- China

- /

- Medical Equipment

- /

- SHSE:688139

Qingdao Haier BiomedicalLtd's (SHSE:688139) earnings trajectory could turn positive as the stock climbs 5.1% this past week

Qingdao Haier Biomedical Co.,Ltd (SHSE:688139) shareholders should be happy to see the share price up 30% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 68% in the last three years. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

The recent uptick of 5.1% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Qingdao Haier BiomedicalLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

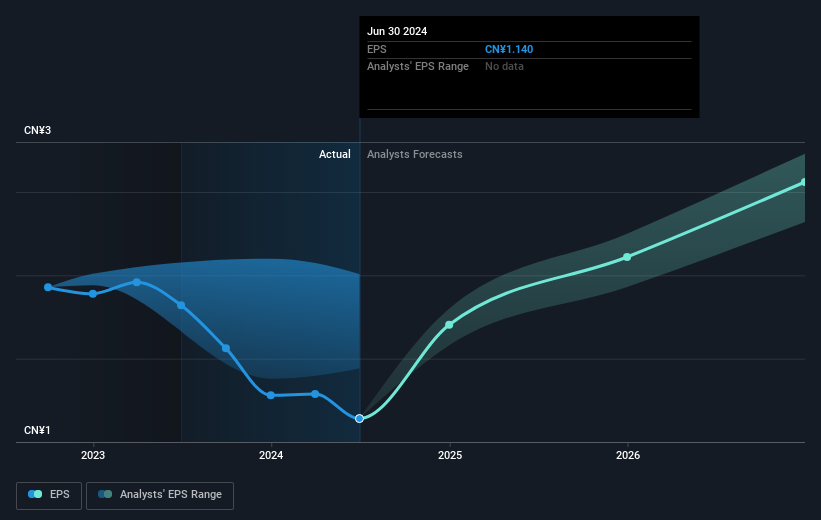

Qingdao Haier BiomedicalLtd saw its EPS decline at a compound rate of 23% per year, over the last three years. The share price decline of 32% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Qingdao Haier BiomedicalLtd's earnings, revenue and cash flow.

A Different Perspective

Qingdao Haier BiomedicalLtd shareholders are down 9.3% for the year (even including dividends), but the market itself is up 9.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.0% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Qingdao Haier BiomedicalLtd you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Haier BiomedicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688139

Qingdao Haier BiomedicalLtd

Engages in the design, manufacture, marketing, and sale of low temperature storage equipment for biomedical samples worldwide.

Flawless balance sheet with high growth potential.