In the current market landscape, major indices like the S&P 500 are reaching new highs, buoyed by optimism surrounding potential trade deals and AI advancements. While large-cap stocks have been in the spotlight, small-cap companies often hold untapped potential for growth, especially when they possess strong fundamentals that can weather economic shifts. Identifying such stocks requires a keen eye for solid financial health and strategic positioning in their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 10.32% | 5.63% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★★★

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market capitalization of SEK12.07 billion.

Operations: BioGaia generates revenue primarily from its Pediatrics segment, contributing SEK1.04 billion, followed by the Adult Health segment at SEK306.08 million.

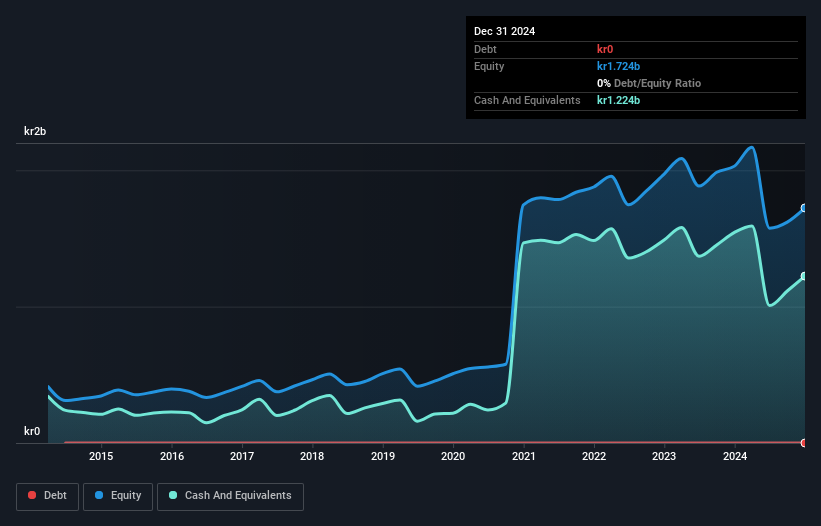

BioGaia, a nimble player in the biotech space, has been navigating some challenges with a -23% earnings growth over the past year compared to the industry's -18.2%. Despite this, it remains debt-free for five years and boasts high-quality earnings. The company is betting on its new product, BioGaia® Gastrus® PURE ACTION, which targets sensitive stomachs with clinically proven probiotics. Recent strategic shifts include terminating a French partnership to establish direct operations there. With free cash flow positive and projected 16% annual earnings growth, BioGaia seems poised for potential expansion in health-conscious markets like France.

- Delve into the full analysis health report here for a deeper understanding of BioGaia.

Examine BioGaia's past performance report to understand how it has performed in the past.

Zhejiang Huangma TechnologyLtd (SHSE:603181)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Huangma Technology Co., Ltd is engaged in the research, development, production, and sale of surfactants and related products both in China and internationally, with a market cap of CN¥6.40 billion.

Operations: Huangma Technology generates revenue primarily from its specialty chemicals segment, which reported CN¥2.21 billion.

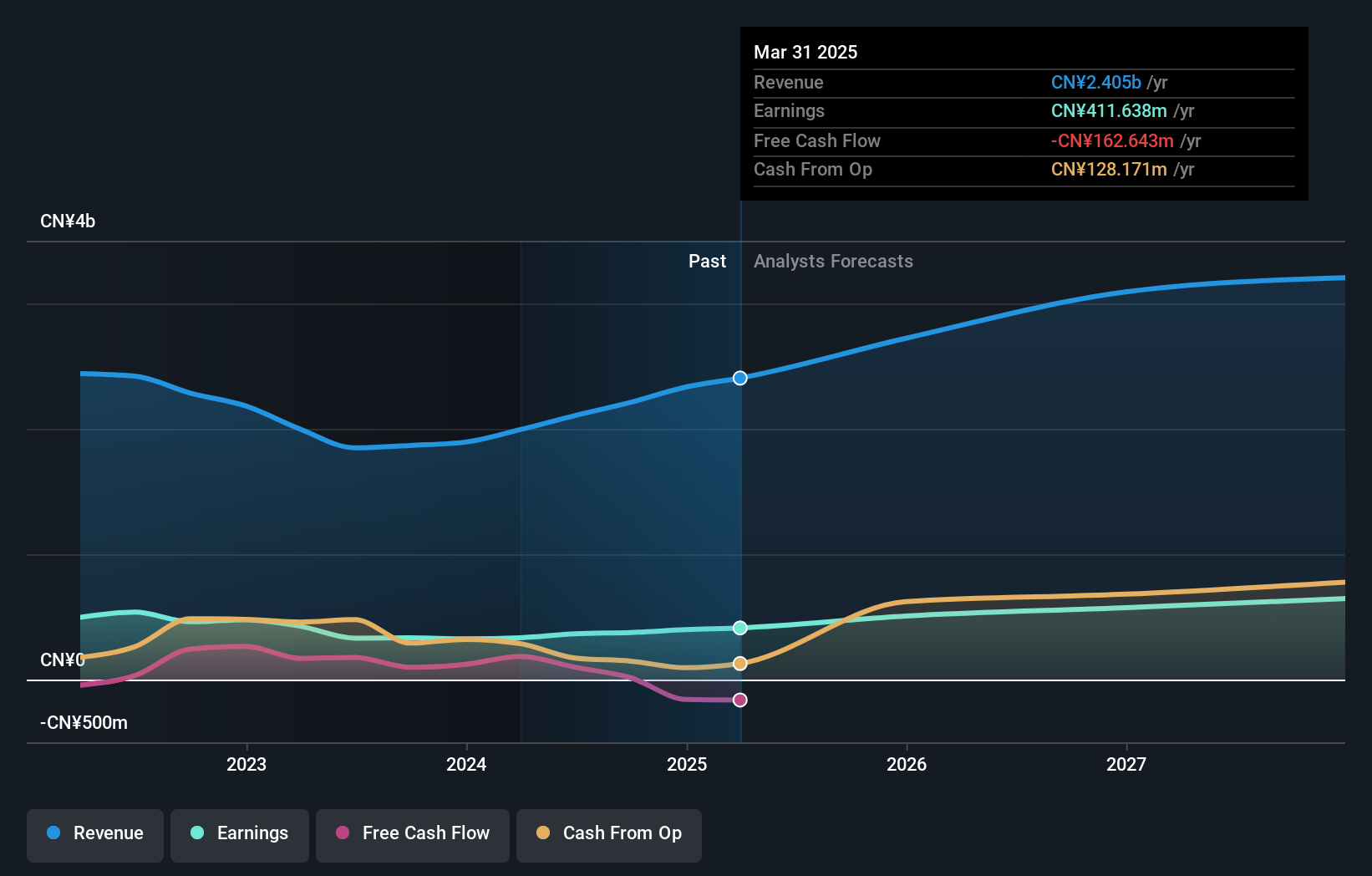

With a knack for steady growth, Zhejiang Huangma Technology Ltd. has seen earnings rise by 12.7% over the past year, outpacing the broader Chemicals industry which faced a -5.3% contraction. The company is trading at a favorable price-to-earnings ratio of 17x, notably below the CN market average of 34.7x, indicating potential value for investors seeking opportunities in this space. Despite an increase in its debt-to-equity ratio to 13.2% over five years, it maintains more cash than total debt and enjoys high-quality earnings with positive free cash flow—factors that likely bolster its financial resilience and appeal as an undiscovered gem in the market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Huangma TechnologyLtd.

Learn about Zhejiang Huangma TechnologyLtd's historical performance.

Huangshan NovelLtd (SZSE:002014)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huangshan Novel Co., Ltd specializes in the manufacturing and sale of packaging materials both in China and internationally, with a market capitalization of CN¥6.36 billion.

Operations: Huangshan NovelLtd generates its revenue primarily from the manufacturing and sale of packaging materials, catering to both domestic and international markets. The company has a market capitalization of CN¥6.36 billion.

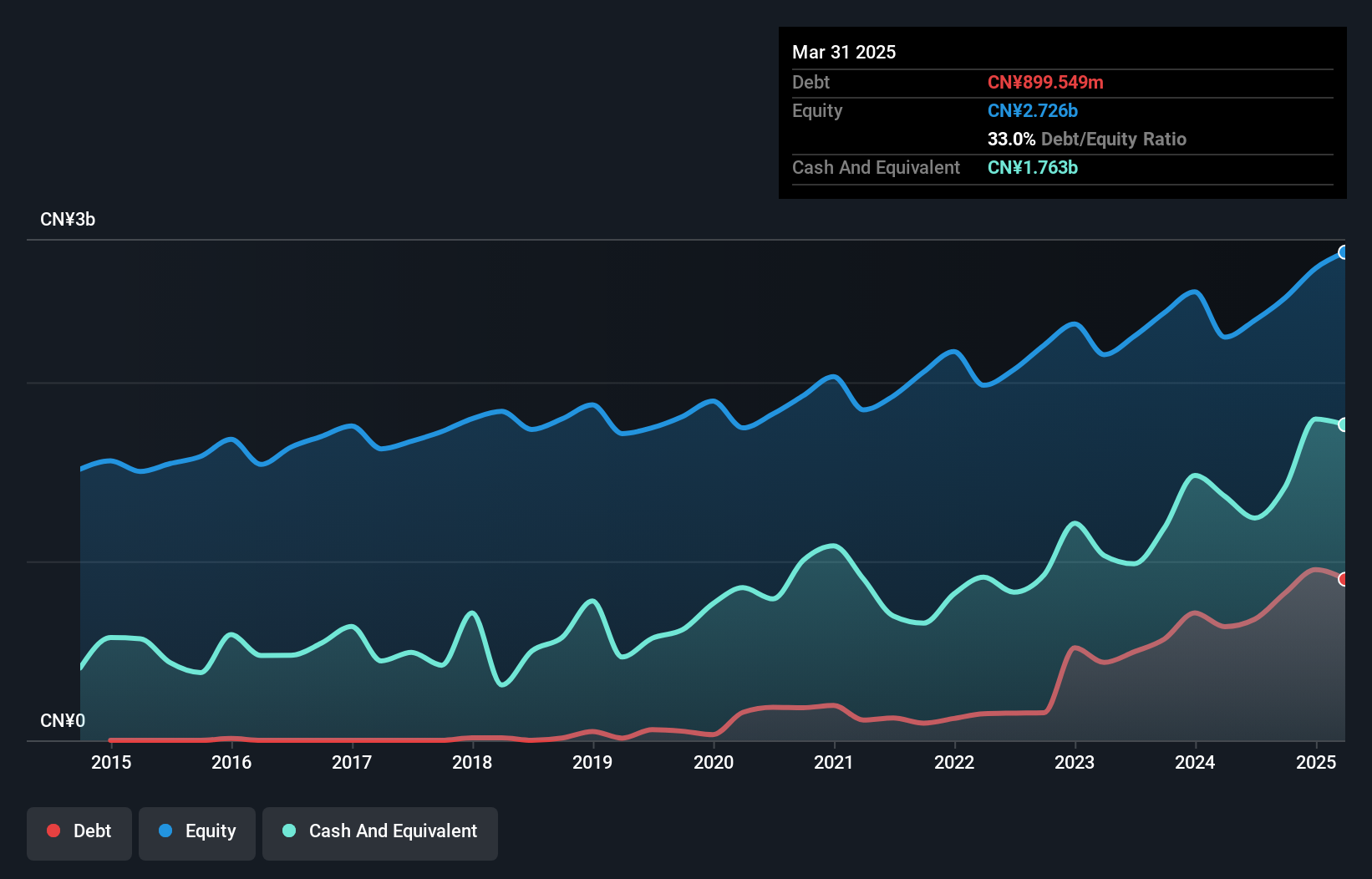

Huangshan NovelLtd, a burgeoning player in its sector, has seen its debt to equity ratio rise significantly from 2.8% to 33.3% over five years, which might suggest increased leverage but also potential for growth. Despite this, the company boasts high-quality earnings and has consistently grown profits by 10% annually over the same period. Trading at a discount of 15.2% below estimated fair value indicates potential undervaluation in the market's eyes. While recent earnings growth of 3.4% lagged behind industry averages, Huangshan's ability to cover interest payments comfortably and maintain positive free cash flow highlights financial resilience amidst expansion efforts.

Key Takeaways

- Navigate through the entire inventory of 4671 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huangshan NovelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002014

Huangshan NovelLtd

Manufactures and sells packaging materials in China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives