Ningbo Tianlong Electronics (SHSE:603266) Is Looking To Continue Growing Its Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Ningbo Tianlong Electronics' (SHSE:603266) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Ningbo Tianlong Electronics:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

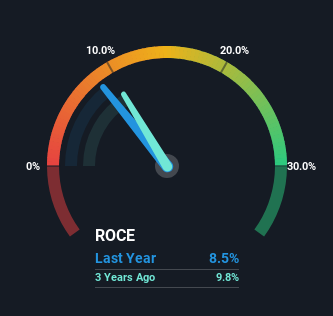

0.085 = CN¥130m ÷ (CN¥2.0b - CN¥428m) (Based on the trailing twelve months to June 2024).

Thus, Ningbo Tianlong Electronics has an ROCE of 8.5%. On its own that's a low return, but compared to the average of 5.5% generated by the Chemicals industry, it's much better.

Check out our latest analysis for Ningbo Tianlong Electronics

Historical performance is a great place to start when researching a stock so above you can see the gauge for Ningbo Tianlong Electronics' ROCE against it's prior returns. If you're interested in investigating Ningbo Tianlong Electronics' past further, check out this free graph covering Ningbo Tianlong Electronics' past earnings, revenue and cash flow.

So How Is Ningbo Tianlong Electronics' ROCE Trending?

Even though ROCE is still low in absolute terms, it's good to see it's heading in the right direction. The data shows that returns on capital have increased substantially over the last five years to 8.5%. Basically the business is earning more per dollar of capital invested and in addition to that, 77% more capital is being employed now too. So we're very much inspired by what we're seeing at Ningbo Tianlong Electronics thanks to its ability to profitably reinvest capital.

In Conclusion...

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Ningbo Tianlong Electronics has. Considering the stock has delivered 32% to its stockholders over the last five years, it may be fair to think that investors aren't fully aware of the promising trends yet. Given that, we'd look further into this stock in case it has more traits that could make it multiply in the long term.

If you want to continue researching Ningbo Tianlong Electronics, you might be interested to know about the 1 warning sign that our analysis has discovered.

While Ningbo Tianlong Electronics isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Tianlong Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603266

Ningbo Tianlong Electronics

Engages in the production and sale of precision molds, injection molding, and automated assembly solutions in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success