- China

- /

- Semiconductors

- /

- SHSE:688052

Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by record highs for major indices like the Dow Jones Industrial Average and S&P 500, global markets are responding to a mix of geopolitical developments and economic data. As investors navigate these conditions, companies with strong insider ownership often attract attention due to the alignment of interests between management and shareholders, potentially enhancing long-term growth prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 43.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 116.0% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We're going to check out a few of the best picks from our screener tool.

Ningxia Baofeng Energy Group (SHSE:600989)

Simply Wall St Growth Rating: ★★★★★★

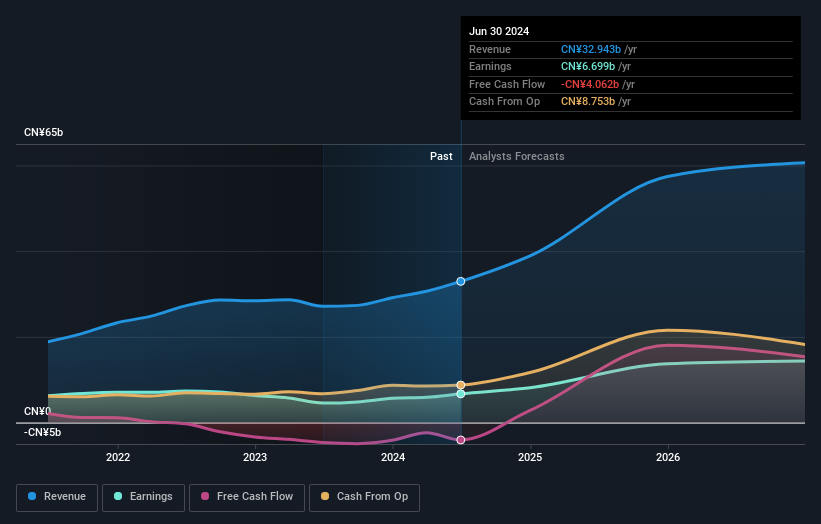

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal-related products and chemicals, with a market capitalization of approximately CN¥118.43 billion.

Operations: The company's revenue segments include coal mining, washing, and coking; coal tar; crude benzene; C4 deep-processed products; methanol; and olefin products.

Insider Ownership: 35%

Earnings Growth Forecast: 38.5% p.a.

Ningxia Baofeng Energy Group demonstrates strong growth potential with forecasted revenue and earnings growth rates of 27.5% and 38.5% annually, respectively, outpacing the Chinese market averages. Despite a high debt level, the company trades at a good value relative to peers and is priced below analyst targets by 37.3%. Recent financials show increased sales (CNY 24.27 billion) and net income (CNY 4.54 billion), although its dividend yield remains inadequately covered by free cash flow.

- Take a closer look at Ningxia Baofeng Energy Group's potential here in our earnings growth report.

- Our expertly prepared valuation report Ningxia Baofeng Energy Group implies its share price may be lower than expected.

Suzhou Novosense Microelectronics (SHSE:688052)

Simply Wall St Growth Rating: ★★★★★☆

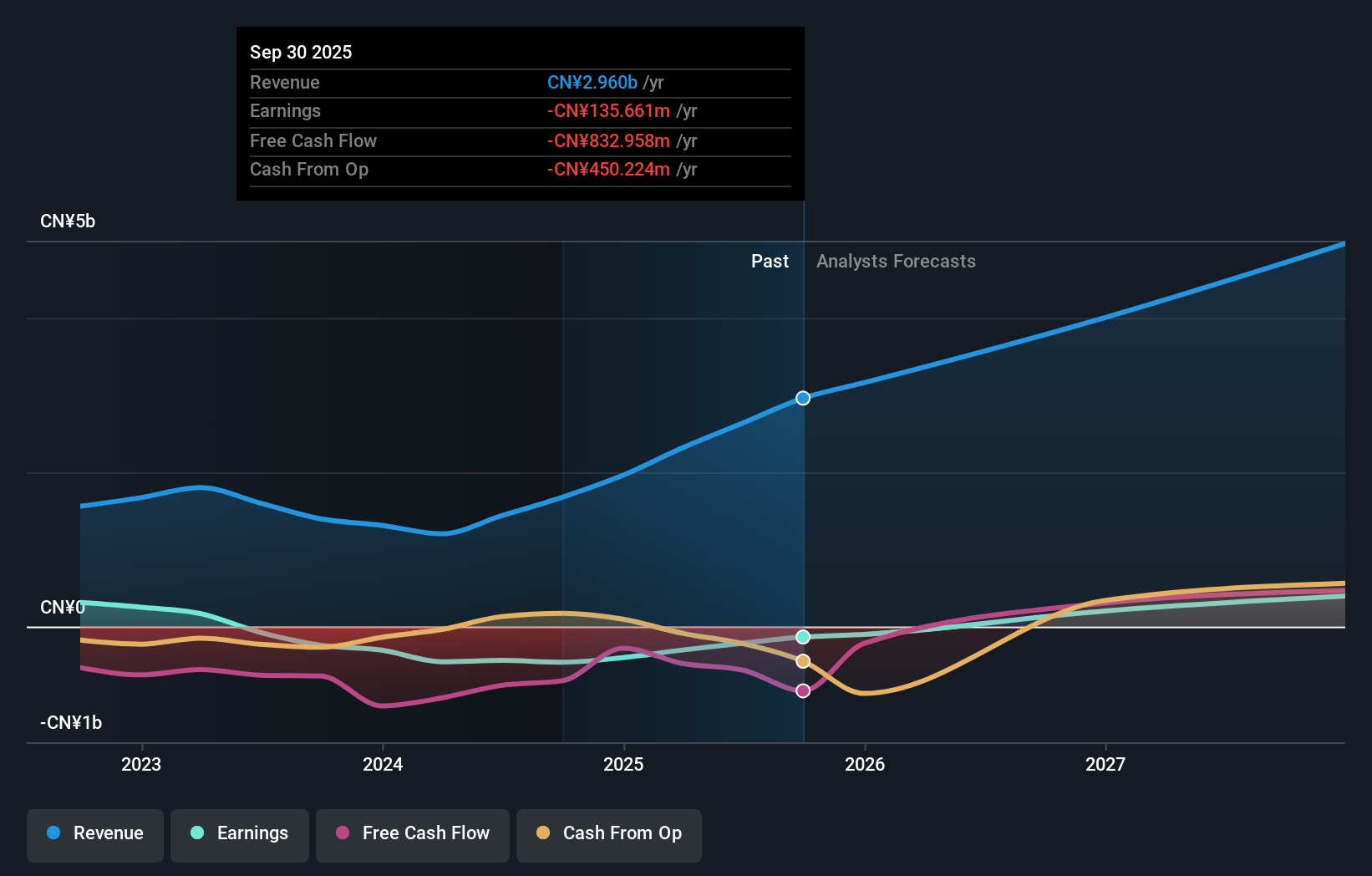

Overview: Suzhou Novosense Microelectronics Co., Ltd. operates in the semiconductor industry, focusing on the design and development of microelectronics products, with a market cap of approximately CN¥16.75 billion.

Operations: Unfortunately, there is no specific revenue segment information provided in the text. If you have more detailed data on their revenue segments, I can help summarize it for you.

Insider Ownership: 25.1%

Earnings Growth Forecast: 123.8% p.a.

Suzhou Novosense Microelectronics is poised for significant growth, with earnings expected to increase by over 120% annually and revenue anticipated to grow at 30.3% per year, surpassing the Chinese market average. Despite recent volatility in share price and a reported net loss of CNY 407.7 million for the first nine months of 2024, the company is forecasted to become profitable within three years, highlighting its potential as a growth-focused investment.

- Click here to discover the nuances of Suzhou Novosense Microelectronics with our detailed analytical future growth report.

- Our expertly prepared valuation report Suzhou Novosense Microelectronics implies its share price may be too high.

Xi'an Bright Laser TechnologiesLtd (SHSE:688333)

Simply Wall St Growth Rating: ★★★★★☆

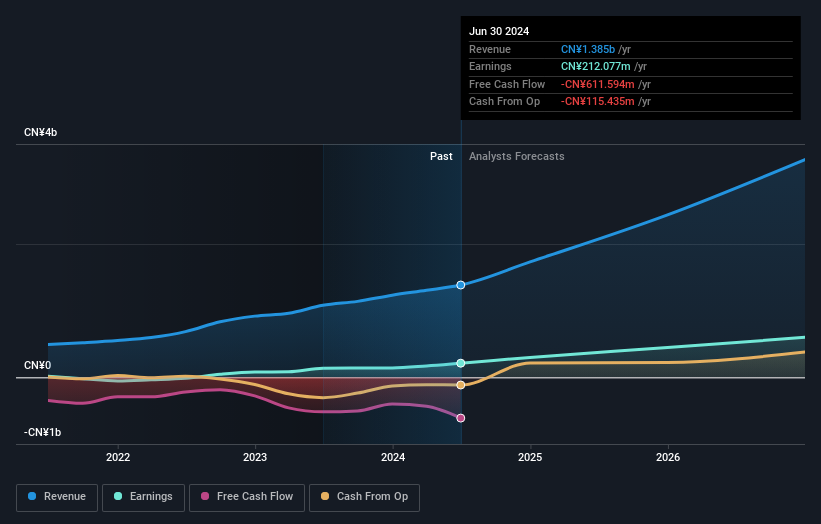

Overview: Xi'an Bright Laser Technologies Co., Ltd. provides metal additive manufacturing and repairing solutions in China, with a market cap of CN¥12.90 billion.

Operations: The company's revenue segments include metal additive manufacturing and repairing solutions in the People's Republic of China.

Insider Ownership: 24.6%

Earnings Growth Forecast: 48.5% p.a.

Xi'an Bright Laser Technologies is experiencing substantial growth, with earnings projected to rise significantly at 48.5% annually and revenue expected to grow by 38% per year, both outpacing the Chinese market. Despite recent volatility and a decline in net income to CNY 26.69 million for the first nine months of 2024, the company has initiated a share buyback program worth up to CNY 100 million, aiming to enhance long-term value and shareholder rights.

- Click to explore a detailed breakdown of our findings in Xi'an Bright Laser TechnologiesLtd's earnings growth report.

- The valuation report we've compiled suggests that Xi'an Bright Laser TechnologiesLtd's current price could be inflated.

Taking Advantage

- Navigate through the entire inventory of 1516 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688052

Suzhou Novosense Microelectronics

Suzhou Novosense Microelectronics Co., Ltd.

High growth potential with adequate balance sheet.