Stock Analysis

- China

- /

- Auto Components

- /

- SHSE:603997

Exploring Value In China Three Stocks Trading Between 27.2% And 40.2% Below Estimated Intrinsic Value On Chinese Exchange

Reviewed by Simply Wall St

Amid a landscape of fluctuating global markets, with notable tensions between the U.S. and China impacting trade dynamics, Chinese equities have shown resilience. This context sets an intriguing stage for investors to consider undervalued stocks in China, particularly those that might be trading below their estimated intrinsic value due to these broader economic currents.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥171.21 | CN¥322.86 | 47% |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥17.45 | CN¥33.00 | 47.1% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥24.29 | CN¥46.09 | 47.3% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.64 | CN¥29.91 | 47.7% |

| INKON Life Technology (SZSE:300143) | CN¥7.47 | CN¥14.64 | 49% |

| China Film (SHSE:600977) | CN¥10.58 | CN¥20.30 | 47.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.71 | CN¥17.33 | 49.7% |

| Seres GroupLtd (SHSE:601127) | CN¥75.30 | CN¥149.83 | 49.7% |

| Shanghai Milkground Food Tech (SHSE:600882) | CN¥13.83 | CN¥26.97 | 48.7% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥50.86 | CN¥96.89 | 47.5% |

Here's a peek at a few of the choices from the screener.

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. is a Chinese company engaged in the production and sale of coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefins with a market capitalization of approximately CN¥128.72 billion.

Operations: The company generates revenue from a variety of segments including coal mining, washing, coking, as well as the production and sale of coal tar, crude benzene, C4 deep-processed products, methanol, and olefins.

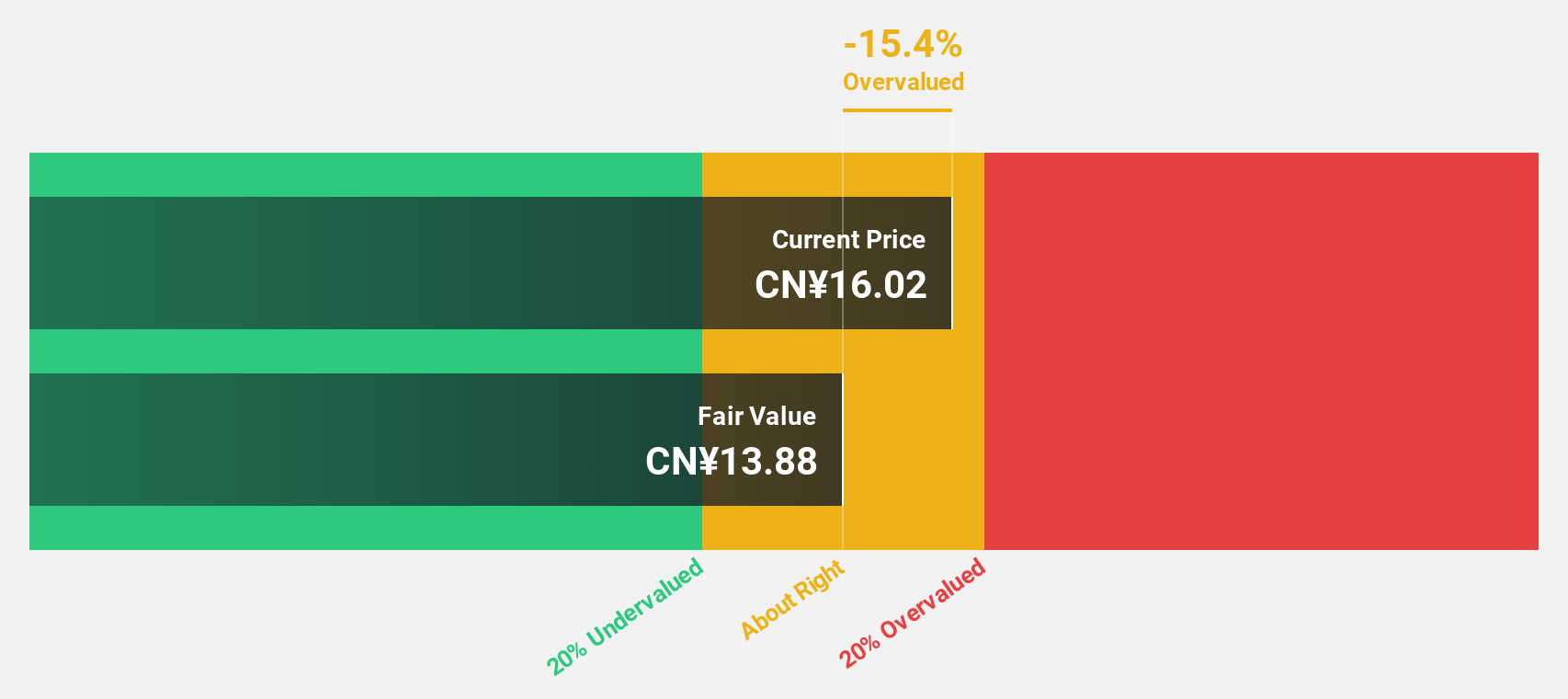

Estimated Discount To Fair Value: 38%

Ningxia Baofeng Energy Group, with recent first-quarter sales rising to CN¥8.23 billion, shows a robust financial trajectory. Despite trading 38% below estimated fair value and showing promising revenue growth at 26.4% annually, concerns linger due to its high debt levels and dividends not well covered by free cash flows. Analysts predict significant earnings growth over the next three years, potentially enhancing its appeal as an undervalued stock based on cash flows in China's market.

- Our earnings growth report unveils the potential for significant increases in Ningxia Baofeng Energy Group's future results.

- Navigate through the intricacies of Ningxia Baofeng Energy Group with our comprehensive financial health report here.

Ningbo Jifeng Auto Parts (SHSE:603997)

Overview: Ningbo Jifeng Auto Parts Co., Ltd. specializes in manufacturing automotive interior parts in China, with a market capitalization of approximately CN¥14.49 billion.

Operations: The company generates its revenue from the production of automotive interior parts.

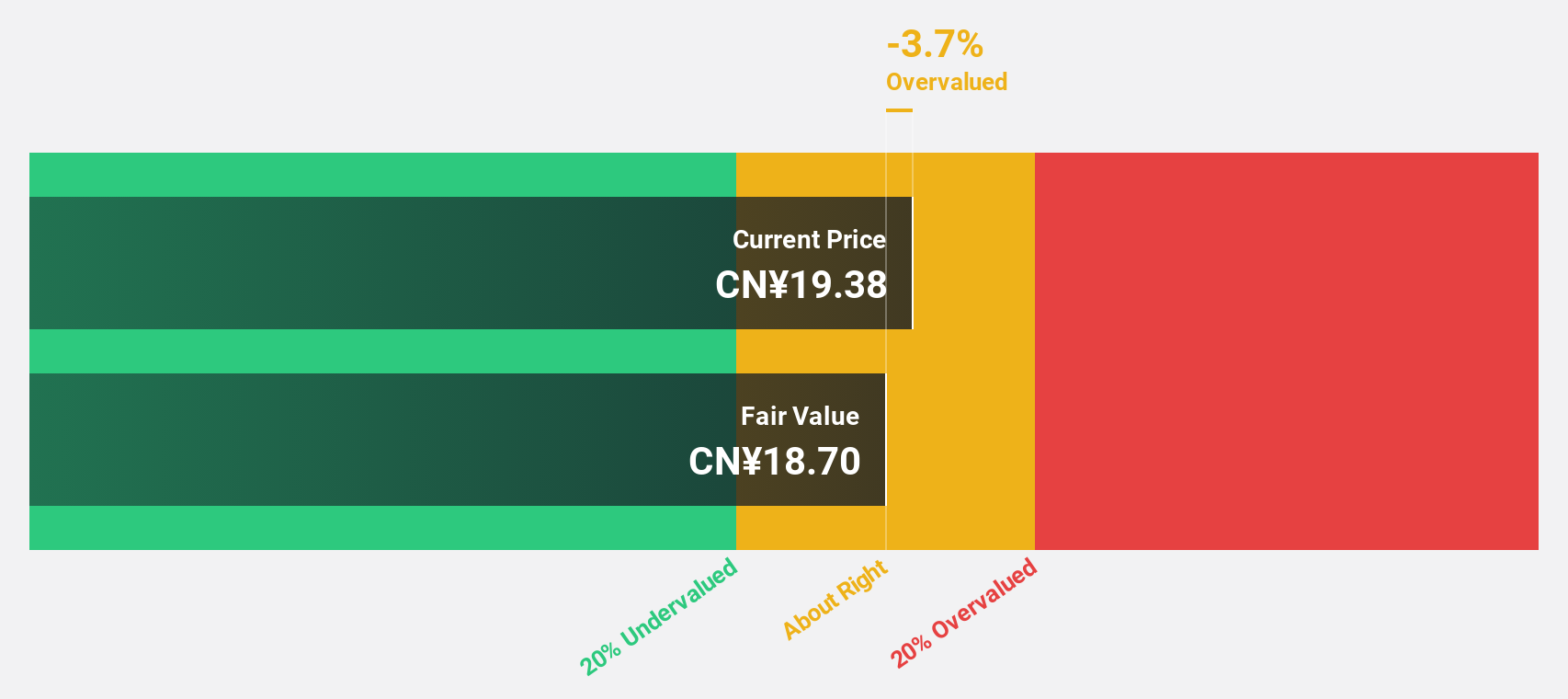

Estimated Discount To Fair Value: 27.2%

Ningbo Jifeng Auto Parts, recently involved in significant M&A activities with stakes sold for substantial sums, reflects a mixed financial picture. While its stock trades at 27.2% below estimated fair value and is expected to see earnings grow by 59.6% annually, concerns arise as interest payments are poorly covered by earnings. Despite these challenges, the company's revenue growth forecast outpaces the broader Chinese market, suggesting potential under current valuations based on cash flows.

- Our growth report here indicates Ningbo Jifeng Auto Parts may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Ningbo Jifeng Auto Parts' balance sheet health report.

Hunan Jiudian Pharmaceutical (SZSE:300705)

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. is a company engaged in researching, developing, producing, and selling pharmaceutical products both domestically in China and internationally, with a market capitalization of approximately CN¥13.43 billion.

Operations: The company generates revenue primarily through its medicine manufacturing segment, which accounted for CN¥2.78 billion.

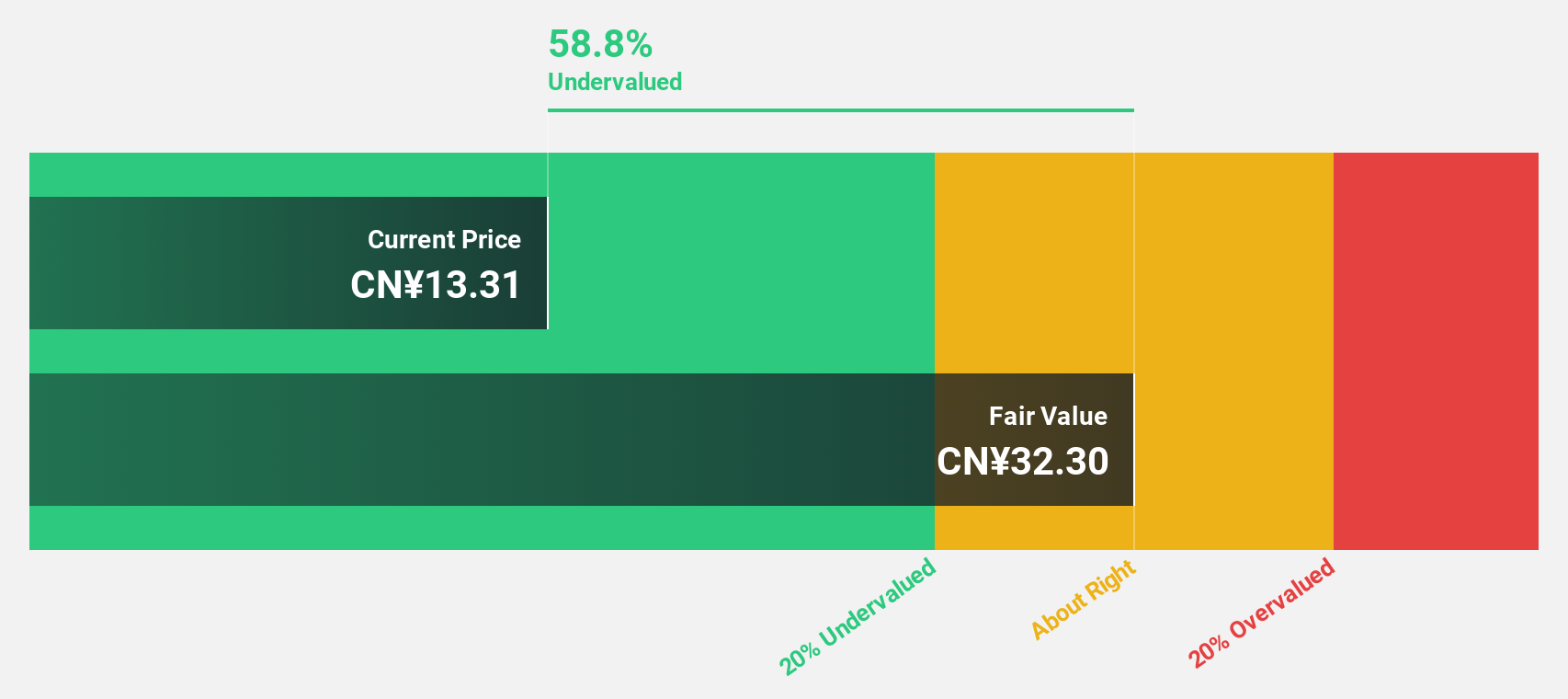

Estimated Discount To Fair Value: 40.2%

Hunan Jiudian Pharmaceutical, with its stock priced at CN¥27.61, trades significantly below its estimated fair value of CN¥46.17, indicating a potential undervaluation based on cash flows. Despite a slower revenue growth forecast (17.2% per year) compared to some market averages, the company's earnings are expected to grow robustly at 27.2% annually. Recent events include a stock split and an increase in dividends, suggesting confidence from management amidst strong past earnings growth of 43.5%. However, the dividend track record remains unstable.

- Our expertly prepared growth report on Hunan Jiudian Pharmaceutical implies its future financial outlook may be stronger than recent results.

- Take a closer look at Hunan Jiudian Pharmaceutical's balance sheet health here in our report.

Summing It All Up

- Investigate our full lineup of 102 Undervalued Chinese Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jifeng Auto Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603997

Ningbo Jifeng Auto Parts

Manufactures automotive interior parts in China.

Reasonable growth potential and fair value.