Shareholders in Guizhou ChitianhuaLtd (SHSE:600227) have lost 53%, as stock drops 10% this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Guizhou Chitianhua Co.,Ltd. (SHSE:600227) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 53% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 44% lower in that time. The falls have accelerated recently, with the share price down 22% in the last three months.

Since Guizhou ChitianhuaLtd has shed CN¥305m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Guizhou ChitianhuaLtd

Because Guizhou ChitianhuaLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Guizhou ChitianhuaLtd saw its revenue grow by 0.7% per year, compound. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 15% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

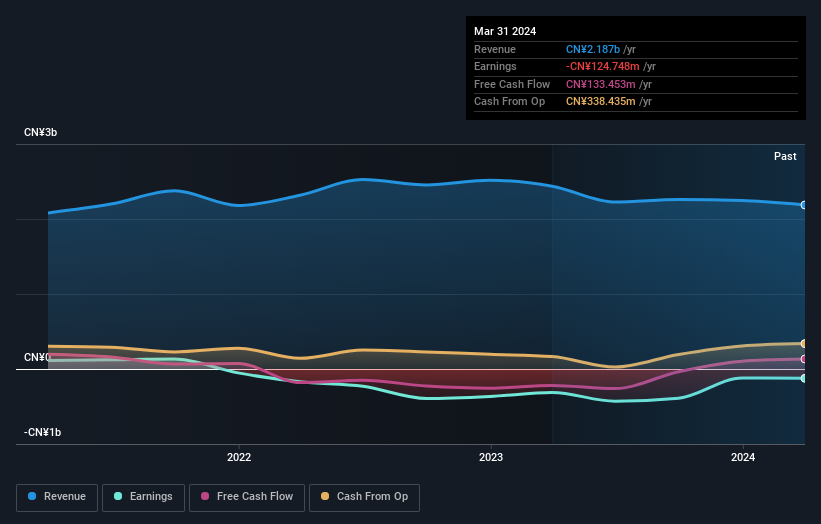

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Guizhou ChitianhuaLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 11% in the twelve months, Guizhou ChitianhuaLtd shareholders did even worse, losing 44%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You could get a better understanding of Guizhou ChitianhuaLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600227

Guizhou ChitianhuaLtd

Engages in the chemical and pharmaceutical businesses in China.

Adequate balance sheet and fair value.