- Japan

- /

- Professional Services

- /

- TSE:7088

3 Global Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

In recent weeks, global markets have faced a mix of challenges, including concerns over elevated valuations in tech stocks and the impact of geopolitical events like the U.S. federal government shutdown. Amidst this backdrop, identifying undervalued stocks can be crucial for investors looking to navigate market volatility and capitalize on potential opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YSB (SEHK:9885) | HK$8.37 | HK$16.62 | 49.6% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.70 | CN¥25.19 | 49.6% |

| Visional (TSE:4194) | ¥9817.00 | ¥19512.48 | 49.7% |

| Tianqi Lithium (SZSE:002466) | CN¥55.32 | CN¥109.02 | 49.3% |

| PharmaResearch (KOSDAQ:A214450) | ₩440000.00 | ₩874308.69 | 49.7% |

| Meitu (SEHK:1357) | HK$8.68 | HK$17.21 | 49.6% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.11 | CN¥19.97 | 49.4% |

| FIT Hon Teng (SEHK:6088) | HK$5.56 | HK$11.10 | 49.9% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

| Allcore (BIT:CORE) | €1.34 | €2.66 | 49.7% |

Let's review some notable picks from our screened stocks.

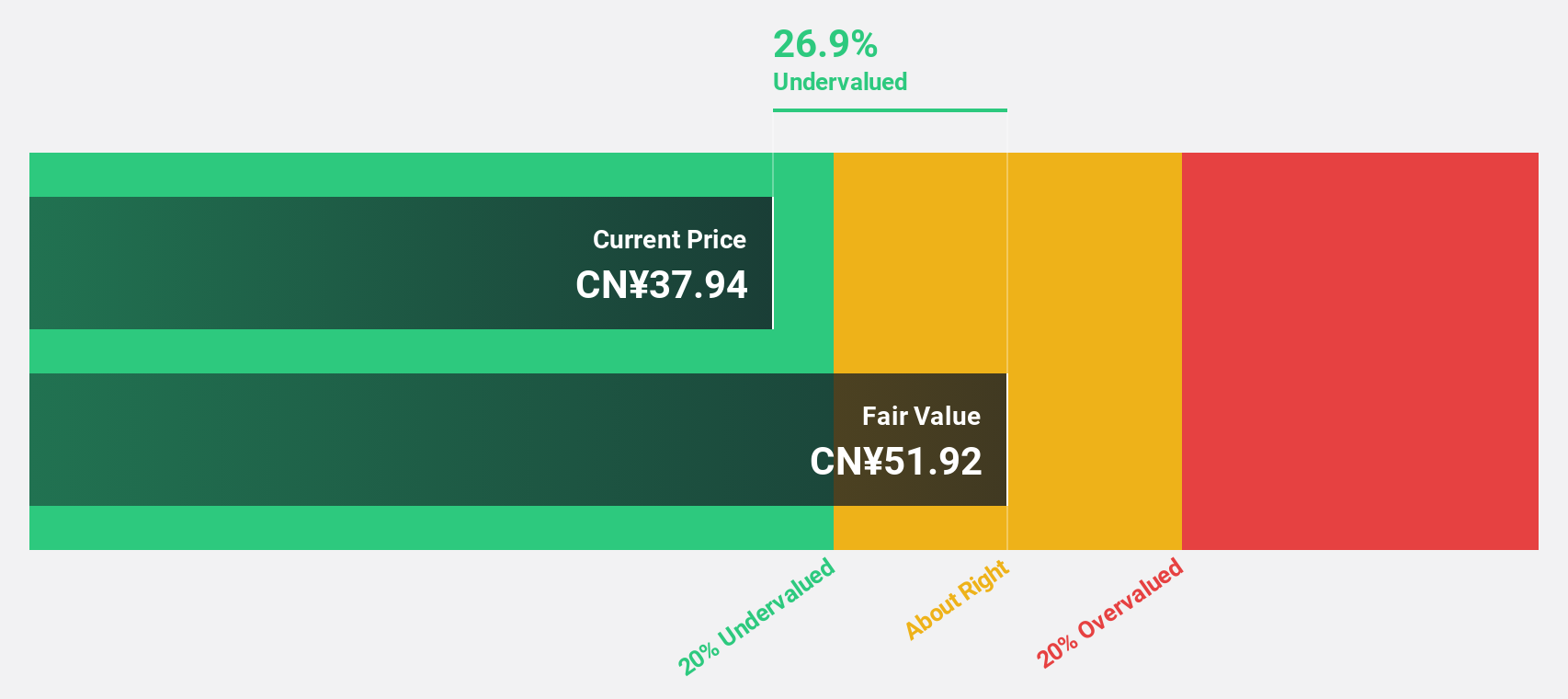

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. operates in China under the 3trees brand, producing and selling paints, coatings, and building materials, with a market cap of CN¥32.77 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 16.7%

SKSHU Paint Co., Ltd. shows potential as an undervalued stock based on cash flows, trading at CN¥45.51, approximately 16.7% below its estimated fair value of CN¥54.65. Despite a high debt level and slower revenue growth forecast compared to the market, its earnings are projected to grow significantly at 27.2% annually, outpacing the market's average growth rate. Recent earnings reports show substantial profit increases with net income rising to CNY 743.61 million for the nine months ended September 2025 from CNY 410.34 million a year ago.

- In light of our recent growth report, it seems possible that SKSHU PaintLtd's financial performance will exceed current levels.

- Get an in-depth perspective on SKSHU PaintLtd's balance sheet by reading our health report here.

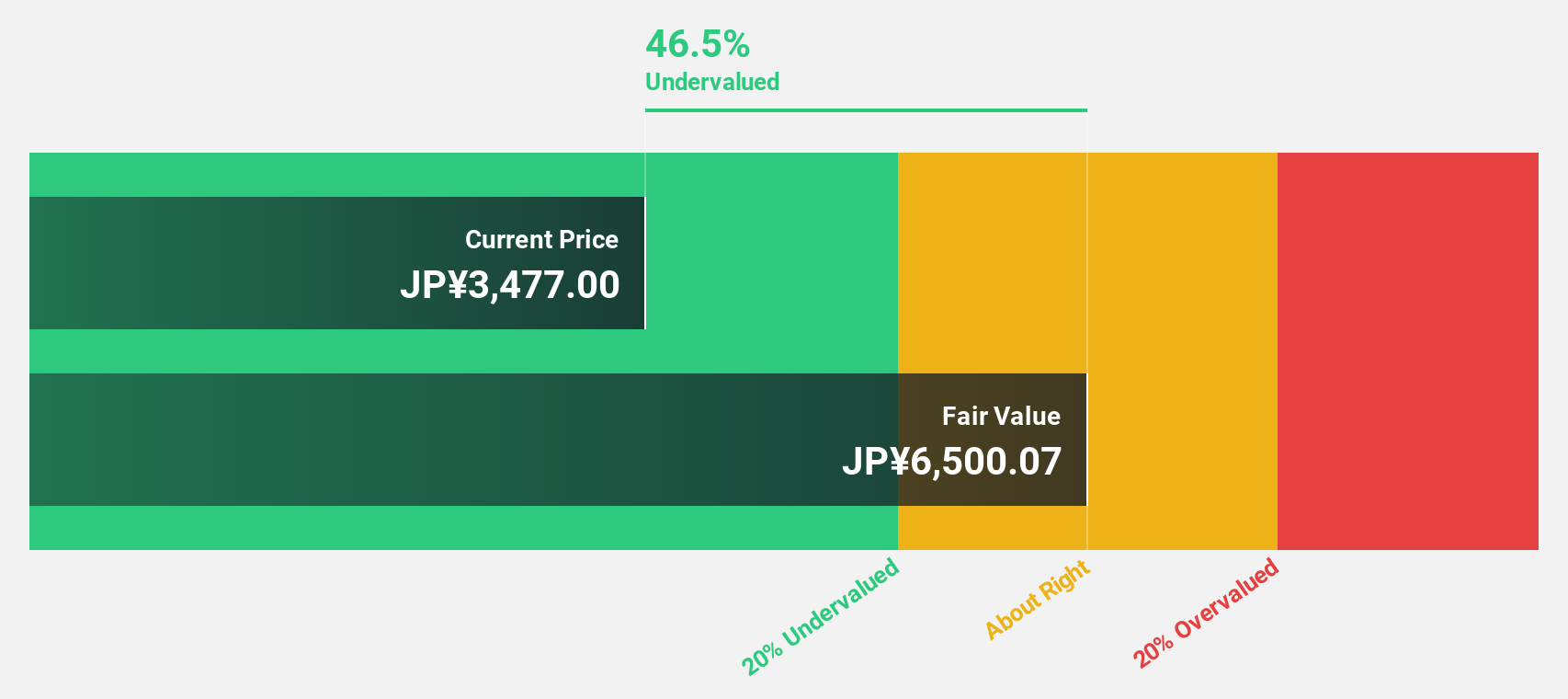

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a pharmaceutical manufacturer and seller with operations in Japan, the United States, Europe, and internationally, boasting a market cap of ¥6.12 trillion.

Operations: The company generates revenue primarily through its Pharmaceutical Operation segment, which reported ¥1.98 billion in revenue.

Estimated Discount To Fair Value: 48.6%

Daiichi Sankyo Company appears undervalued based on cash flows, trading at ¥3,394, significantly below its estimated fair value of ¥6,603.36. Despite recent product-related announcements and promising clinical trials in oncology, the company's share price has been highly volatile over the past three months. Earnings grew by 11.8% last year and are forecast to grow annually by 14.3%, surpassing the Japanese market's average growth rate of 7.9%. However, its dividend yield is not well covered by free cash flows.

- Our earnings growth report unveils the potential for significant increases in Daiichi Sankyo Company's future results.

- Unlock comprehensive insights into our analysis of Daiichi Sankyo Company stock in this financial health report.

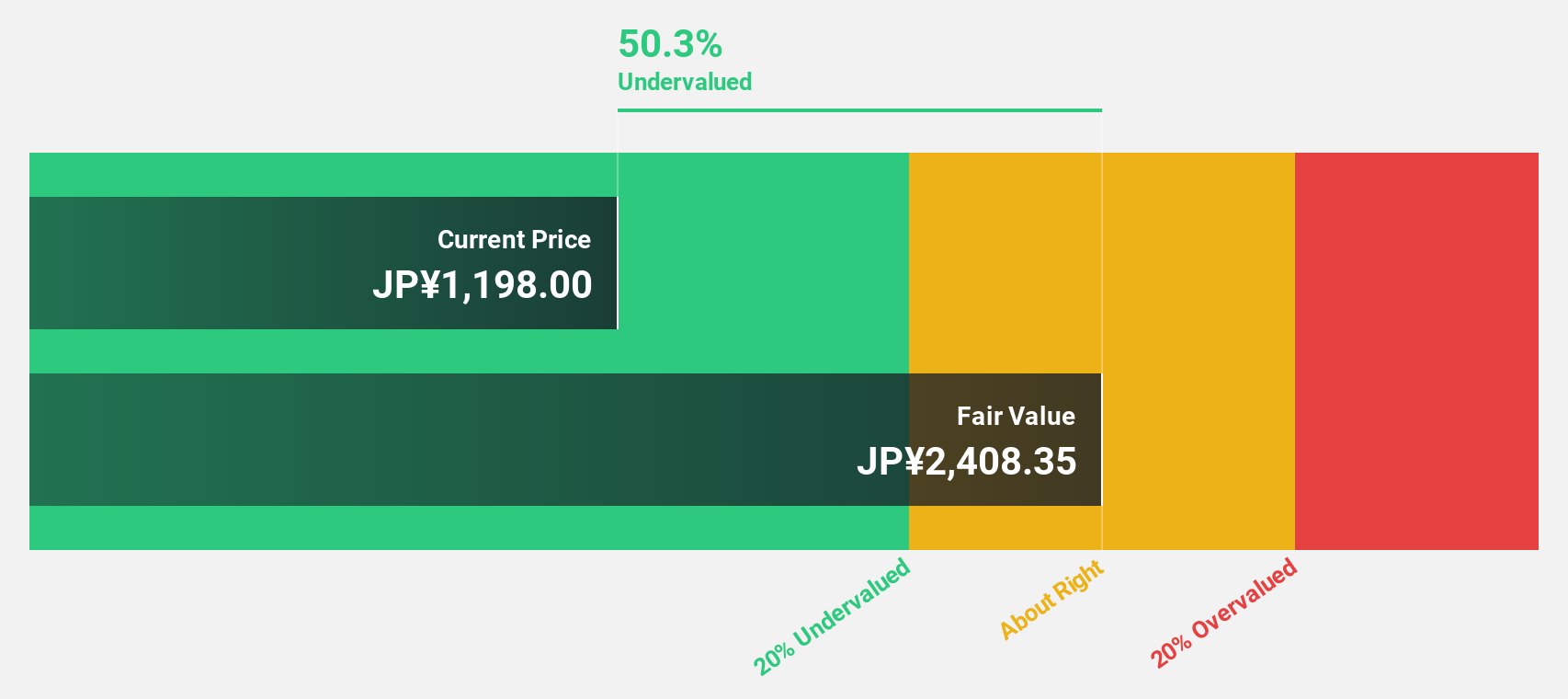

Forum Engineering (TSE:7088)

Overview: Forum Engineering Inc. specializes in the dispatch and introduction of engineers, offering a variety of services to engineers, science and engineering students, and others in Japan, with a market cap of ¥67.88 billion.

Operations: The company generates revenue primarily through its Engineer Staffing Service and Engineer Referral Service, amounting to ¥35.39 billion.

Estimated Discount To Fair Value: 18.5%

Forum Engineering Inc. trades at ¥1,590, below its estimated fair value of ¥1,951.73, indicating it may be undervalued based on cash flows. Earnings grew by 23.3% last year and are forecast to grow annually by 8.62%, outpacing the Japanese market's average growth rate of 7.9%. However, the dividend yield of 3.93% is not well covered by earnings. Recent acquisition interest from KKR & Co., valuing the company at ¥90 billion, might influence future valuations and strategic direction.

- The analysis detailed in our Forum Engineering growth report hints at robust future financial performance.

- Take a closer look at Forum Engineering's balance sheet health here in our report.

Seize The Opportunity

- Navigate through the entire inventory of 509 Undervalued Global Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7088

Forum Engineering

Provides dispatch and introduction of engineers, and a wide range of services to engineers, science and engineering students, and other people in Japan.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives