As global markets navigate a landscape marked by U.S.-China trade tensions and shifting monetary policies, Asian stock markets are presenting unique opportunities amid the broader volatility. In this dynamic environment, identifying stocks with strong fundamentals and resilience to economic fluctuations can be key to uncovering hidden gems in Asia's diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CMC | 0.07% | 2.92% | 8.37% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.94% | 1.09% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.64% | 15.30% | ★★★★★★ |

| Center International GroupLtd | 17.61% | 0.53% | -25.53% | ★★★★★★ |

| Saison Technology | NA | 1.35% | -9.69% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 7.79% | 10.01% | ★★★★★★ |

| KNJ | 75.75% | 8.26% | 43.04% | ★★★★★☆ |

| Nippon Care Supply | 16.37% | 10.41% | 0.50% | ★★★★☆☆ |

| Jiangxi Jiangnan New Material Technology | 70.94% | 21.41% | 14.67% | ★★★★☆☆ |

| Lan Fa Textile | 47.00% | -13.74% | 4.93% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Huide Science & TechnologyLtd (SHSE:603192)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Huide Science & Technology Co., Ltd specializes in the research, production, sale, and service of polyurethane resin for leather and polyurethane elastomer products both in China and internationally, with a market cap of CN¥4.42 billion.

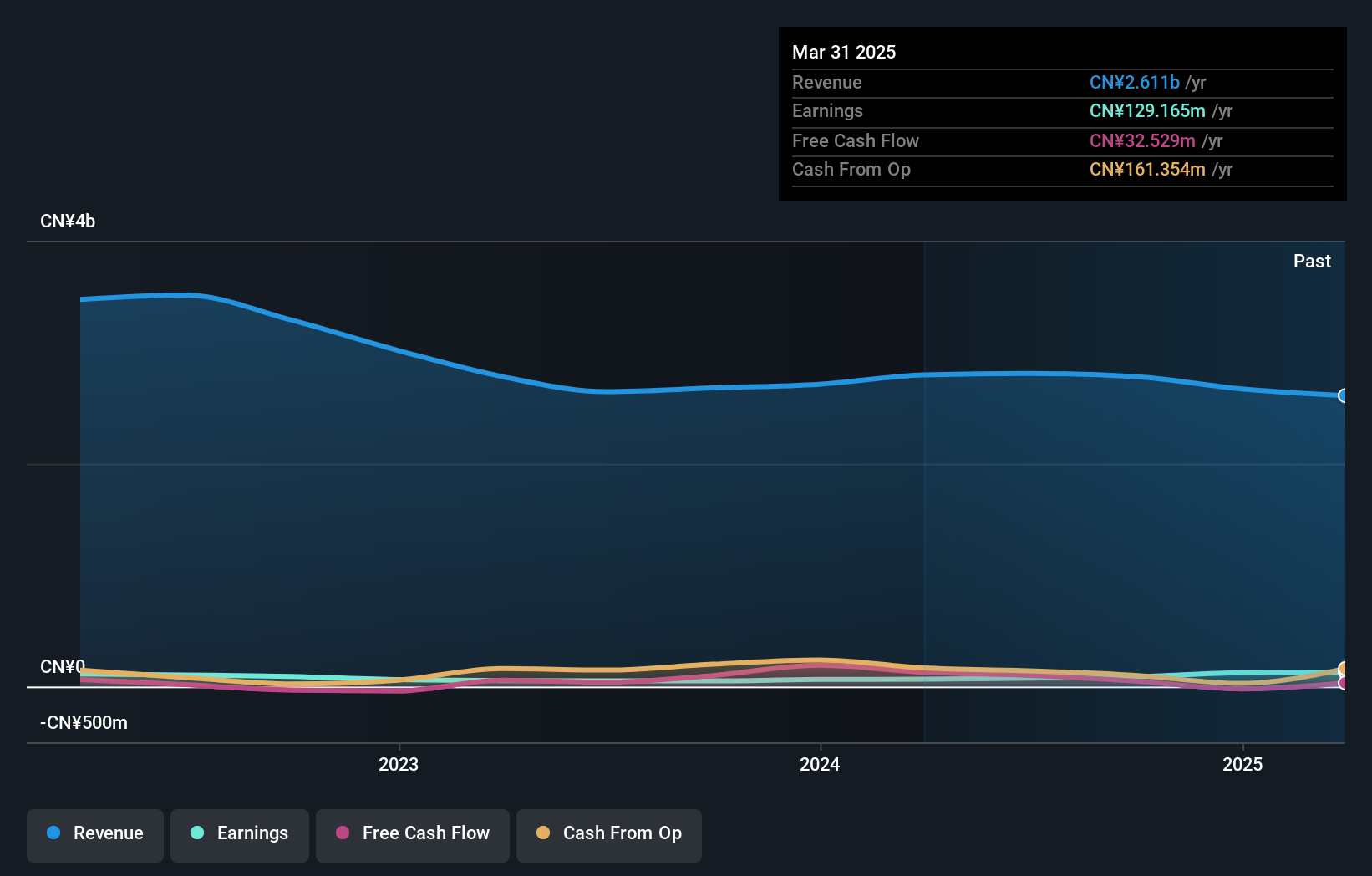

Operations: Huide generates revenue primarily from the production and sale of polyurethane resin and elastomer products. The company's financial performance includes a focus on managing costs associated with its manufacturing processes. It has reported a net profit margin of 12.5%, reflecting the efficiency of its operations in converting revenue into profit.

Shanghai Huide Science & Technology Co. Ltd., a smaller player in the chemicals industry, has shown impressive earnings growth of 71% over the past year, outpacing the industry's 2%. Their debt-to-equity ratio improved from 4.4% to 3.9% over five years, indicating prudent financial management. Despite a volatile share price recently, Huide trades at nearly half its estimated fair value and remains free cash flow positive. A strategic partnership with Novoloop® aims to scale production of sustainable thermoplastic polyurethane, positioning Huide at the forefront of circular economy innovations while maintaining high-quality earnings and robust interest coverage.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Huide Science & TechnologyLtd.

Learn about Shanghai Huide Science & TechnologyLtd's historical performance.

Shenzhen Cereals HoldingsLtd (SZSE:000019)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Cereals Holdings Co., Ltd. operates in the wholesale and retail, food processing and manufacturing, and leasing and commerce service sectors both within China and internationally, with a market cap of CN¥8.57 billion.

Operations: The company's revenue is primarily driven by its wholesale and retail segment, generating CN¥3.55 billion, followed by leasing and business services at CN¥1.04 billion, and manufacturing at CN¥745.42 million.

Shenzhen Cereals Holdings, a small player in the food sector, has shown resilience with its debt to equity ratio dropping from 26.1% to 22.1% over five years, indicating prudent financial management. The company reported net income of CNY 176 million for the first half of 2025, up from CNY 129 million the previous year, reflecting strong operational performance despite a slight dip in sales and revenue. Notably, earnings per share rose to CNY 0.1527 from CNY 0.112 year-on-year. With earnings growth outpacing the industry at 20.7%, it seems poised for continued momentum amidst recent board changes enhancing governance structure.

TOA (TSE:1885)

Simply Wall St Value Rating: ★★★★★☆

Overview: TOA Corporation offers construction and engineering services in Japan, with a market capitalization of ¥183.27 billion.

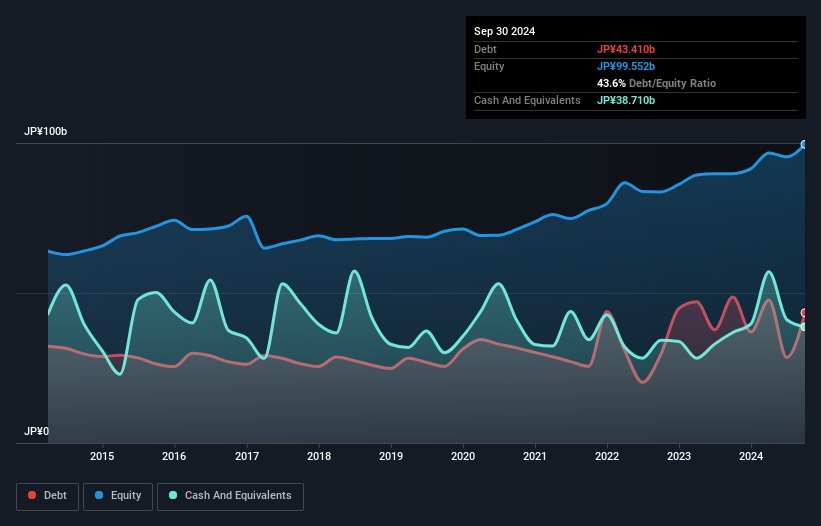

Operations: The company's primary revenue streams are from the Domestic Civil Engineering Business, generating ¥146.48 billion, and the Domestic Building Construction Business, contributing ¥113.76 billion. The Overseas Business adds ¥72.76 billion to its revenue profile.

TOA Corporation, a relatively small player in its field, has demonstrated notable earnings growth of 88.8% over the past year, surpassing the construction industry's 19.1%. The company's debt-to-equity ratio improved from 47.6% to 41.7% in five years, indicating prudent financial management. With a price-to-earnings ratio of 10.8x compared to Japan's market average of 14.6x, TOA appears attractively valued for investors seeking growth potential at a reasonable cost. Recent corporate actions include repurchasing shares worth ¥3,126 million and issuing earnings guidance projecting ¥335 billion in net sales for the fiscal year ending March 2026.

- Dive into the specifics of TOA here with our thorough health report.

Examine TOA's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Embark on your investment journey to our 2386 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603192

Shanghai Huide Science & TechnologyLtd

Engages in the research, production, sale, and service of polyurethane resin for leather and polyurethane elastomer related products in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives