Amidst a backdrop of waning optimism about Beijing's stimulus measures, Chinese equities have experienced a downturn, with the Shanghai Composite Index and CSI 300 both recording significant losses. As investors navigate these challenging conditions, identifying stocks that may be trading below their estimated value becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥56.19 | CN¥109.27 | 48.6% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥12.95 | CN¥25.45 | 49.1% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥30.04 | CN¥58.40 | 48.6% |

| Neusoft (SHSE:600718) | CN¥9.69 | CN¥19.28 | 49.7% |

| Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777) | CN¥19.26 | CN¥36.36 | 47% |

| Seres GroupLtd (SHSE:601127) | CN¥91.40 | CN¥171.87 | 46.8% |

| Brilliance Technology (SZSE:300542) | CN¥21.08 | CN¥40.72 | 48.2% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥25.58 | CN¥48.19 | 46.9% |

| Yangmei ChemicalLtd (SHSE:600691) | CN¥2.07 | CN¥3.96 | 47.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥10.18 | CN¥19.25 | 47.1% |

Underneath we present a selection of stocks filtered out by our screen.

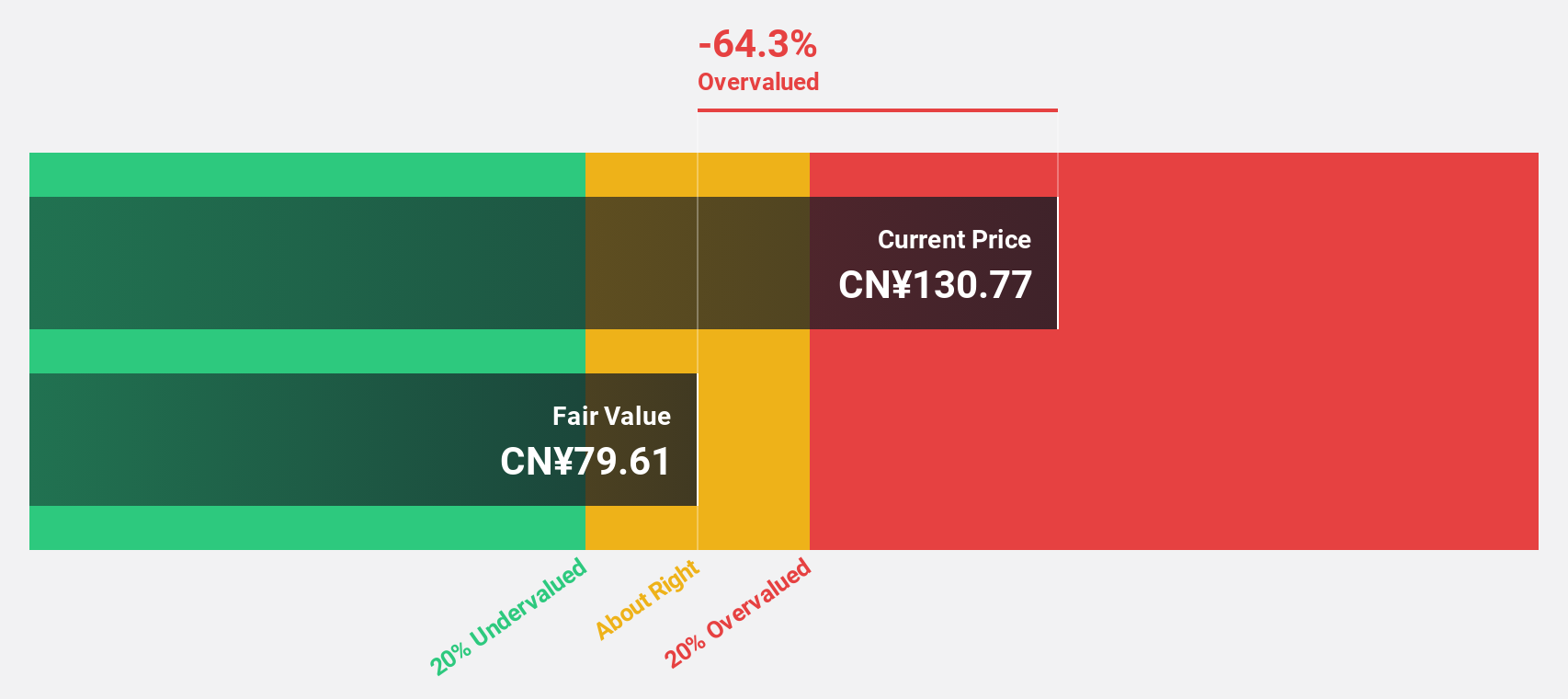

Seres GroupLtd (SHSE:601127)

Overview: Seres Group Co., Ltd. is a Chinese company engaged in the research, development, manufacturing, sales, and supply of automobiles and auto parts, with a market capitalization of approximately CN¥137.64 billion.

Operations: The company's revenue from the automobile industry amounts to CN¥89.85 billion.

Estimated Discount To Fair Value: 46.8%

Seres Group Ltd. appears highly undervalued based on cash flows, trading significantly below its estimated fair value of CN¥171.87 at CN¥91.4. The company's earnings are forecast to grow 40% annually, outpacing the Chinese market's growth rate and reflecting robust revenue growth of 22.8% per year. Recent financial results show a substantial turnaround with net income reaching CN¥1.62 billion for H1 2024 from a previous loss, highlighting strong operational recovery and potential for future profitability enhancements.

- Upon reviewing our latest growth report, Seres GroupLtd's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Seres GroupLtd stock in this financial health report.

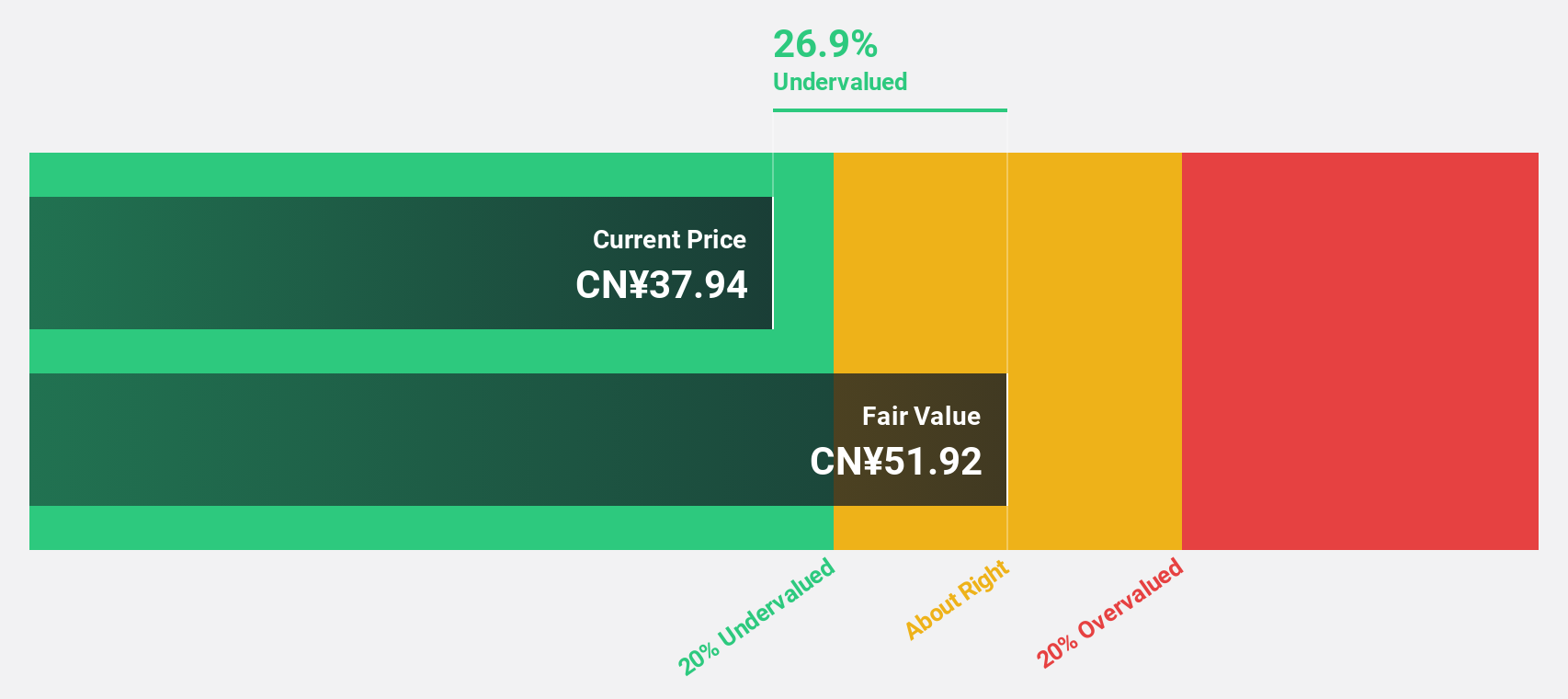

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. operates in China, producing and selling paints, coatings, and building materials under the 3trees brand, with a market capitalization of approximately CN¥20.75 billion.

Operations: SKSHU Paint Co., Ltd. generates revenue through its production and sale of paints, coatings, and building materials under the 3trees brand in China.

Estimated Discount To Fair Value: 23.6%

SKSHU Paint Ltd. is trading at CN¥41.62, more than 20% below its estimated fair value of CN¥54.51, suggesting it may be undervalued based on cash flows despite recent volatility in share price. Earnings are projected to grow significantly at 55.8% annually, outpacing the market average, though revenue growth lags behind industry expectations. Recent financials show a dip in net income to CN¥210 million for H1 2024 from CN¥310.56 million last year amidst high debt levels and reduced profit margins.

- The analysis detailed in our SKSHU PaintLtd growth report hints at robust future financial performance.

- Dive into the specifics of SKSHU PaintLtd here with our thorough financial health report.

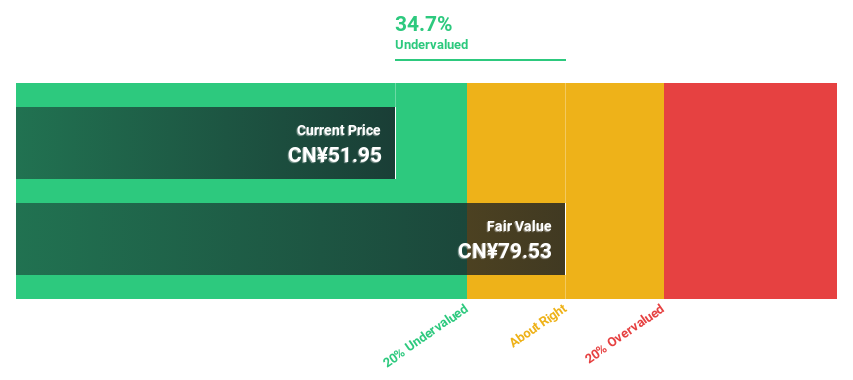

Inner Mongolia Furui Medical Science (SZSE:300049)

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science sector with a market capitalization of approximately CN¥12.69 billion.

Operations: Inner Mongolia Furui Medical Science Co., Ltd. generates its revenue from various segments within the medical science sector.

Estimated Discount To Fair Value: 40%

Inner Mongolia Furui Medical Science Co., Ltd. trades at CN¥47.71, significantly below its estimated fair value of CN¥79.53, reflecting potential undervaluation based on cash flows despite robust financial performance. Recent earnings for H1 2024 show net income rising to CNY 75.36 million from CNY 43.82 million year-over-year, with revenue reaching CNY 642.63 million from CNY 524.48 million previously, suggesting strong operational growth and profitability amidst expectations of high future earnings and revenue growth rates surpassing market averages.

- Insights from our recent growth report point to a promising forecast for Inner Mongolia Furui Medical Science's business outlook.

- Click here to discover the nuances of Inner Mongolia Furui Medical Science with our detailed financial health report.

Make It Happen

- Unlock our comprehensive list of 106 Undervalued Chinese Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601127

Seres GroupLtd

Researches and develops, manufactures, sells, and supplies automobiles, auto parts and other products in China.

Exceptional growth potential and undervalued.