There's Reason For Concern Over Guizhou RedStar Developing Co.,Ltd.'s (SHSE:600367) Massive 25% Price Jump

Guizhou RedStar Developing Co.,Ltd. (SHSE:600367) shares have continued their recent momentum with a 25% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 6.2% isn't as attractive.

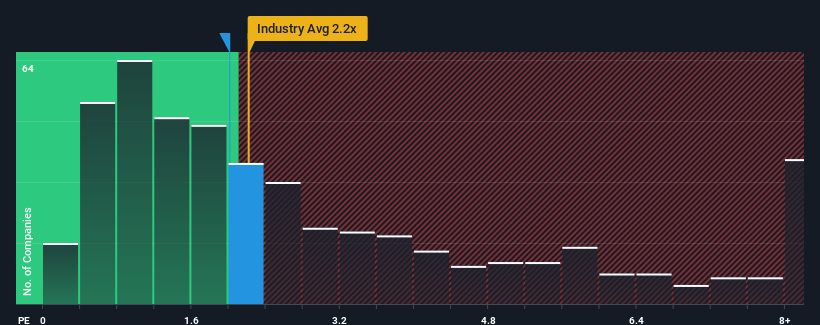

In spite of the firm bounce in price, there still wouldn't be many who think Guizhou RedStar DevelopingLtd's price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S in China's Chemicals industry is similar at about 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Guizhou RedStar DevelopingLtd

How Guizhou RedStar DevelopingLtd Has Been Performing

As an illustration, revenue has deteriorated at Guizhou RedStar DevelopingLtd over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guizhou RedStar DevelopingLtd's earnings, revenue and cash flow.How Is Guizhou RedStar DevelopingLtd's Revenue Growth Trending?

Guizhou RedStar DevelopingLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Even so, admirably revenue has lifted 46% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 23% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Guizhou RedStar DevelopingLtd's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Guizhou RedStar DevelopingLtd's P/S

Guizhou RedStar DevelopingLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Guizhou RedStar DevelopingLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 3 warning signs for Guizhou RedStar DevelopingLtd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600367

Guizhou RedStar DevelopingLtd

Develops, manufactures, and sells electronic magnetic materials, rubber plastics additives, and green plant extracts in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives