Sanxiang Advanced Materials Co., Ltd. (SHSE:603663) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Despite an already strong run, Sanxiang Advanced Materials Co., Ltd. (SHSE:603663) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 106% in the last year.

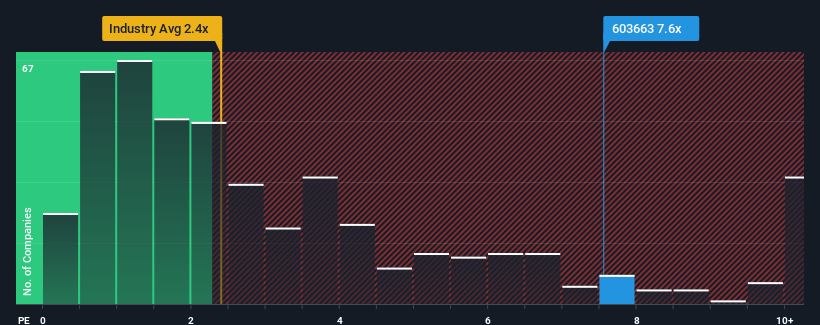

Since its price has surged higher, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Sanxiang Advanced Materials as a stock not worth researching with its 7.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Sanxiang Advanced Materials

What Does Sanxiang Advanced Materials' P/S Mean For Shareholders?

Sanxiang Advanced Materials' revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Sanxiang Advanced Materials will help you uncover what's on the horizon.How Is Sanxiang Advanced Materials' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Sanxiang Advanced Materials' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 52% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we can see why Sanxiang Advanced Materials is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Sanxiang Advanced Materials' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Sanxiang Advanced Materials' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Sanxiang Advanced Materials with six simple checks.

If these risks are making you reconsider your opinion on Sanxiang Advanced Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603663

Sanxiang Advanced Materials

Engages in the manufacture and sale of fused zirconia, cast modified materials, and single crystal fused aluminum materials.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives