Asian Market Insights: PropNex And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets grapple with mixed performances and geopolitical developments, the Asian market continues to be a focal point for investors seeking diverse opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area despite the term's somewhat outdated feel. In this article, we explore three penny stocks that exemplify financial strength and growth potential in Asia's evolving economic landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.78 | THB2.96B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.08 | SGD429.61M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.70 | THB2.82B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.32 | SGD13.11B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.07 | HK$2.88B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.46 | THB9.01B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 951 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited, with a market cap of SGD1.72 billion, is an investment holding company offering real estate services in Singapore.

Operations: The company's revenue is primarily derived from Agency Services at SGD830.49 million and Project Marketing Services at SGD352.77 million, with additional contributions from Training Services and Administrative Support Services totaling SGD6.60 million.

Market Cap: SGD1.72B

PropNex Limited, with a market cap of SGD1.72 billion, demonstrates strong financial health and growth potential among penny stocks. The company is debt-free and boasts an outstanding return on equity of 52.8%. Its recent earnings report showed impressive growth, with net income rising to SGD42.26 million for the half-year ended June 2025, up from SGD19 million the previous year. PropNex's earnings have grown by 43.4% over the past year, outpacing industry averages. Despite a relatively inexperienced management team and unsustainable dividend coverage by earnings, its stable weekly volatility and experienced board offer stability amidst rapid growth dynamics in Asia's real estate sector.

- Take a closer look at PropNex's potential here in our financial health report.

- Understand PropNex's earnings outlook by examining our growth report.

Danhua Chemical TechnologyLtd (SHSE:600844)

Simply Wall St Financial Health Rating: ★★★★☆☆

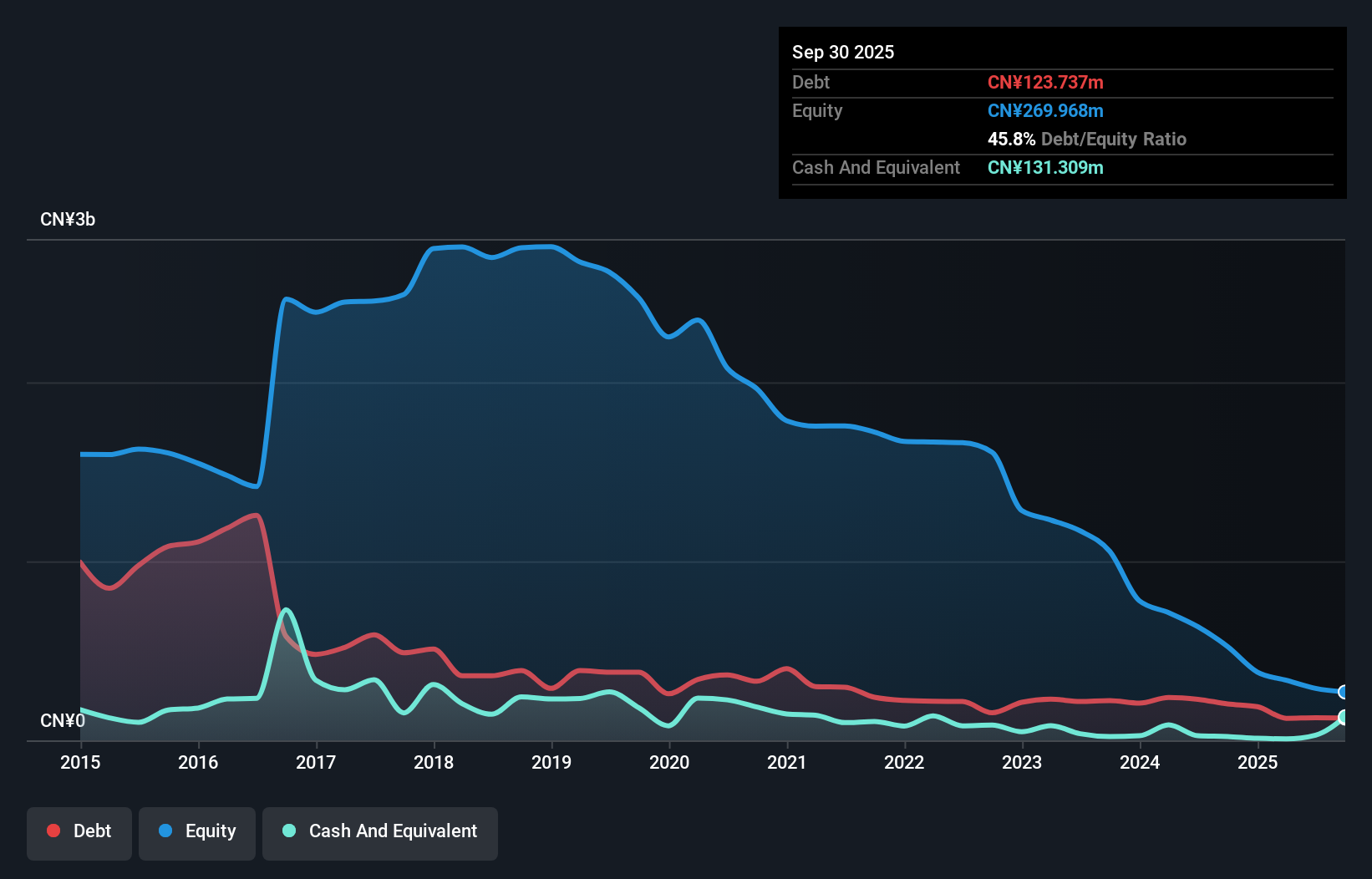

Overview: Danhua Chemical Technology Co., Ltd, along with its subsidiaries, is involved in the production and sale of coal chemical products in China and has a market capitalization of CN¥2.94 billion.

Operations: Danhua Chemical Technology Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥2.94B

Danhua Chemical Technology Co., Ltd, with a market cap of CN¥2.94 billion, faces challenges typical of penny stocks. Despite reporting sales of CN¥687.59 million for the nine months ended September 2025, the company remains unprofitable with a net loss of CN¥88.8 million for the same period. While short-term assets fall short in covering liabilities, long-term liabilities are well-managed by its asset base. The management team is experienced and has maintained stability without significant shareholder dilution over the past year, yet increased debt levels pose concerns amidst ongoing financial losses and negative return on equity metrics.

- Jump into the full analysis health report here for a deeper understanding of Danhua Chemical TechnologyLtd.

- Assess Danhua Chemical TechnologyLtd's previous results with our detailed historical performance reports.

Jiangsu Fasten (SZSE:000890)

Simply Wall St Financial Health Rating: ★★★★☆☆

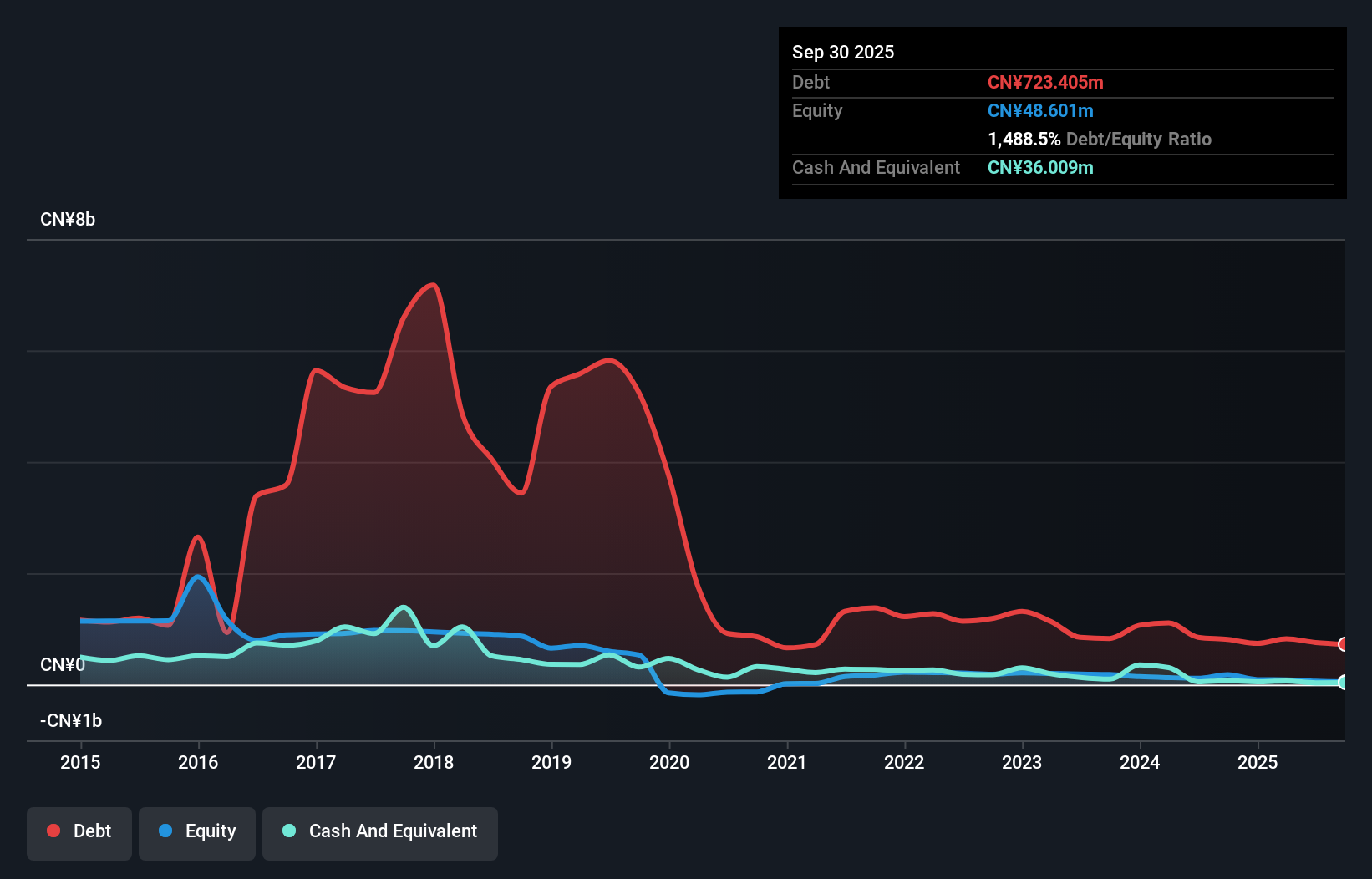

Overview: Jiangsu Fasten Company Limited, with a market cap of CN¥2.04 billion, produces and sells steel wires and wire ropes both in China and internationally through its subsidiaries.

Operations: There are no specific revenue segments reported for Jiangsu Fasten.

Market Cap: CN¥2.04B

Jiangsu Fasten Company Limited, with a market cap of CN¥2.04 billion, continues to navigate the challenges associated with penny stocks. Despite reporting sales of CN¥204.53 million for the nine months ended September 2025, it remains unprofitable but has reduced its net loss from CN¥41.35 million to CN¥22.77 million year-on-year. The company's short-term assets are insufficient to cover its short-term liabilities, though long-term liabilities are well-managed by its asset base. With an experienced management team and no significant shareholder dilution recently, Jiangsu Fasten maintains a stable cash runway exceeding three years despite high debt levels and ongoing financial losses.

- Dive into the specifics of Jiangsu Fasten here with our thorough balance sheet health report.

- Evaluate Jiangsu Fasten's historical performance by accessing our past performance report.

Make It Happen

- Get an in-depth perspective on all 951 Asian Penny Stocks by using our screener here.

- Ready To Venture Into Other Investment Styles? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600844

Danhua Chemical TechnologyLtd

Engages in the production and sale of coal chemical products in China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives