- China

- /

- Metals and Mining

- /

- SHSE:600961

Earnings Tell The Story For Zhuzhou Smelter Group Co.,Ltd. (SHSE:600961) As Its Stock Soars 29%

Zhuzhou Smelter Group Co.,Ltd. (SHSE:600961) shares have continued their recent momentum with a 29% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

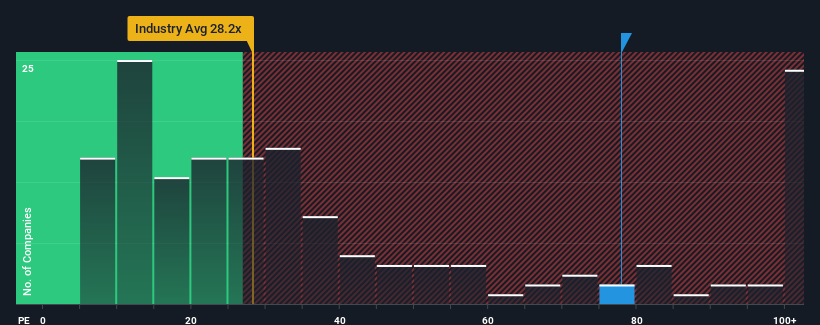

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Zhuzhou Smelter GroupLtd as a stock to avoid entirely with its 77.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Zhuzhou Smelter GroupLtd's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Zhuzhou Smelter GroupLtd

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Zhuzhou Smelter GroupLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 63%. As a result, earnings from three years ago have also fallen 66% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 409% during the coming year according to the lone analyst following the company. With the market only predicted to deliver 39%, the company is positioned for a stronger earnings result.

With this information, we can see why Zhuzhou Smelter GroupLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Zhuzhou Smelter GroupLtd have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zhuzhou Smelter GroupLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Zhuzhou Smelter GroupLtd is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

If you're unsure about the strength of Zhuzhou Smelter GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Smelter GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600961

Zhuzhou Smelter GroupLtd

Produces and sells lead, zinc, and its alloy products under the Torch brand in China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives