Undiscovered Gems Three Promising Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record levels, investor sentiment is buoyed by domestic policy shifts and geopolitical developments. In this dynamic environment, identifying promising stocks involves looking for companies that can capitalize on current economic trends and demonstrate resilience amid evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Guyuelongshan Shaoxing WineLtd (SHSE:600059)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Guyuelongshan Shaoxing Wine Co., Ltd is engaged in the production and sale of rice wine, liquor, and edible alcohol both domestically in China and internationally, with a market capitalization of CN¥8.33 billion.

Operations: The company generates revenue from the sale of rice wine, liquor, and edible alcohol in both domestic and international markets. Its financial performance is highlighted by a notable trend in its gross profit margin.

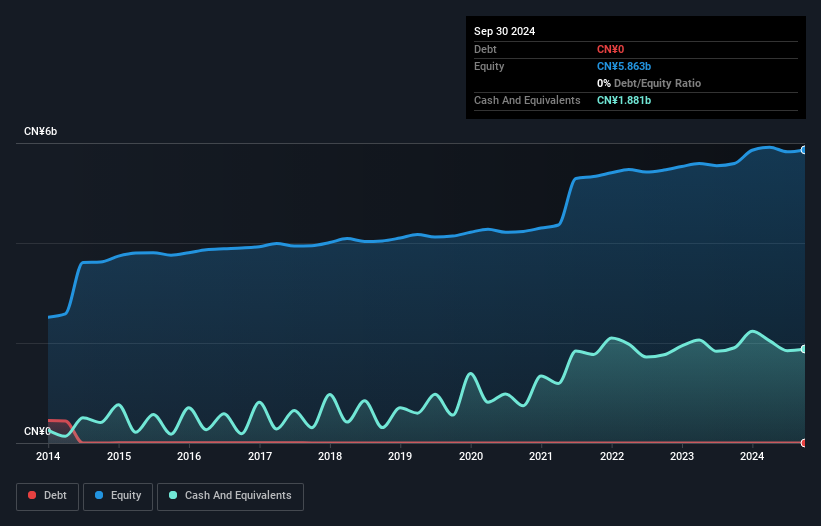

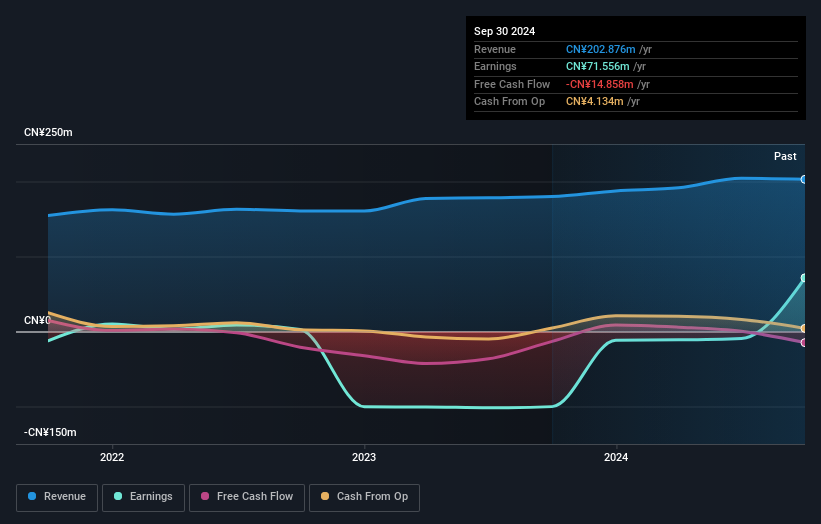

Zhejiang Guyuelongshan, a notable player in the beverage industry, has seen its earnings grow by 94.5% over the past year, significantly outpacing the sector's 16.1%. With no debt on its books now compared to a debt-to-equity ratio of 0.03% five years ago, it showcases financial prudence. However, recent earnings were influenced by a one-off gain of CN¥262.7 million as of September 2024. Despite this boost, future prospects seem challenging with forecasts indicating an average annual earnings decline of 37.2% over the next three years, suggesting potential headwinds ahead for this company in its market segment.

- Unlock comprehensive insights into our analysis of Zhejiang Guyuelongshan Shaoxing WineLtd stock in this health report.

Understand Zhejiang Guyuelongshan Shaoxing WineLtd's track record by examining our Past report.

Guangxi Hechi Chemical (SZSE:000953)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangxi Hechi Chemical Co., Ltd engages in the research, development, production, and sale of chemical raw materials and preparations in China with a market cap of CN¥2.16 billion.

Operations: Guangxi Hechi Chemical generates revenue through the sale of chemical raw materials and preparations. The company has a market capitalization of CN¥2.16 billion, reflecting its valuation in the financial markets.

Guangxi Hechi Chemical has shown a remarkable turnaround, reporting a net income of CNY 79.29 million for the first nine months of 2024, compared to a net loss of CNY 3.83 million last year. This shift is underpinned by sales growth from CNY 151.31 million to CNY 166.7 million and an improved earnings per share figure at CNY 0.2166 from a previous loss per share of CNY 0.0105. The company also repurchased shares worth CNY 2.24 million recently, indicating confidence in its market value, while maintaining a satisfactory net debt to equity ratio of 11.5%.

Jiangxi Tianli Technology (SZSE:300399)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Tianli Technology, INC. offers mobile information services in China with a market capitalization of CN¥4.24 billion.

Operations: The company generates revenue primarily through its mobile information services in China. It has a market capitalization of CN¥4.24 billion.

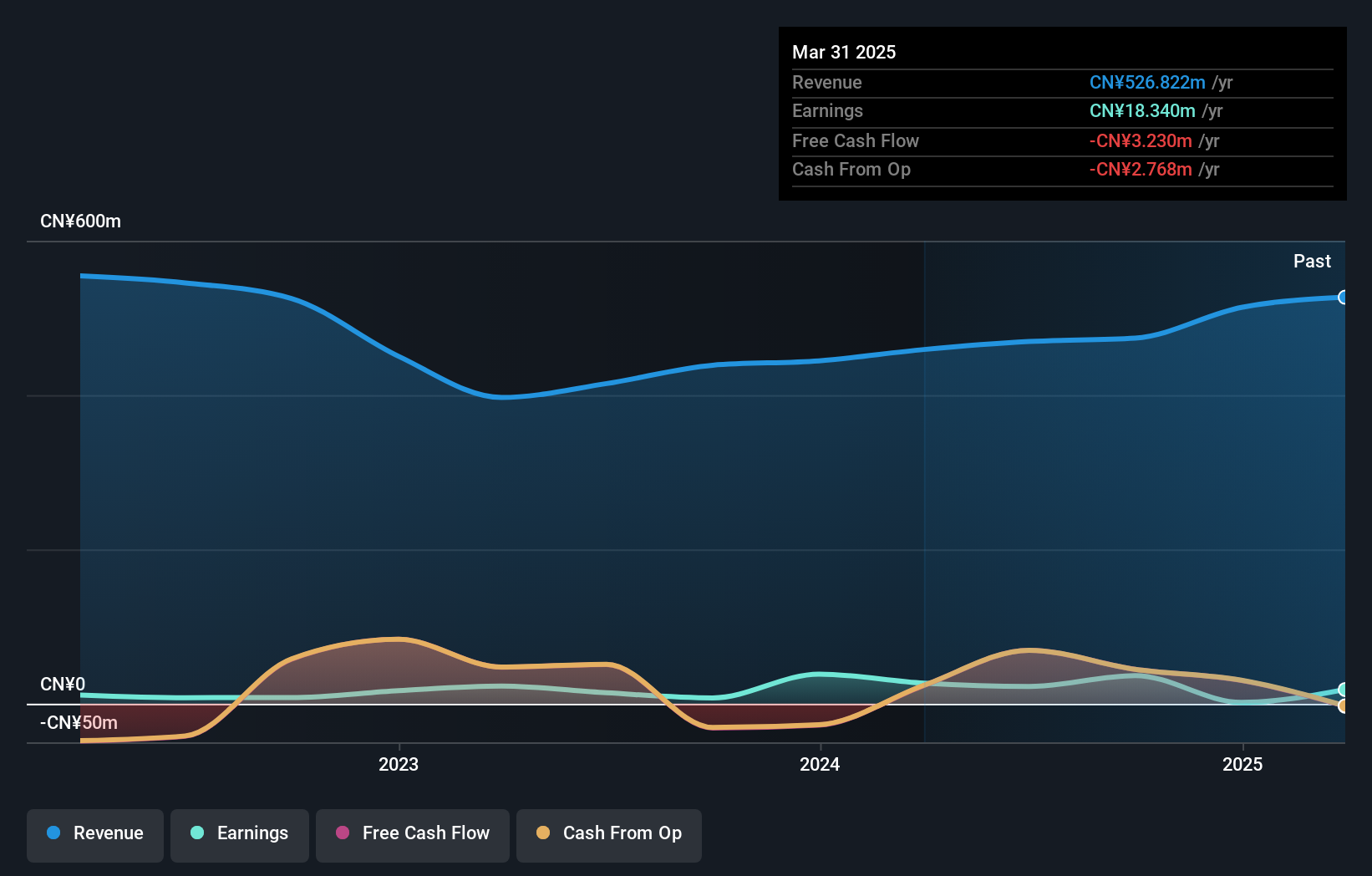

Jiangxi Tianli Technology, a nimble player in its industry, reported earnings growth of 389.5% over the past year, outpacing the broader software sector's -11.2%. Despite this impressive surge, earnings have dipped by 2.4% annually over five years, likely influenced by a CN¥16M one-off gain affecting recent results. The company remains debt-free and has shown positive free cash flow recently at CN¥69.08M for June 2024 but faced a net loss of CN¥7.84M for nine months ending September 2024 compared to a smaller loss last year; share price volatility persists as an ongoing concern.

Next Steps

- Embark on your investment journey to our 4630 Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Guyuelongshan Shaoxing WineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600059

Zhejiang Guyuelongshan Shaoxing WineLtd

Produces and sells rice wine, liquor, and edible alcohol in China and internationally.

Flawless balance sheet with proven track record.