- China

- /

- Healthtech

- /

- SZSE:300253

Winning Health Technology Group (SZSE:300253) sheds CN¥708m, company earnings and investor returns have been trending downwards for past three years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Winning Health Technology Group Co., Ltd. (SZSE:300253) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 62% drop in the share price over that period. The more recent news is of little comfort, with the share price down 33% in a year. Furthermore, it's down 10% in about a quarter. That's not much fun for holders.

With the stock having lost 5.0% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Winning Health Technology Group

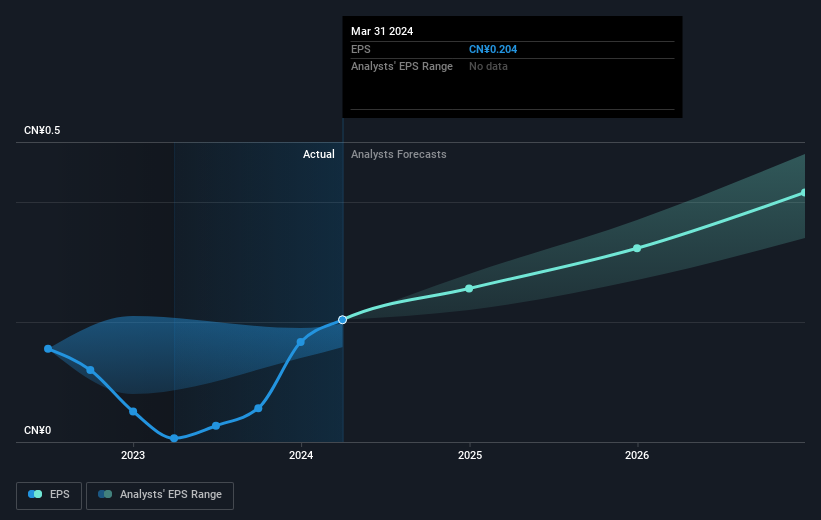

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, Winning Health Technology Group's earnings per share (EPS) dropped by 4.0% each year. This reduction in EPS is slower than the 28% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Winning Health Technology Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

While the broader market lost about 8.9% in the twelve months, Winning Health Technology Group shareholders did even worse, losing 33% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Winning Health Technology Group that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Winning Health Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300253

Winning Health Technology Group

Winning Health Technology Group Co., Ltd.

Reasonable growth potential with adequate balance sheet.