Stock Analysis

- China

- /

- Healthcare Services

- /

- SZSE:300143

Edifier Technology Leads Three Value Stocks On The Chinese Exchange That Could Be Trading Below Their Worth

Reviewed by Simply Wall St

As global markets exhibit varied responses to economic signals, China's stock market has shown a mixed performance with key indices like the Shanghai Composite experiencing declines amidst fluctuating economic data. In such a landscape, identifying stocks that may be undervalued becomes particularly crucial, as they might represent opportunities for value in a market where broader trends are not uniformly positive.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥173.36 | CN¥311.70 | 44.4% |

| Uni-Trend Technology (China) (SHSE:688628) | CN¥32.42 | CN¥59.45 | 45.5% |

| Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267) | CN¥31.00 | CN¥56.83 | 45.5% |

| Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.09 | CN¥19.89 | 49.3% |

| GemPharmatech (SHSE:688046) | CN¥10.47 | CN¥19.45 | 46.2% |

| INKON Life Technology (SZSE:300143) | CN¥7.40 | CN¥14.64 | 49.5% |

| Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥50.46 | CN¥91.34 | 44.8% |

| China Film (SHSE:600977) | CN¥10.82 | CN¥20.18 | 46.4% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥45.52 | CN¥89.72 | 49.3% |

| Levima Advanced Materials (SZSE:003022) | CN¥13.95 | CN¥25.66 | 45.6% |

Let's review some notable picks from our screened stocks

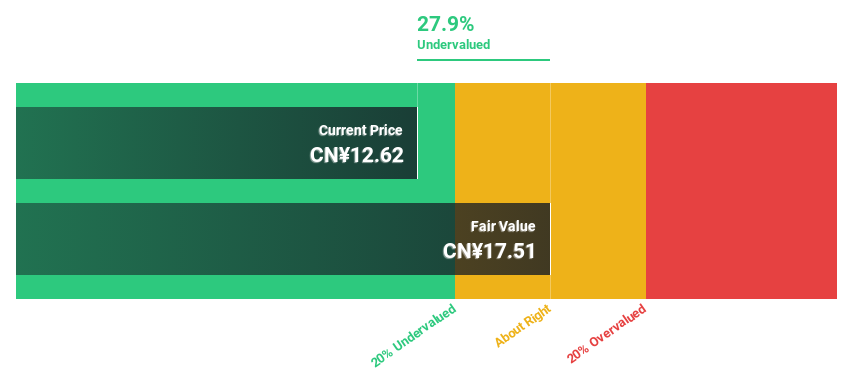

Edifier Technology (SZSE:002351)

Overview: Edifier Technology Co., Ltd. is a company based in China that specializes in designing, producing, and selling audio equipment, with a market capitalization of approximately CN¥11.63 billion.

Operations: The company generates CN¥2.83 billion from its E-Pneumatic segment.

Estimated Discount To Fair Value: 25.2%

Edifier Technology, priced at CN¥13.08, trades below the estimated fair value of CN¥17.48, indicating a potential undervaluation based on discounted cash flows. The company's earnings have increased by 69.2% over the past year with future earnings expected to grow by 21.69% annually, though slightly below the market forecast of 22.2%. Despite an unstable dividend track record, recent dividends were affirmed with a payout of CNY 2 per 10 shares in June 2024.

- The analysis detailed in our Edifier Technology growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Edifier Technology.

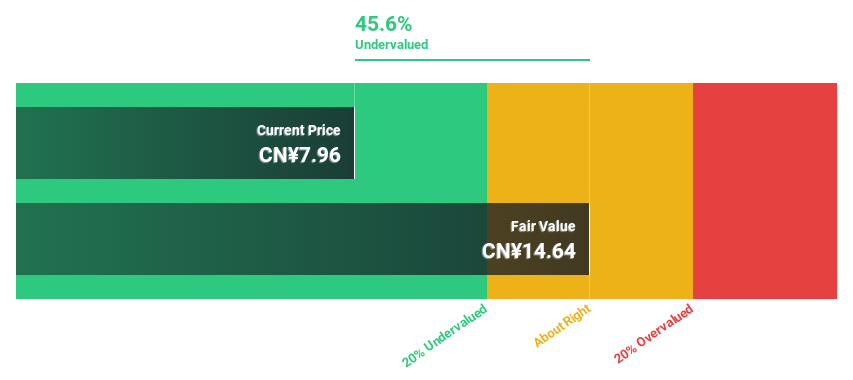

INKON Life Technology (SZSE:300143)

Overview: INKON Life Technology Co., Ltd. operates an ecological platform offering a continuum of medical services for tumor management, spanning pre-diagnosis to treatment and health maintenance, both in China and globally, with a market cap of approximately CN¥4.69 billion.

Operations: The company generates revenue through its integrated medical services platform focusing on tumor management across pre-diagnosis, treatment, and health maintenance stages.

Estimated Discount To Fair Value: 49.5%

INKON Life Technology, with a current trading price of CN¥7.4, appears significantly undervalued based on its discounted cash flow valuation of CN¥14.64. The company's financial turnaround is evident as it moved from a substantial net loss to reporting a net income of CNY 100.44 million in 2023, reflecting improved operational efficiency and market positioning. Despite this progress, its forecasted annual earnings growth rate at 28.5% surpasses the Chinese market average, although its projected return on equity remains modest at 9.8%.

- Our comprehensive growth report raises the possibility that INKON Life Technology is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of INKON Life Technology stock in this financial health report.

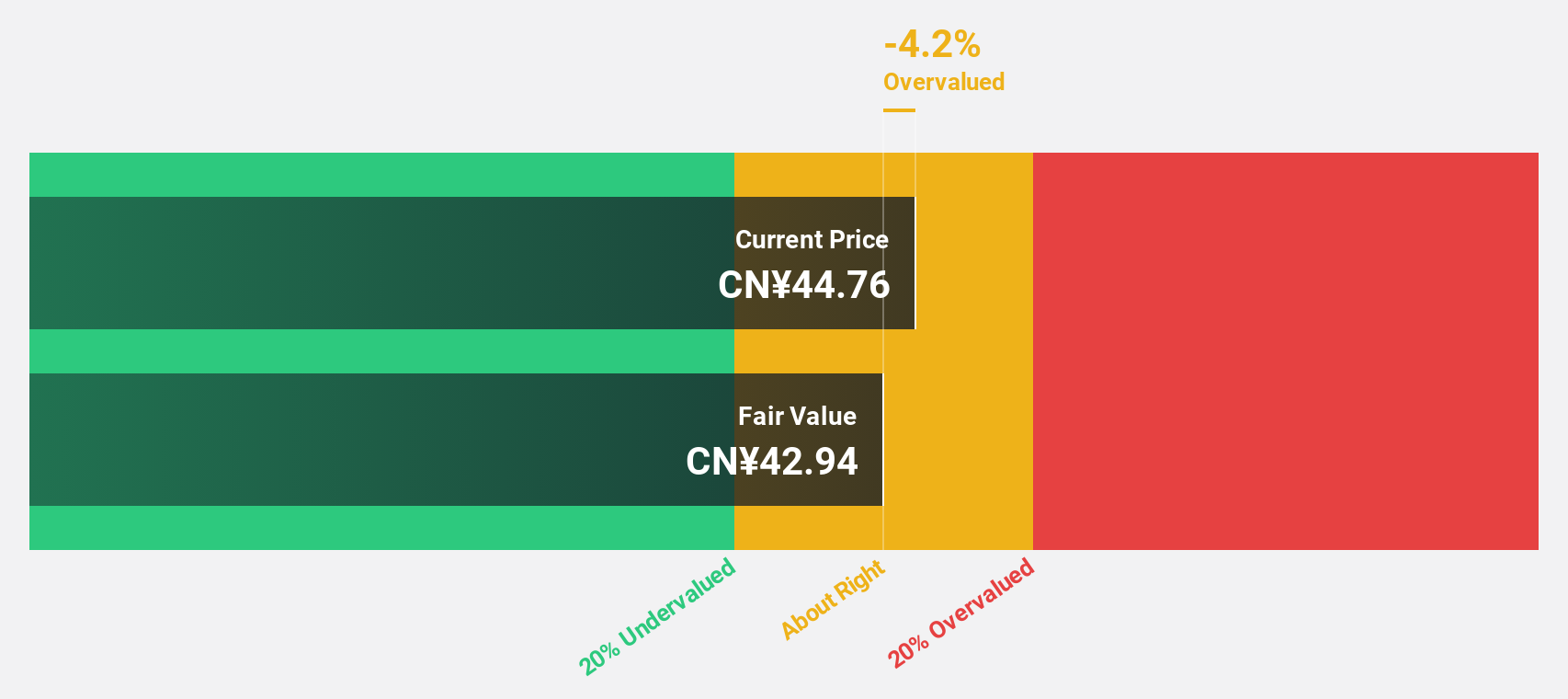

Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957)

Overview: Yunnan Botanee Bio-Technology Group Co., LTD focuses on the production and distribution of skincare and makeup products within China, with a market capitalization of approximately CN¥20.81 billion.

Operations: The company generates revenue primarily from the production and distribution of skincare and makeup products.

Estimated Discount To Fair Value: 17.8%

Yunnan Botanee Bio-Technology Group Co.LTD, priced at CN¥49.48, trades below its estimated fair value of CN¥60.17, reflecting a moderate undervaluation based on cash flow analysis. Despite this, the company's projected earnings growth is robust at 23.1% annually over the next three years, outpacing the broader Chinese market's growth rate. However, concerns arise from its declining profit margins and unstable dividend track record, alongside recent decreases in dividend payouts as evidenced by multiple announcements in May 2024.

- The growth report we've compiled suggests that Yunnan Botanee Bio-Technology GroupLTD's future prospects could be on the up.

- Click here to discover the nuances of Yunnan Botanee Bio-Technology GroupLTD with our detailed financial health report.

Summing It All Up

- Gain an insight into the universe of 94 Undervalued Chinese Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether INKON Life Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300143

INKON Life Technology

Focuses on building an ecological platform for chain of pre-diagnosis/treatment/health providing medical services for tumors in China and internationally.

Flawless balance sheet with reasonable growth potential.