Stock Analysis

3 Leading Growth Companies On Chinese Exchange With Insider Ownership Up To 36%

Reviewed by Simply Wall St

Amidst a backdrop of significant government interventions aimed at stabilizing the property sector and mixed economic signals, China's market presents a complex landscape for investors. In such an environment, growth companies with high insider ownership can be particularly compelling, as substantial insider stakes often signal confidence in the company's prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 64.8% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Underneath we present a selection of stocks filtered out by our screen.

Goodwill E-Health Info (SHSE:688246)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Goodwill E-Health Info Co., Ltd. is a Chinese company specializing in the research and development of medical information software, with a market capitalization of approximately CN¥3.64 billion.

Operations: The company specializes in medical information software development, reflected in its revenue generation solely from this segment.

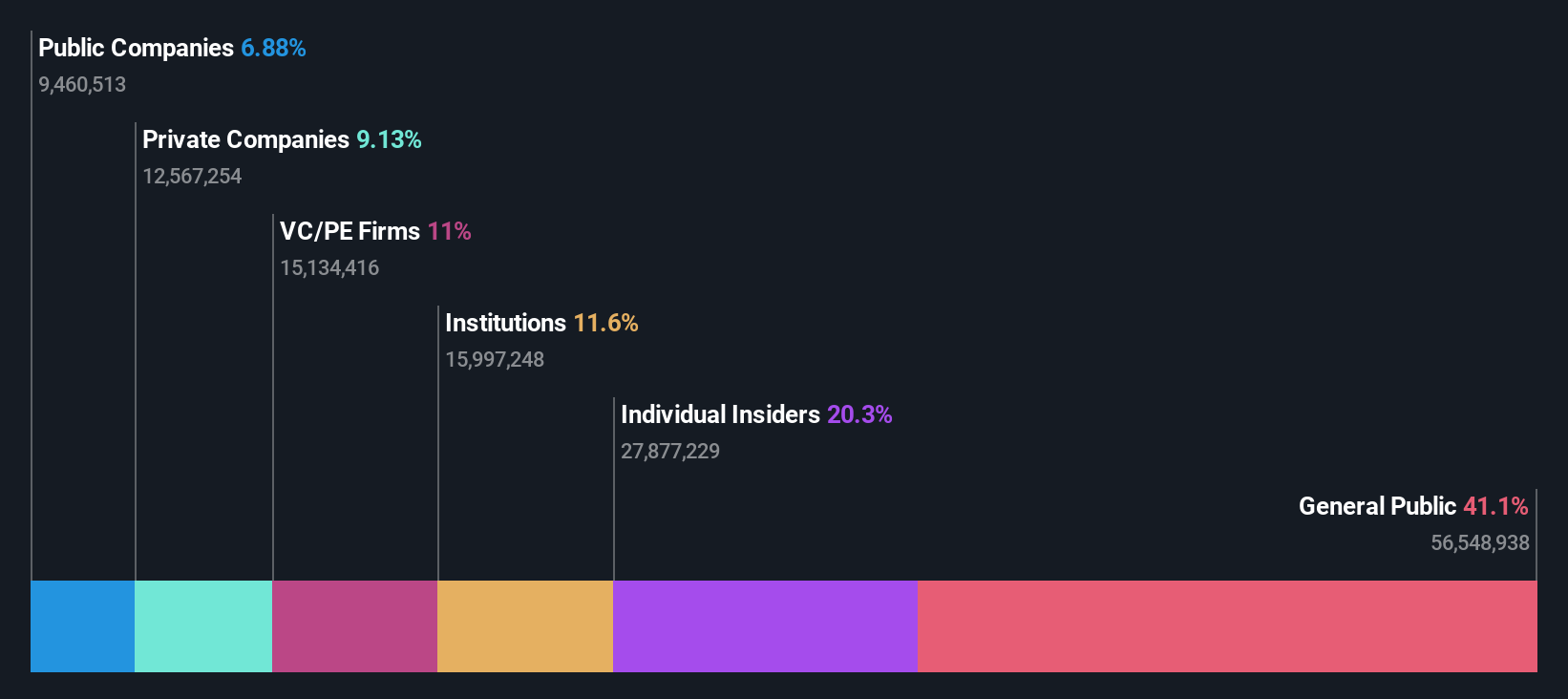

Insider Ownership: 20.1%

Goodwill E-Health Info, despite its recent net losses and revenue decline from the previous year, shows promising signs of recovery with a reduced net loss in Q1 2024 and a significant share buyback program. The company's earnings and revenue are expected to grow substantially over the next three years, outpacing market averages. However, challenges remain with a forecasted low return on equity and ongoing share price volatility. These factors highlight both the potential growth trajectory and areas of concern for Goodwill E-Health Info in China's competitive e-health sector.

- Delve into the full analysis future growth report here for a deeper understanding of Goodwill E-Health Info.

- Our valuation report here indicates Goodwill E-Health Info may be overvalued.

Fujian Boss Software (SZSE:300525)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fujian Boss Software Corp., a provider of software products and services in China, has a market capitalization of approximately CN¥9.79 billion.

Operations: The company generates its revenue from various software products and services across China.

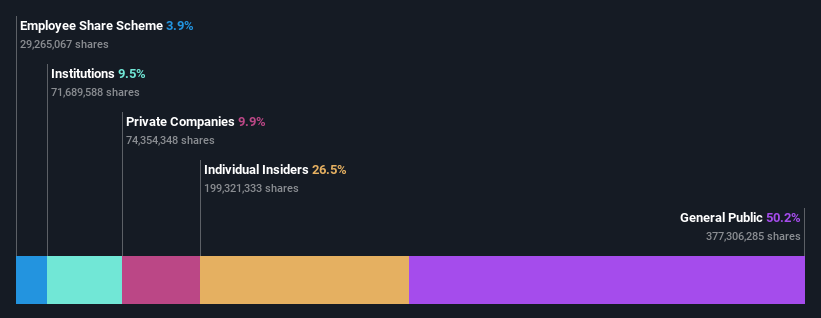

Insider Ownership: 26.5%

Fujian Boss Software, a Chinese growth company with high insider ownership, reported a robust financial performance in 2023 with sales and net income showing significant increases from the previous year. Despite this positive trend, the company experienced a net loss in Q1 2024. Nevertheless, Fujian Boss is expected to sustain higher-than-market earnings growth over the next few years. The firm also maintains a competitive price-to-earnings ratio compared to its peers and has recently completed a share buyback program.

- Click here to discover the nuances of Fujian Boss Software with our detailed analytical future growth report.

- Our expertly prepared valuation report Fujian Boss Software implies its share price may be lower than expected.

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. specializes in the research, development, production, and sale of circuit protection devices and fuses, with a market capitalization of approximately CN¥5.97 billion.

Operations: The company generates revenue primarily from the sale of circuit protection devices and fuses.

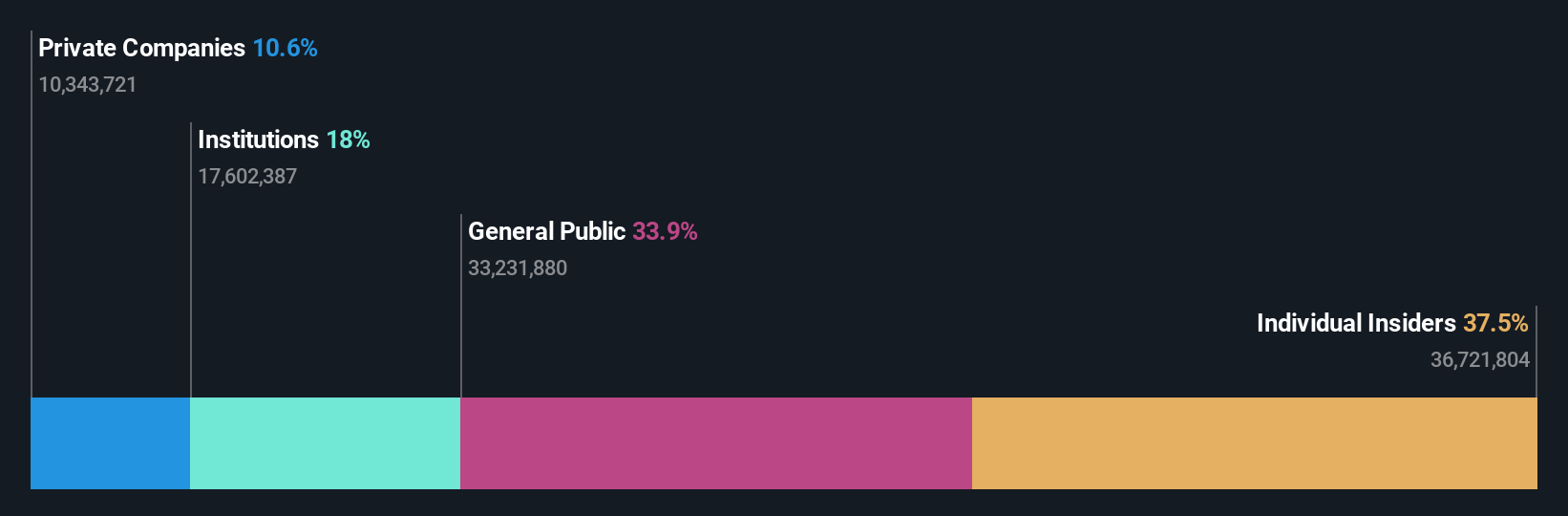

Insider Ownership: 36.7%

Xi'an Sinofuse Electric, a Chinese growth company with high insider ownership, recently declared a modest dividend following a year of significant revenue increase to CNY 1.06 billion. Despite this growth, profit margins declined from the previous year, reflecting challenges in maintaining profitability. The company forecasts robust future earnings growth at 43.12% per year, outpacing the market prediction of 23.3%. However, concerns about dividend coverage and lower profit margins may temper investor enthusiasm.

- Click to explore a detailed breakdown of our findings in Xi'an Sinofuse Electric's earnings growth report.

- The valuation report we've compiled suggests that Xi'an Sinofuse Electric's current price could be inflated.

Key Takeaways

- Dive into all 410 of the Fast Growing Chinese Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Fujian Boss Software is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300525

High growth potential with solid track record.