Hubei Zhenhua Chemical Co.,Ltd. (SHSE:603067) Surges 31% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Hubei Zhenhua Chemical Co.,Ltd. (SHSE:603067) shares have been powering on, with a gain of 31% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.4% over the last year.

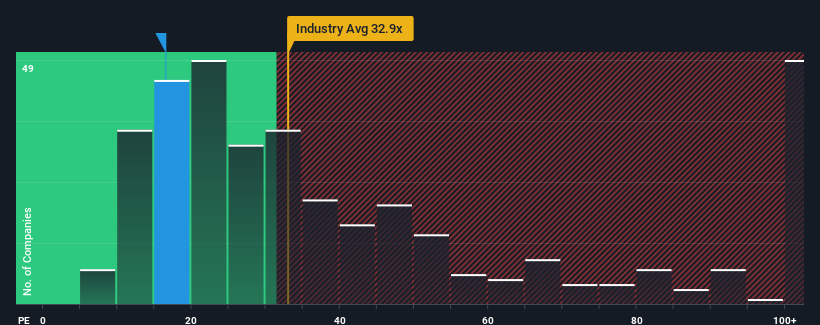

Even after such a large jump in price, Hubei Zhenhua ChemicalLtd's price-to-earnings (or "P/E") ratio of 16.5x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 59x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Hubei Zhenhua ChemicalLtd's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Hubei Zhenhua ChemicalLtd

How Is Hubei Zhenhua ChemicalLtd's Growth Trending?

Hubei Zhenhua ChemicalLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. Even so, admirably EPS has lifted 94% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 18% per annum during the coming three years according to the two analysts following the company. With the market predicted to deliver 21% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Hubei Zhenhua ChemicalLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Hubei Zhenhua ChemicalLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hubei Zhenhua ChemicalLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hubei Zhenhua ChemicalLtd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Zhenhua ChemicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603067

Hubei Zhenhua ChemicalLtd

Engages in the research, development, manufacture, and sale of chromium salt and other related products primarily in China.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives