- China

- /

- Metals and Mining

- /

- SHSE:601969

Hainan Mining Co., Ltd. (SHSE:601969) Soars 25% But It's A Story Of Risk Vs Reward

Hainan Mining Co., Ltd. (SHSE:601969) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

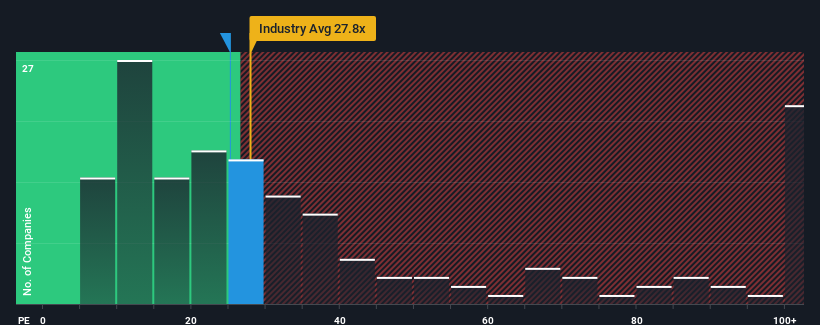

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Hainan Mining as an attractive investment with its 25.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The recently shrinking earnings for Hainan Mining have been in line with the market. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Hainan Mining

Is There Any Growth For Hainan Mining?

Hainan Mining's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.4%. Even so, admirably EPS has lifted 518% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 55% during the coming year according to the only analyst following the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Hainan Mining is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Hainan Mining's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hainan Mining currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Hainan Mining that you should be aware of.

Of course, you might also be able to find a better stock than Hainan Mining. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601969

Hainan Mining

Hainan Mining Co., Ltd. mines, processes, and sells iron ore in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026