- China

- /

- Metals and Mining

- /

- SHSE:601969

Hainan Mining Co., Ltd. (SHSE:601969) Surges 26% Yet Its Low P/E Is No Reason For Excitement

Hainan Mining Co., Ltd. (SHSE:601969) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 8.8% isn't as impressive.

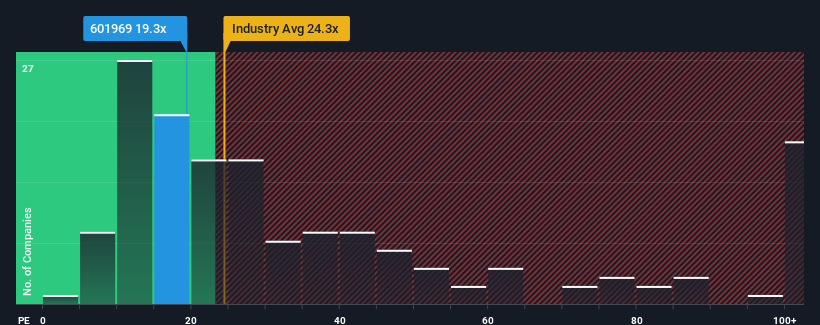

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Hainan Mining as an attractive investment with its 19.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hainan Mining certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Hainan Mining

Is There Any Growth For Hainan Mining?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hainan Mining's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 55% last year. EPS has also lifted 7.1% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the lone analyst watching the company. With the market predicted to deliver 19% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why Hainan Mining is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Hainan Mining's P/E?

Despite Hainan Mining's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hainan Mining's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Hainan Mining.

Of course, you might also be able to find a better stock than Hainan Mining. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601969

Hainan Mining

Hainan Mining Co., Ltd. mines, processes, and sells iron ore in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026