Top 3 Chinese Stocks Trading Below Estimated Value In September 2024

Reviewed by Simply Wall St

As of September 2024, Chinese equities have shown resilience despite a series of underwhelming economic data, with indices like the Shanghai Composite and CSI 300 posting gains. This performance comes amid broader global market optimism spurred by the U.S. Federal Reserve's recent rate cut. In this environment, identifying undervalued stocks can be particularly rewarding for investors seeking opportunities that may benefit from potential economic stimulus measures and improving market sentiment.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningxia Baofeng Energy Group (SHSE:600989) | CN¥14.72 | CN¥28.76 | 48.8% |

| Beijing InHand Networks Technology (SHSE:688080) | CN¥23.34 | CN¥45.00 | 48.1% |

| Beijing SDL TechnologyLtd (SZSE:002658) | CN¥5.46 | CN¥10.56 | 48.3% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥32.18 | CN¥63.82 | 49.6% |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥138.27 | CN¥272.23 | 49.2% |

| Jiangsu Hongdou IndustrialLTD (SHSE:600400) | CN¥2.09 | CN¥4.08 | 48.8% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.07 | CN¥13.97 | 49.4% |

| Aerospace CH UAVLtd (SZSE:002389) | CN¥13.18 | CN¥25.99 | 49.3% |

| Jiugui Liquor (SZSE:000799) | CN¥37.80 | CN¥73.92 | 48.9% |

| Cybrid Technologies (SHSE:603212) | CN¥9.71 | CN¥18.90 | 48.6% |

Let's uncover some gems from our specialized screener.

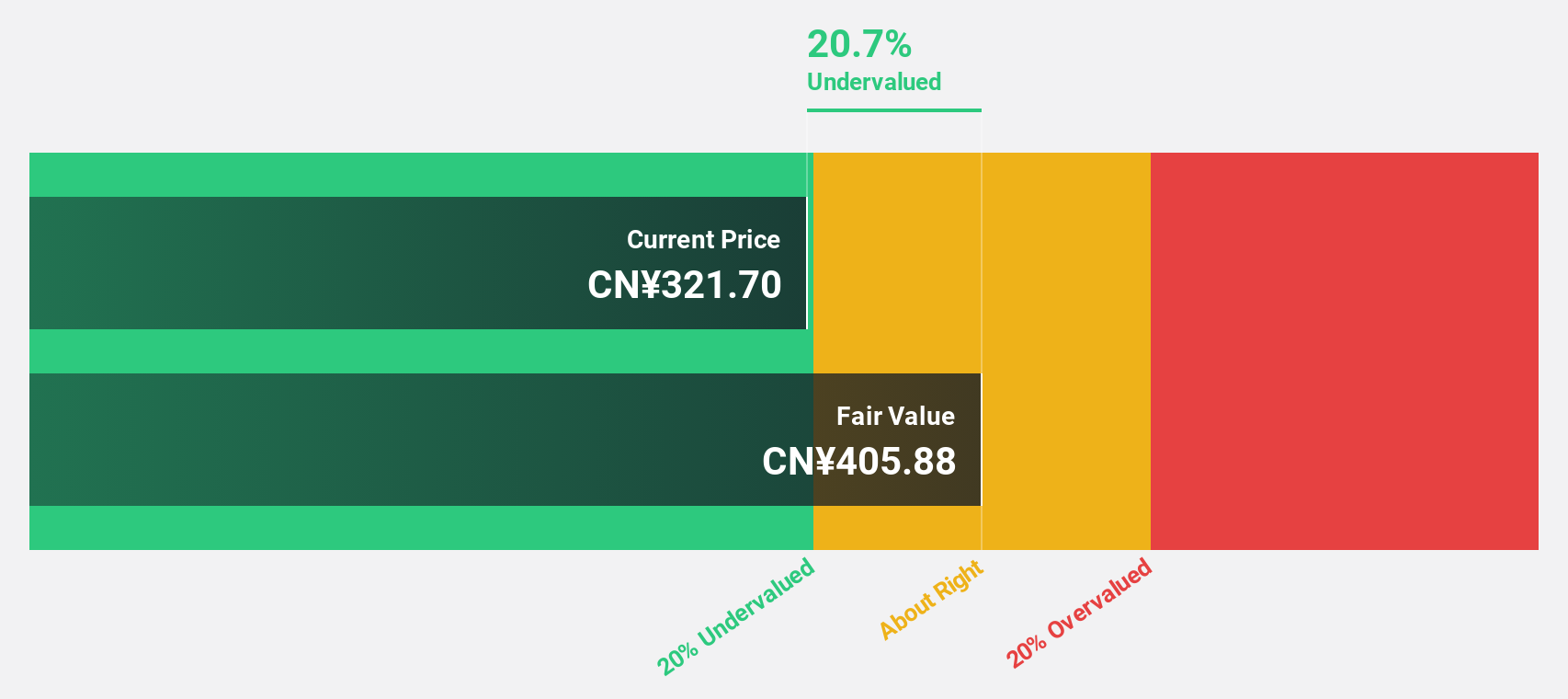

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. produces and sells paints, coatings, and building materials under the 3trees brand in China, with a market cap of CN¥15.29 billion.

Operations: SKSHU Paint Co., Ltd. generates revenue from the production and sale of paints, coatings, and building materials under the 3trees brand in China.

Estimated Discount To Fair Value: 45.2%

SKSHU Paint Ltd. is trading at 45.2% below its estimated fair value of CN¥52.97, with a current price of CN¥29.02, indicating it may be undervalued based on cash flows despite high debt levels and volatile share prices. Recent earnings show a decline in net income to CN¥210 million for H1 2024 from CN¥310.56 million a year ago, though earnings are projected to grow significantly by 55.8% annually over the next three years.

- According our earnings growth report, there's an indication that SKSHU PaintLtd might be ready to expand.

- Navigate through the intricacies of SKSHU PaintLtd with our comprehensive financial health report here.

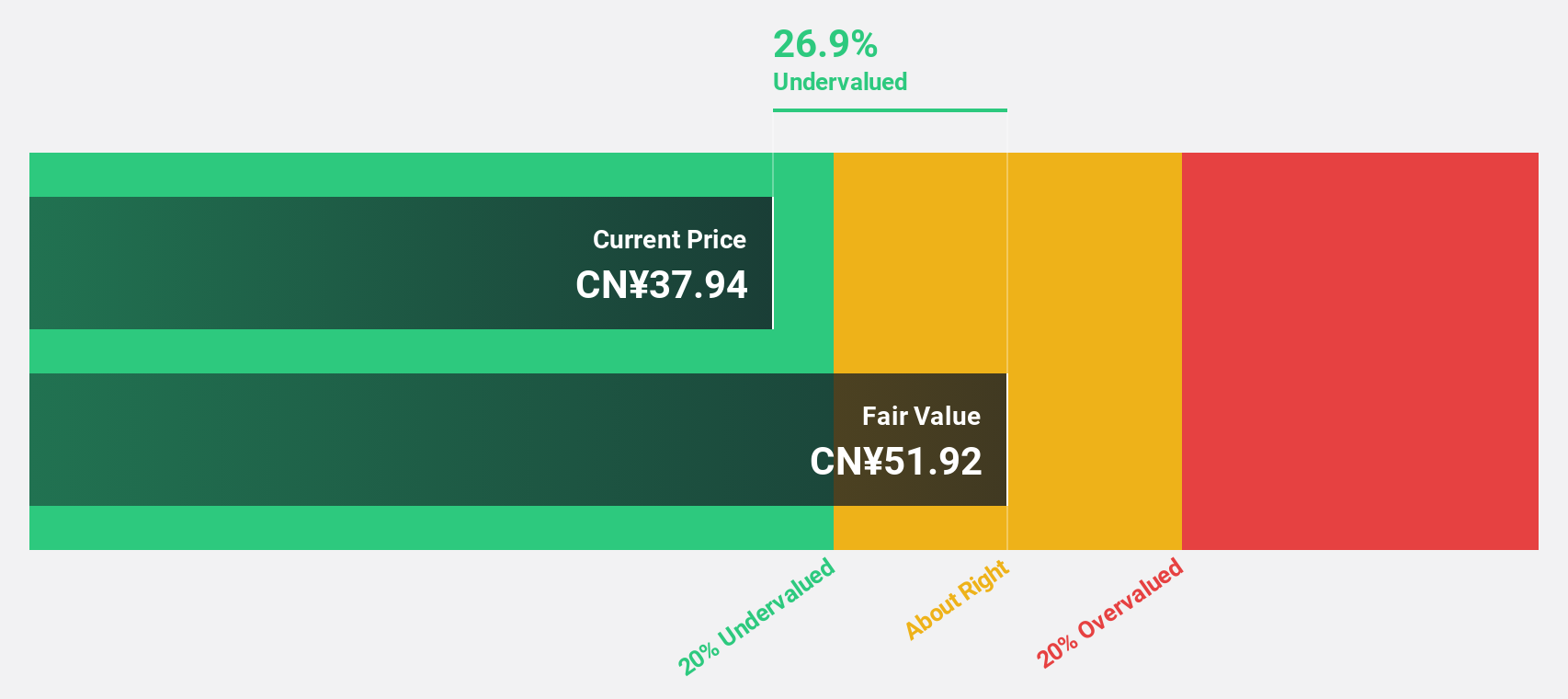

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. manufactures beverages in China and has a market cap of CN¥90.82 billion.

Operations: Eastroc Beverage(Group) Co., Ltd. generates CN¥13.68 billion from the production, sales, and wholesale of beverages and pre-packaged foods.

Estimated Discount To Fair Value: 18.7%

Eastroc Beverage(Group) is trading at 18.7% below its estimated fair value of CN¥279.2, with a current price of CN¥227.04, suggesting it may be undervalued based on cash flows. Recent earnings for H1 2024 show substantial growth, with net income rising to CN¥1.73 billion from CN¥1.11 billion a year ago and revenue increasing to CN¥7.87 billion from CN¥5.46 billion, highlighting strong financial performance and significant future earnings growth potential at 23% annually over the next three years.

- The growth report we've compiled suggests that Eastroc Beverage(Group)'s future prospects could be on the up.

- Click here to discover the nuances of Eastroc Beverage(Group) with our detailed financial health report.

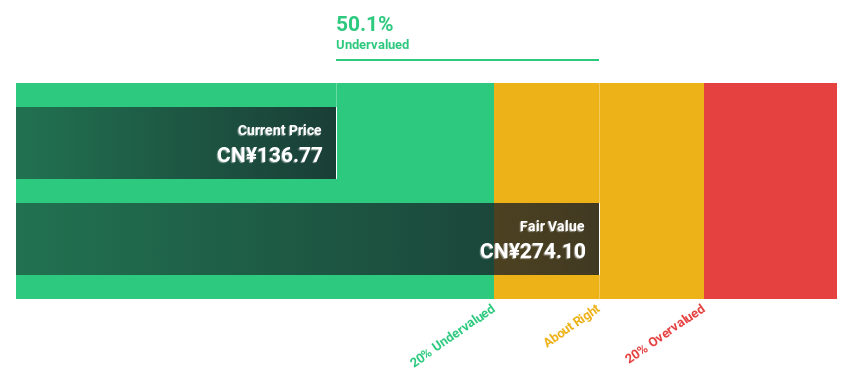

Imeik Technology DevelopmentLtd (SZSE:300896)

Overview: Imeik Technology Development Co., Ltd. focuses on the research, development, production, and transformation of biomedical soft tissue repair materials in China and has a market cap of CN¥41.66 billion.

Operations: Imeik Technology Development Ltd. generates revenue primarily from its Surgical & Medical Equipment segment, which amounts to CN¥3.07 billion.

Estimated Discount To Fair Value: 49.2%

Imeik Technology Development Ltd. is trading at CN¥138.27, significantly below its estimated fair value of CN¥272.23, indicating substantial undervaluation based on cash flows. Recent H1 2024 earnings show robust growth with net income rising to CN¥1.12 billion from CN¥963.4 million a year ago and revenue increasing to CNY 1,656.91 million from CNY 1,459.48 million a year ago, supporting strong future earnings growth forecasts of 22% annually over the next three years.

- Our earnings growth report unveils the potential for significant increases in Imeik Technology DevelopmentLtd's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Imeik Technology DevelopmentLtd.

Where To Now?

- Discover the full array of 117 Undervalued Chinese Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastroc Beverage(Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605499

Outstanding track record with high growth potential.