- China

- /

- Metals and Mining

- /

- SHSE:600595

Henan Zhongfu Industrial Co.,Ltd (SHSE:600595) Held Back By Insufficient Growth Even After Shares Climb 26%

Henan Zhongfu Industrial Co.,Ltd (SHSE:600595) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 9.5% isn't as attractive.

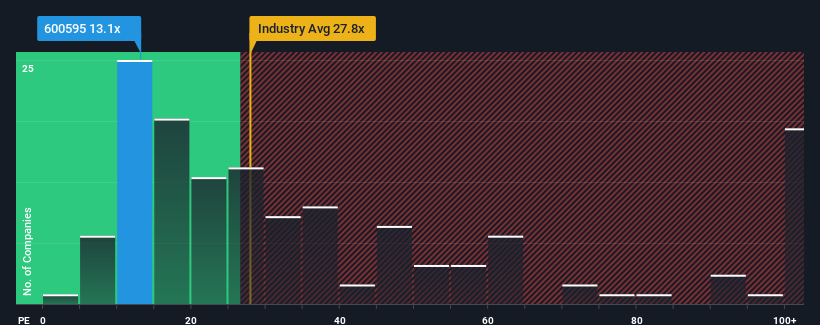

Even after such a large jump in price, Henan Zhongfu IndustrialLtd's price-to-earnings (or "P/E") ratio of 13.1x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 36x and even P/E's above 70x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Henan Zhongfu IndustrialLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Henan Zhongfu IndustrialLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Henan Zhongfu IndustrialLtd would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 52% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 21% over the next year. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Henan Zhongfu IndustrialLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Henan Zhongfu IndustrialLtd's P/E

Shares in Henan Zhongfu IndustrialLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Henan Zhongfu IndustrialLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Henan Zhongfu IndustrialLtd with six simple checks.

If you're unsure about the strength of Henan Zhongfu IndustrialLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Henan Zhongfu IndustrialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600595

Henan Zhongfu IndustrialLtd

Processes, manufactures, and sells electrolytic aluminum and aluminum products in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives