- China

- /

- Metals and Mining

- /

- SHSE:600490

Pengxin International MiningLtd Leads 3 Global Penny Stocks To Consider

Reviewed by Simply Wall St

As global markets grapple with policy risks and growth concerns, many investors are reassessing their portfolios amidst fluctuating indices and economic uncertainties. In this climate, penny stocks—though an outdated term—remain a relevant area of interest for those seeking potential value in smaller or newer companies. With strong financials as a guiding light, these stocks can offer unique opportunities for growth that larger firms might overlook.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.62 | £292.45M | ★★★★★★ |

| NEXG Berhad (KLSE:DSONIC) | MYR0.265 | MYR737.27M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.40 | SGD9.48B | ★★★★★☆ |

| Bosideng International Holdings (SEHK:3998) | HK$4.12 | HK$44.24B | ★★★★★★ |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.28 | MYR636.19M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.73 | A$79.25M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.73 | £424.27M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.965 | £294.89M | ★★★★☆☆ |

Click here to see the full list of 5,723 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Pengxin International MiningLtd (SHSE:600490)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pengxin International Mining Co., Ltd operates in the non-ferrous metal industry on a global scale and has a market cap of CN¥7.32 billion.

Operations: Pengxin International Mining Co., Ltd does not report specific revenue segments.

Market Cap: CN¥7.32B

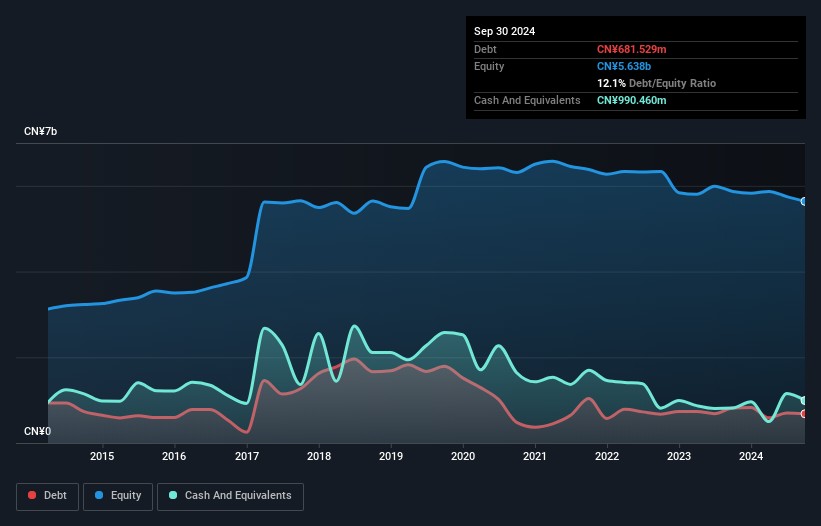

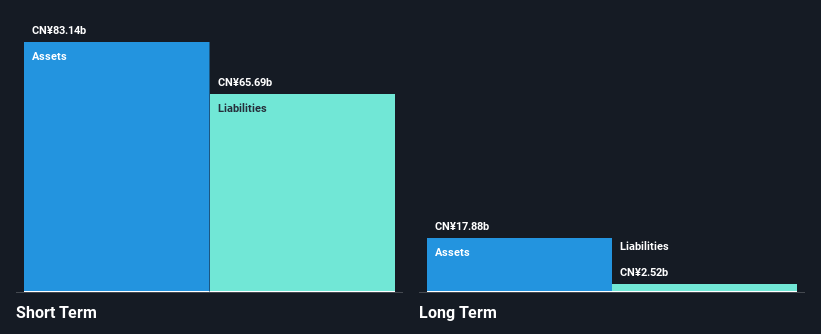

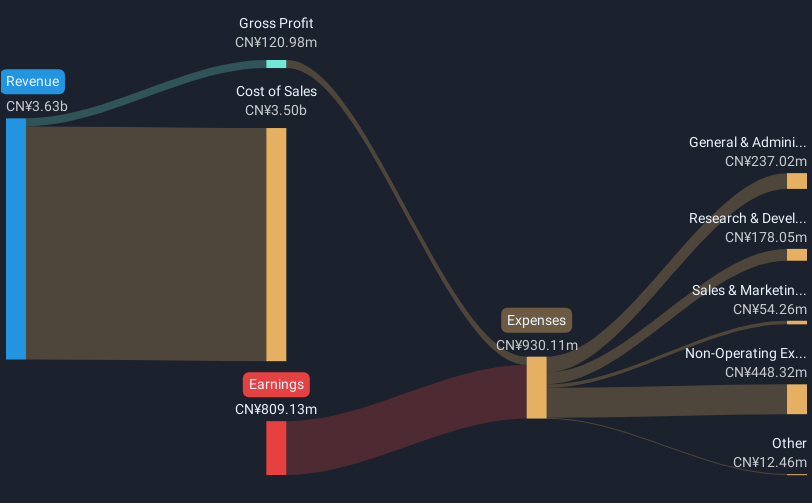

Pengxin International Mining Co., Ltd, with a market cap of CN¥7.32 billion, operates in the non-ferrous metal industry but remains pre-revenue. The company has not diluted shareholders over the past year and maintains a seasoned board with an average tenure of 3.8 years. Despite having more cash than total debt and short-term assets exceeding both short- and long-term liabilities, Pengxin faces challenges such as negative operating cash flow and return on equity, alongside high share price volatility. While its debt-to-equity ratio has improved significantly over five years, profitability remains elusive with increasing losses annually by a very large rate.

- Click here to discover the nuances of Pengxin International MiningLtd with our detailed analytical financial health report.

- Explore historical data to track Pengxin International MiningLtd's performance over time in our past results report.

Jointown Pharmaceutical Group (SHSE:600998)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jointown Pharmaceutical Group Co., Ltd offers pharmaceutical supply chain services in China and has a market cap of CN¥24.71 billion.

Operations: Jointown Pharmaceutical Group Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥24.71B

Jointown Pharmaceutical Group Co., Ltd, with a market cap of CN¥24.71 billion, is trading at a favorable price-to-earnings ratio of 12x compared to the broader Chinese market. The company has demonstrated financial stability with short-term assets exceeding both short- and long-term liabilities and maintains more cash than total debt. However, negative earnings growth poses challenges despite high-quality past earnings and stable weekly volatility. Recent strategic alliances, such as the agreement with BGM Group for licorice-based products, highlight potential for expanded market presence. A recent share buyback indicates confidence in its valuation amidst ongoing industry challenges.

- Unlock comprehensive insights into our analysis of Jointown Pharmaceutical Group stock in this financial health report.

- Gain insights into Jointown Pharmaceutical Group's outlook and expected performance with our report on the company's earnings estimates.

Suzhou Victory Precision Manufacture (SZSE:002426)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Suzhou Victory Precision Manufacture Co., Ltd. operates in the precision manufacturing industry and has a market capitalization of approximately CN¥12.42 billion.

Operations: Suzhou Victory Precision Manufacture Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥12.42B

Suzhou Victory Precision Manufacture Co., Ltd. faces challenges with a negative return on equity and unprofitability, yet it has a sufficient cash runway for over three years. The company's debt-to-equity ratio remains high at 49.3%, though it has slightly improved over five years. Short-term liabilities exceed short-term assets by CN¥900 million, indicating potential liquidity concerns, but long-term liabilities are well-covered. Recent developments include plans for an A-share offering to specific parties and a private placement agreement to raise up to CN¥1.95 billion, suggesting strategic moves towards capital restructuring and shareholder engagement amidst volatility in share price performance.

- Jump into the full analysis health report here for a deeper understanding of Suzhou Victory Precision Manufacture.

- Assess Suzhou Victory Precision Manufacture's previous results with our detailed historical performance reports.

Seize The Opportunity

- Unlock more gems! Our Global Penny Stocks screener has unearthed 5,720 more companies for you to explore.Click here to unveil our expertly curated list of 5,723 Global Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600490

Pengxin International MiningLtd

Operates in the non-ferrous metal industry worldwide.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)