrigerant's price-to-earnings (or "P/E") ratio of 35x might still make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 27x and even P/E's below 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Zhejiang Yonghe Refrigerant hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Zhejiang Yonghe Refrigerant

How Is Zhejiang Yonghe Refrigerant's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Zhejiang Yonghe Refrigerant's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 63% each year over the next three years. That's shaping up to be materially higher than the 24% per annum growth forecast for the broader market.

With this information, we can see why Zhejiang Yonghe Refrigerant is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

There's still some solid strength behind Zhejiang Yonghe Refrigerant's P/E, if not its share price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhejiang Yonghe Refrigerant maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Zhejiang Yonghe Refrigerant (2 don't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Yonghe Refrigerant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605020

Zhejiang Yonghe Refrigerant

Engages in research and development, production, and sale of fluorine chemical products.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives