- China

- /

- Medical Equipment

- /

- SHSE:688161

Beijing Yuanliu Hongyuan Electronic Technology And 2 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

With global markets experiencing a mix of record highs and inflationary pressures, investors are navigating a complex landscape marked by economic uncertainties and policy shifts. Amidst this environment, identifying undervalued stocks can be an appealing strategy for those looking to capitalize on potential market inefficiencies. In this article, we explore Beijing Yuanliu Hongyuan Electronic Technology and two other stocks that may currently be trading below their estimated value, offering insights into how they might present opportunities in today's fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.48 | US$36.92 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$110.50 | NT$220.75 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$55.32 | US$110.32 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$14.90 | MX$29.71 | 49.9% |

| Com2uS (KOSDAQ:A078340) | ₩48250.00 | ₩96043.49 | 49.8% |

| F-Secure Oyj (HLSE:FSECURE) | €1.706 | €3.41 | 49.9% |

| AIMECHATEC (TSE:6227) | ¥3785.00 | ¥7563.15 | 50% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €3.285 | €6.57 | 50% |

| Hindustan Foods (BSE:519126) | ₹572.85 | ₹1143.64 | 49.9% |

Let's dive into some prime choices out of the screener.

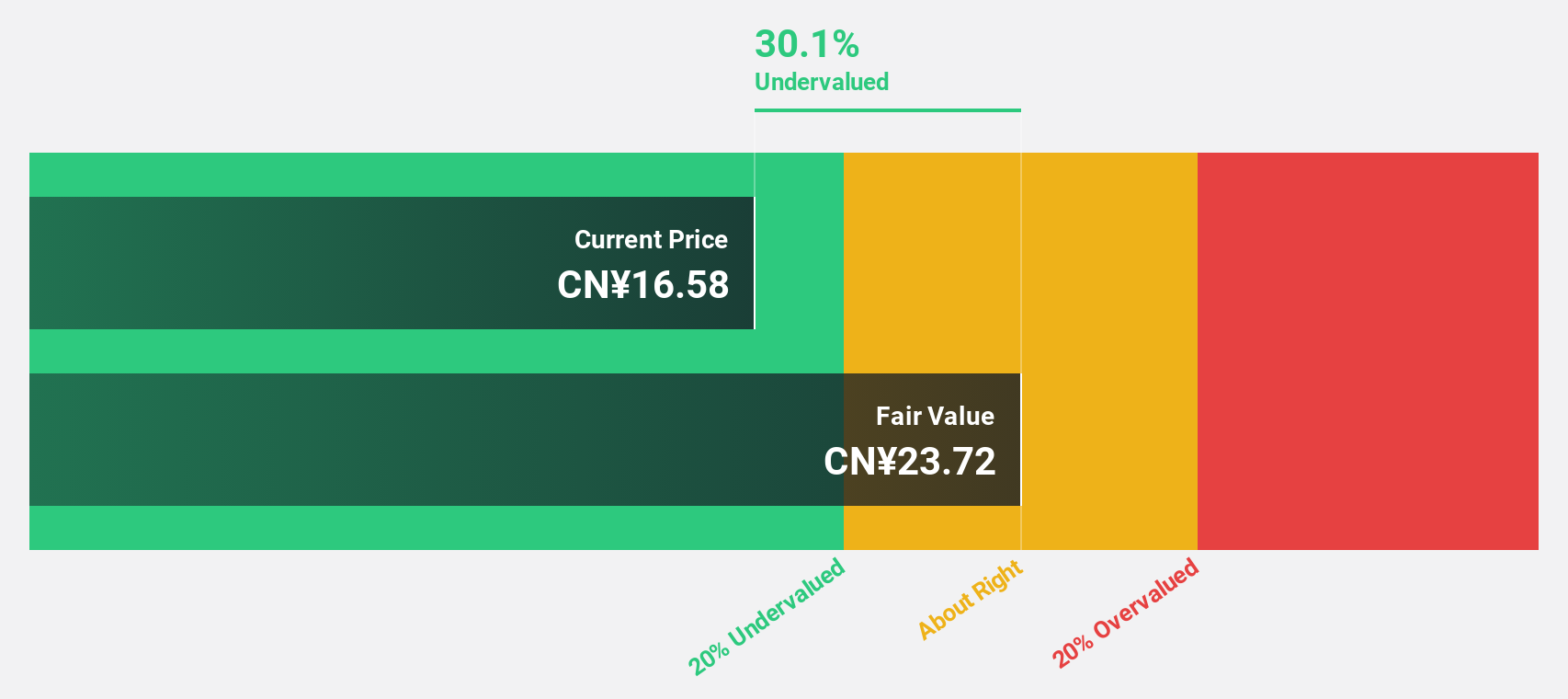

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market cap of CN¥8.21 billion.

Operations: I'm unable to provide a summary of the company's revenue segments as no specific segment details were included in the provided text.

Estimated Discount To Fair Value: 43.6%

Beijing Yuanliu Hongyuan Electronic Technology is trading at CN¥37.75, significantly below its estimated fair value of CN¥66.96, suggesting undervaluation based on cash flows. Despite a low forecasted return on equity of 9.5%, the company shows strong growth potential with expected annual earnings and revenue growth rates of 40.86% and 24%, respectively, outpacing the Chinese market averages. However, profit margins have declined from last year’s levels, indicating some operational challenges.

- In light of our recent growth report, it seems possible that Beijing Yuanliu Hongyuan Electronic Technology's financial performance will exceed current levels.

- Take a closer look at Beijing Yuanliu Hongyuan Electronic Technology's balance sheet health here in our report.

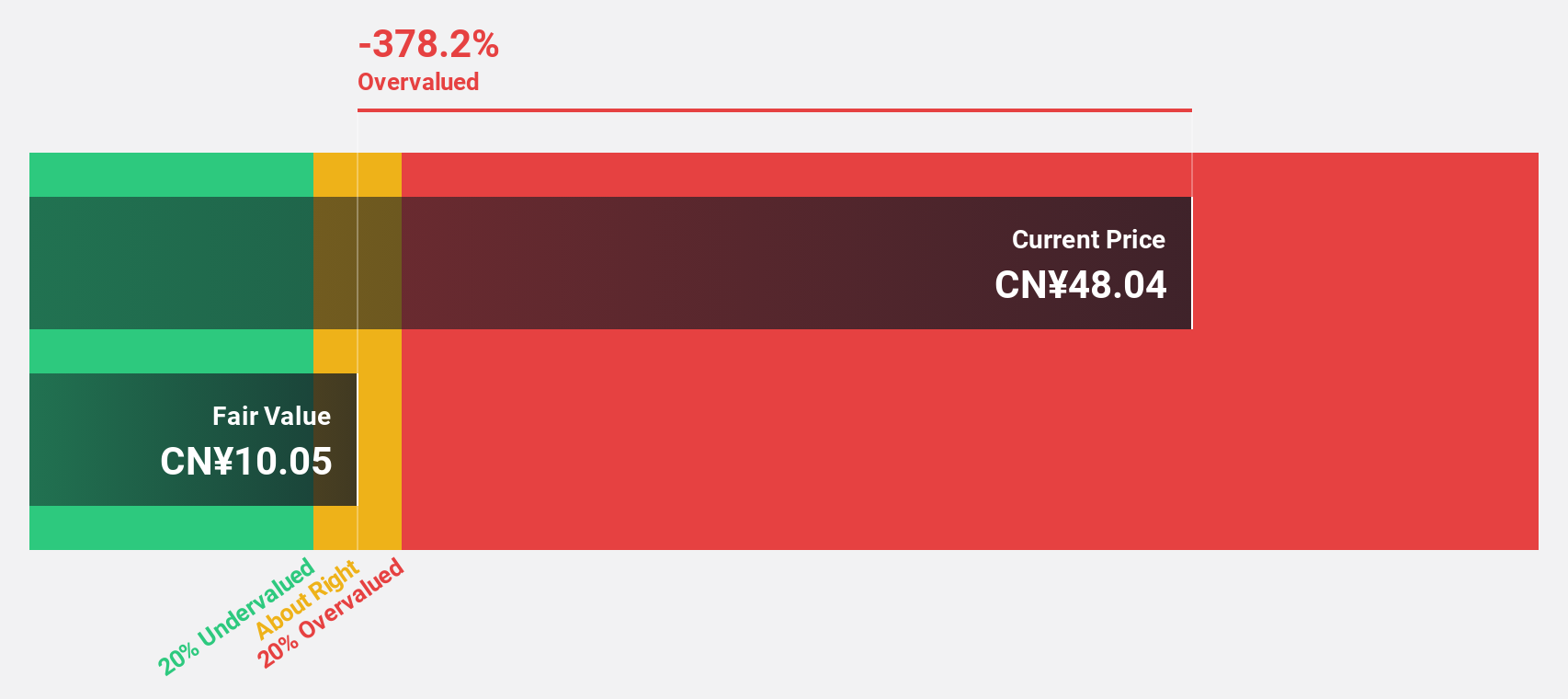

Shandong Weigao Orthopaedic Device (SHSE:688161)

Overview: Shandong Weigao Orthopaedic Device Co., Ltd. operates in the medical device industry, focusing on orthopaedic products, with a market cap of CN¥10.44 billion.

Operations: The company generates revenue primarily from its medical products segment, amounting to CN¥1.28 billion.

Estimated Discount To Fair Value: 39.6%

Shandong Weigao Orthopaedic Device, trading at CN¥26.81, is significantly undervalued compared to its estimated fair value of CN¥44.41, based on cash flows. Despite being removed from the Shanghai Stock Exchange Health Care Sector Index recently, the company demonstrates robust growth potential with earnings expected to grow 30.4% annually over three years and revenue growth forecasted at 19.3% per year—both surpassing market averages—though it faces a low future return on equity of 7.7%.

- Upon reviewing our latest growth report, Shandong Weigao Orthopaedic Device's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Shandong Weigao Orthopaedic Device with our comprehensive financial health report here.

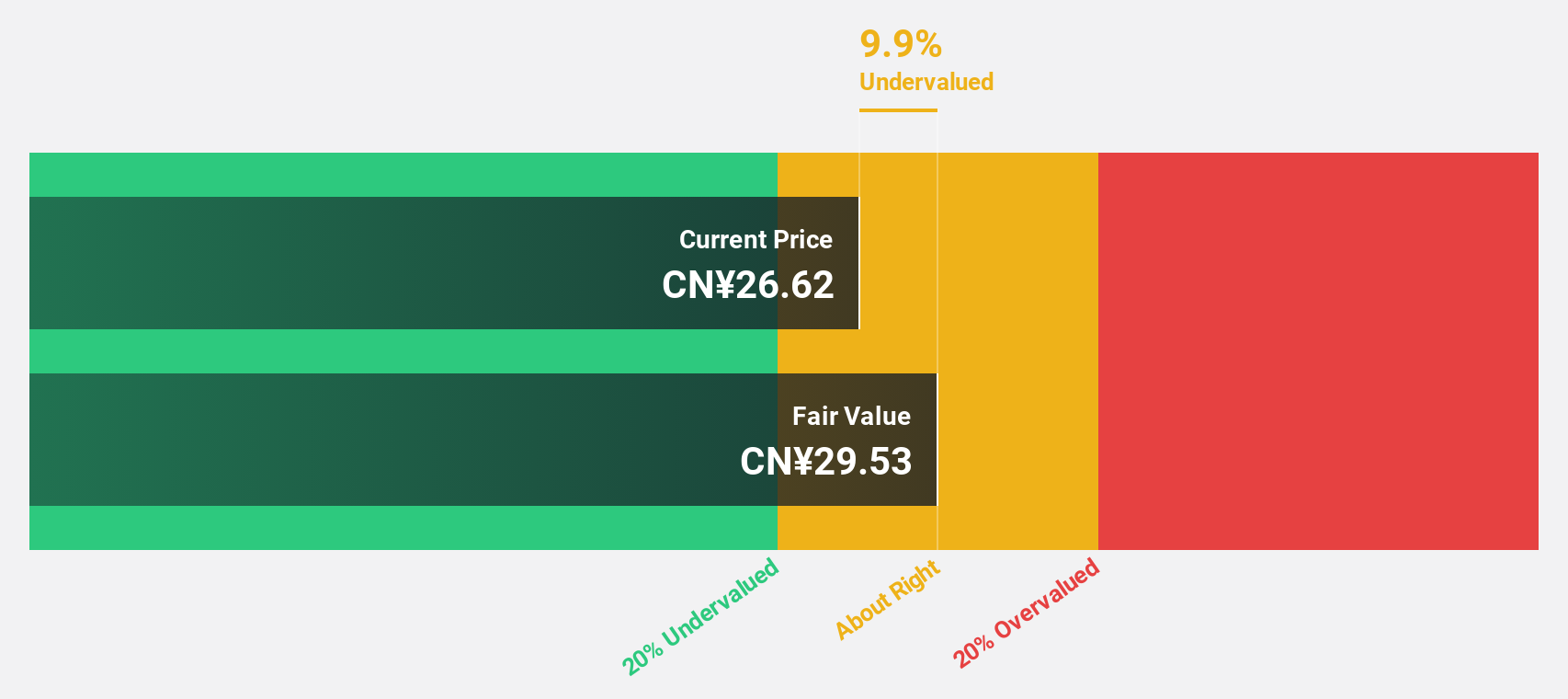

Beijing ConST Instruments Technology (SZSE:300445)

Overview: Beijing ConST Instruments Technology Inc. researches, develops, manufactures, and sells digital testing instruments and equipment both in China and internationally, with a market cap of CN¥3.90 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 20.2%

Beijing ConST Instruments Technology, priced at CN¥18.44, is trading 20.2% below its estimated fair value of CN¥23.1, based on cash flows. The company has shown strong past performance with a 47% earnings growth last year and is forecasted to continue growing revenue at 21.7% annually—outpacing the market average—despite a lower expected return on equity of 13.2% in three years and earnings growth slightly below the market rate at 24.4%.

- According our earnings growth report, there's an indication that Beijing ConST Instruments Technology might be ready to expand.

- Get an in-depth perspective on Beijing ConST Instruments Technology's balance sheet by reading our health report here.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 917 more companies for you to explore.Click here to unveil our expertly curated list of 920 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688161

Shandong Weigao Orthopaedic Device

Shandong Weigao Orthopaedic Device Co., Ltd.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives