Earnings Tell The Story For Kingfa Sci. & Tech. Co., Ltd. (SHSE:600143) As Its Stock Soars 27%

Kingfa Sci. & Tech. Co., Ltd. (SHSE:600143) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 41%.

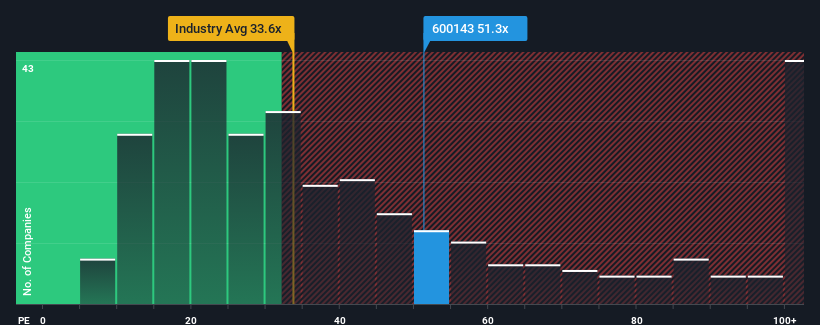

After such a large jump in price, Kingfa Sci. & Tech may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 51.3x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings that are retreating more than the market's of late, Kingfa Sci. & Tech has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Kingfa Sci. & Tech

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Kingfa Sci. & Tech would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. This means it has also seen a slide in earnings over the longer-term as EPS is down 80% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 172% as estimated by the dual analysts watching the company. With the market only predicted to deliver 38%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Kingfa Sci. & Tech's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Kingfa Sci. & Tech shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kingfa Sci. & Tech maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Kingfa Sci. & Tech (1 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Kingfa Sci. & Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kingfa Sci. & Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600143

Kingfa Sci. & Tech

Engages in the research, development, production, and sale of chemical products worldwide.

Slight risk and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.