Global markets have experienced a robust rally, with the S&P 500 and Nasdaq Composite reaching all-time highs, driven by positive developments such as easing Middle East tensions and promising trade deals. As investors navigate these buoyant market conditions, penny stocks—despite their somewhat outdated moniker—remain an intriguing investment area for those eyeing smaller or newer companies. These stocks can offer surprising value when backed by solid financial health, presenting potential growth opportunities that might defy expectations.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.42 | A$116.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.24 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.545 | SEK2.44B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| AWC Berhad (KLSE:AWC) | MYR0.57 | MYR191.13M | ✅ 5 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,866 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★☆☆

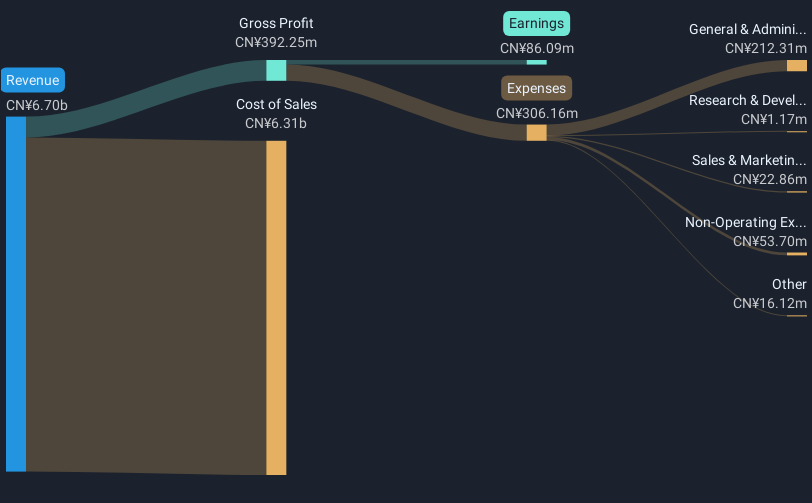

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market cap of CN¥5.59 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥5.59B

Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry with a market cap of CN¥5.59 billion, showing stable weekly volatility at 6%. The company reported first-quarter sales of CN¥1.79 billion, up from CN¥1.58 billion a year ago, though net income declined to CN¥21.44 million from CN¥28.65 million. Despite reduced debt levels and satisfactory net debt to equity ratio at 0.6%, its interest payments are not well covered by EBIT (2.9x). Short-term assets exceed both short and long-term liabilities, but earnings have seen significant declines over recent years with low return on equity at 0.3%.

- Take a closer look at Yechiu Metal Recycling (China)'s potential here in our financial health report.

- Explore historical data to track Yechiu Metal Recycling (China)'s performance over time in our past results report.

Shaanxi Beiyuan Chemical Industry Group (SHSE:601568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaanxi Beiyuan Chemical Industry Group Co., Ltd. operates in the chemical industry, focusing on the production and distribution of various chemical products, with a market cap of CN¥16.60 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥16.6B

Shaanxi Beiyuan Chemical Industry Group, with a market cap of CN¥16.60 billion, has shown significant improvement in earnings, growing by 20.4% over the past year despite a five-year decline trend. The company's debt management is robust; it holds more cash than total debt and its operating cash flow covers debt well. Recent earnings reports reveal an increase in net income to CN¥87.8 million from CN¥16.19 million year-over-year, indicating enhanced profitability and stable short-term assets exceeding liabilities. However, its return on equity remains low at 2.6%, and dividends are not well covered by current earnings or free cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of Shaanxi Beiyuan Chemical Industry Group.

- Learn about Shaanxi Beiyuan Chemical Industry Group's historical performance here.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. (SZSE:300094) operates in the aquaculture industry, focusing on the production and sale of aquatic products, with a market cap of CN¥4.10 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥4.1B

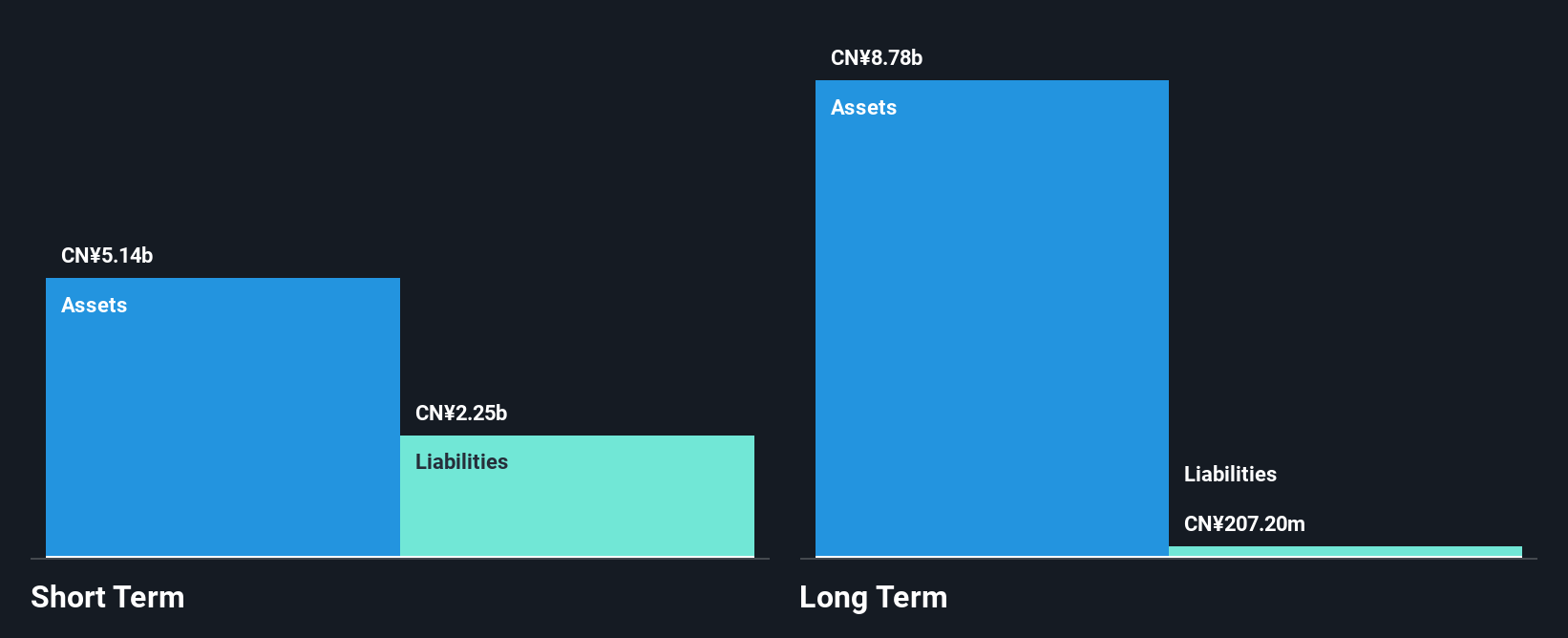

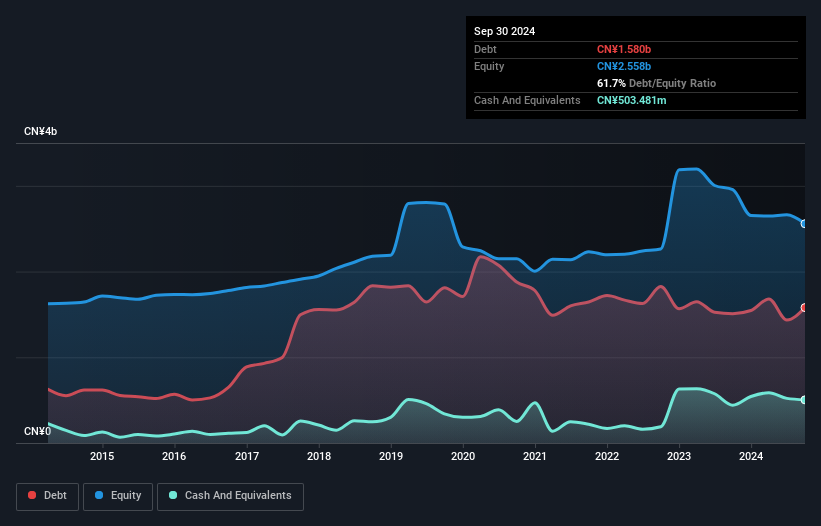

Zhanjiang Guolian Aquatic Products, with a market cap of CN¥4.10 billion, faces challenges as its earnings have declined by 13% annually over five years and it remains unprofitable with a negative return on equity of -40.07%. Despite this, the company maintains strong liquidity; short-term assets of CN¥2.9 billion cover both short-term and long-term liabilities comfortably. The management team is relatively new, averaging 1.7 years in tenure, which may impact strategic stability. Recent financials show reduced sales and revenue year-over-year but a slight improvement in first-quarter net income to CN¥6.03 million from CNY 3.51 million previously reported.

- Click to explore a detailed breakdown of our findings in Zhanjiang Guolian Aquatic Products' financial health report.

- Assess Zhanjiang Guolian Aquatic Products' previous results with our detailed historical performance reports.

Next Steps

- Jump into our full catalog of 3,866 Global Penny Stocks here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhanjiang Guolian Aquatic Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300094

Zhanjiang Guolian Aquatic Products

Zhanjiang Guolian Aquatic Products Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives