July 2024 Insight Into Three Chinese Stocks Estimated To Be Below Fair Value

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, China's economic landscape presents unique opportunities as strong export data tempers concerns about domestic demand. As investors seek value in this complex environment, identifying stocks that appear to be trading below their intrinsic worth could offer potential avenues for portfolio enhancement.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥171.20 | CN¥321.06 | 46.7% |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥17.24 | CN¥33.17 | 48% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥23.39 | CN¥45.80 | 48.9% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.37 | CN¥29.93 | 48.6% |

| INKON Life Technology (SZSE:300143) | CN¥7.39 | CN¥14.64 | 49.5% |

| Shanghai Milkground Food Tech (SHSE:600882) | CN¥13.72 | CN¥26.97 | 49.1% |

| China Film (SHSE:600977) | CN¥10.51 | CN¥20.27 | 48.2% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.70 | CN¥17.27 | 49.6% |

| Seres GroupLtd (SHSE:601127) | CN¥77.27 | CN¥149.66 | 48.4% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥50.38 | CN¥96.65 | 47.9% |

Let's uncover some gems from our specialized screener.

Shenzhen Hopewind Electric (SHSE:603063)

Overview: Shenzhen Hopewind Electric Co., Ltd. specializes in the research, development, manufacturing, sales, and service of energy and electric drive products with a market capitalization of approximately CN¥6.73 billion.

Operations: The company generates revenue through the development, manufacturing, and sales of energy and electric drive products.

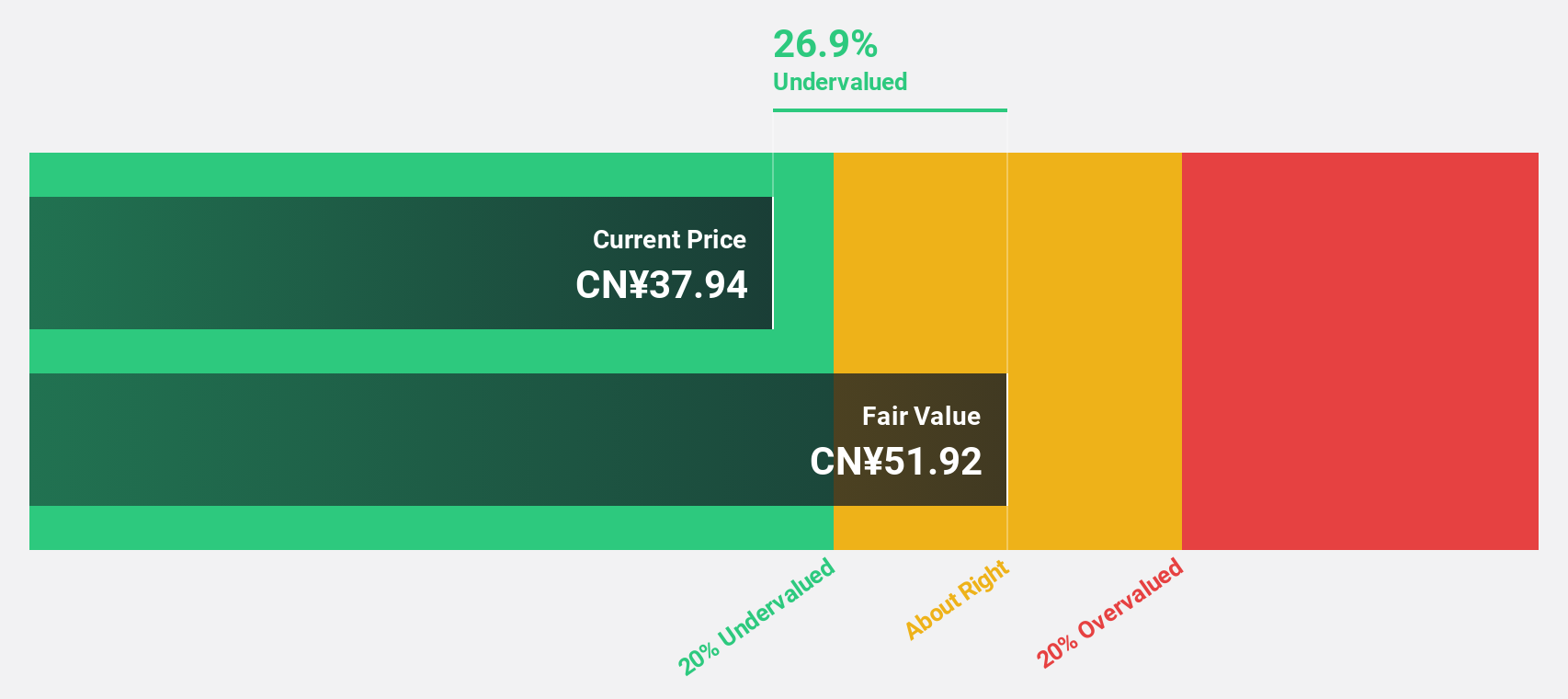

Estimated Discount To Fair Value: 35%

Shenzhen Hopewind Electric is currently undervalued based on DCF, with its trading price significantly below the estimated fair value, indicating a potential investment opportunity. Despite a recent dip in quarterly earnings and revenue from CNY 609.74 million to CNY 548.5 million and net income decreasing to CNY 55.35 million, annual figures show robust growth with revenue jumping to CNY 3.75 billion and net income rising sharply to CNY 502.25 million. Forecasted earnings growth is substantial at over 20% annually, outpacing the broader Chinese market expectations, although its dividend coverage by free cash flows remains weak.

- In light of our recent growth report, it seems possible that Shenzhen Hopewind Electric's financial performance will exceed current levels.

- Click here to discover the nuances of Shenzhen Hopewind Electric with our detailed financial health report.

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd., operating under the 3trees brand, specializes in the production and sale of paints, coatings, and building materials exclusively in China, with a market capitalization of CN¥19.12 billion.

Operations: The company generates its revenue from the production and sale of paints, coatings, and building materials.

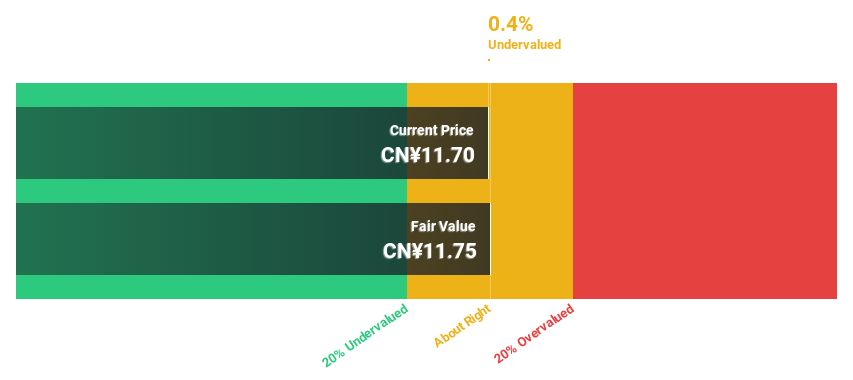

Estimated Discount To Fair Value: 26.4%

SKSHU Paint Co., Ltd. is considered undervalued based on its current trading price of CN¥36.28, significantly below the DCF-estimated fair value of CN¥49.27. Despite a volatile share price and low profit margins (1.6% compared to last year's 3.4%), the company's earnings are expected to grow robustly by 44% annually, outperforming the broader Chinese market forecast of 22.2%. However, its interest payments are poorly covered by earnings, indicating potential financial stress despite high forecasted Return on Equity at 25.8%. Recent financial results show an increase in Q1 net income from CN¥26.42 million to CN¥47.08 million year-over-year, suggesting improving profitability.

- Insights from our recent growth report point to a promising forecast for SKSHU PaintLtd's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of SKSHU PaintLtd.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. is a company focused on the development and manufacturing of medical devices, with a market capitalization of CN¥13.86 billion.

Operations: The company generates revenue primarily from its medical products segment, totaling CN¥1.07 billion.

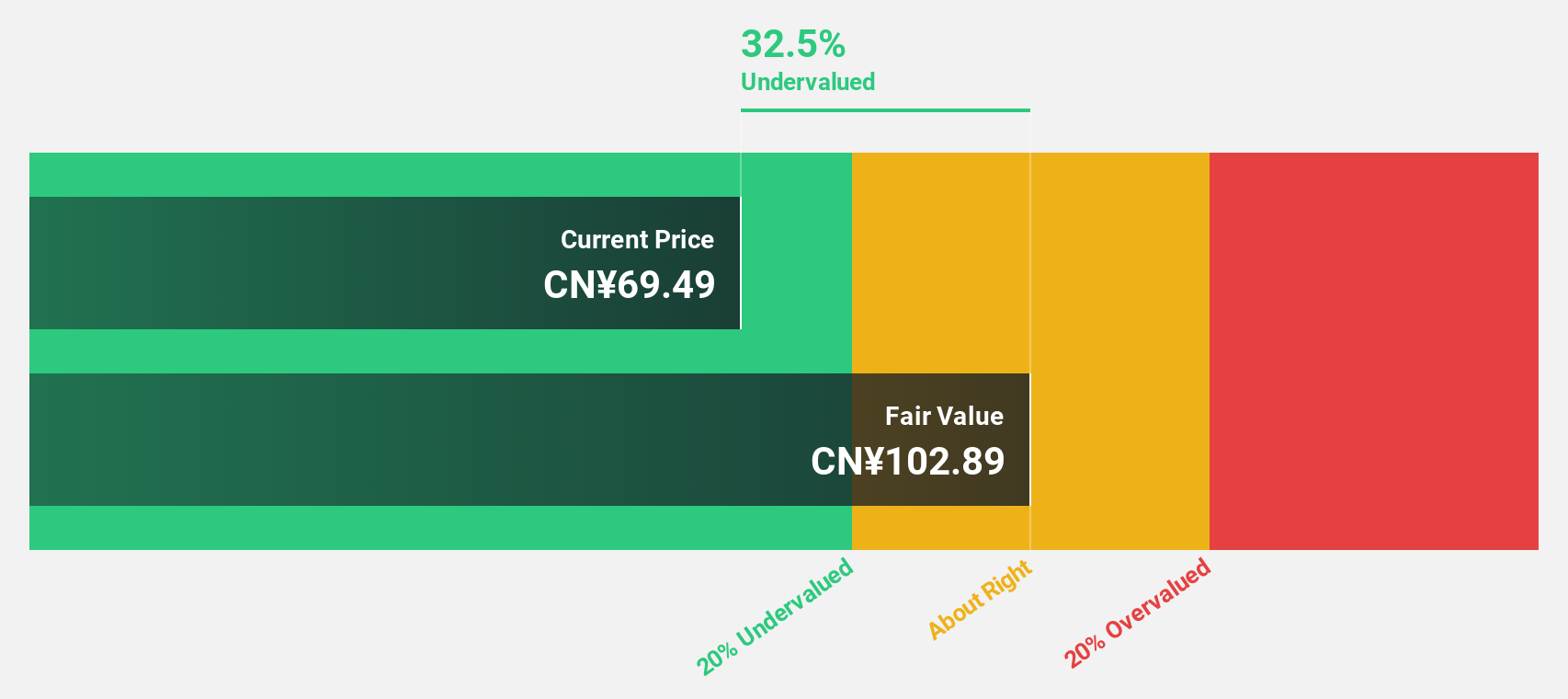

Estimated Discount To Fair Value: 40.2%

Eyebright Medical Technology (Beijing) is trading at CN¥73.13, which is 40.2% below its estimated fair value of CN¥122.28, signaling a significant undervaluation based on cash flows. The company's earnings and revenue are expected to grow by 27.15% and 28.8% per year respectively, outpacing the Chinese market projections of 22.2% for earnings and 13.7% for revenue growth annually. However, its forecasted Return on Equity in three years at 17.7% remains low compared to industry benchmarks.

- Our growth report here indicates Eyebright Medical Technology (Beijing) may be poised for an improving outlook.

- Navigate through the intricacies of Eyebright Medical Technology (Beijing) with our comprehensive financial health report here.

Where To Now?

- Discover the full array of 103 Undervalued Chinese Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603737

SKSHU PaintLtd

Produces and sells paints, coatings, and building materials under the 3trees brand in China.

Undervalued with high growth potential.