Solid Earnings Reflect Guangxi Huaxi Nonferrous MetalLtd's (SHSE:600301) Strength As A Business

Guangxi Huaxi Nonferrous Metal Co.,Ltd (SHSE:600301) just reported healthy earnings but the stock price didn't move much. Our analysis suggests that investors might be missing some promising details.

See our latest analysis for Guangxi Huaxi Nonferrous MetalLtd

A Closer Look At Guangxi Huaxi Nonferrous MetalLtd's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

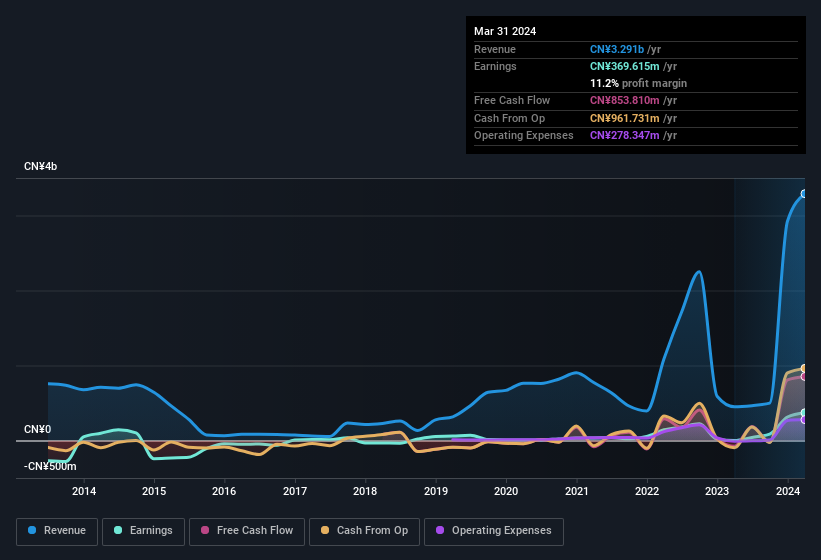

Guangxi Huaxi Nonferrous MetalLtd has an accrual ratio of -0.13 for the year to March 2024. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. Indeed, in the last twelve months it reported free cash flow of CN¥854m, well over the CN¥369.6m it reported in profit. Notably, Guangxi Huaxi Nonferrous MetalLtd had negative free cash flow last year, so the CN¥854m it produced this year was a welcome improvement. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Guangxi Huaxi Nonferrous MetalLtd issued 6.8% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Guangxi Huaxi Nonferrous MetalLtd's EPS by clicking here.

How Is Dilution Impacting Guangxi Huaxi Nonferrous MetalLtd's Earnings Per Share (EPS)?

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Guangxi Huaxi Nonferrous MetalLtd's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Guangxi Huaxi Nonferrous MetalLtd's Profit Performance

In conclusion, Guangxi Huaxi Nonferrous MetalLtd has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. After taking into account all these factors, we think that Guangxi Huaxi Nonferrous MetalLtd's statutory results are a decent reflection of its underlying earnings power. If you'd like to know more about Guangxi Huaxi Nonferrous MetalLtd as a business, it's important to be aware of any risks it's facing. While conducting our analysis, we found that Guangxi Huaxi Nonferrous MetalLtd has 1 warning sign and it would be unwise to ignore it.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600301

Guangxi Huaxi Nonferrous MetalLtd

Trades in steel, bulk commodities, and other products in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success