- China

- /

- Medical Equipment

- /

- SHSE:605369

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable upswing, with small-cap indices like the Russell 2000 reaching record highs amid robust trading activity and geopolitical developments. As investors navigate these dynamic conditions, identifying stocks with strong fundamentals and growth potential becomes increasingly important.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic Region, Europe, North America, Asia, and internationally with a market cap of SEK10.37 billion.

Operations: Lesjöfors contributes SEK4.82 billion and Beijer Tech SEK2.25 billion to the company's revenue streams.

Beijer Alma, a notable player in the machinery sector, recently reported robust earnings growth of 44.5%, outpacing the industry's -5% performance. The company achieved net income of SEK 303 million for Q3 2024, up from SEK 134 million the previous year. A significant one-off gain of SEK 223 million influenced recent financial results. Despite trading at an attractive value—35.2% below estimated fair value—its net debt to equity ratio stands at a high 51.5%. Interest payments are well-covered with EBIT at 4.3x coverage, indicating solid operational efficiency amidst its financial challenges.

- Get an in-depth perspective on Beijer Alma's performance by reading our health report here.

Examine Beijer Alma's past performance report to understand how it has performed in the past.

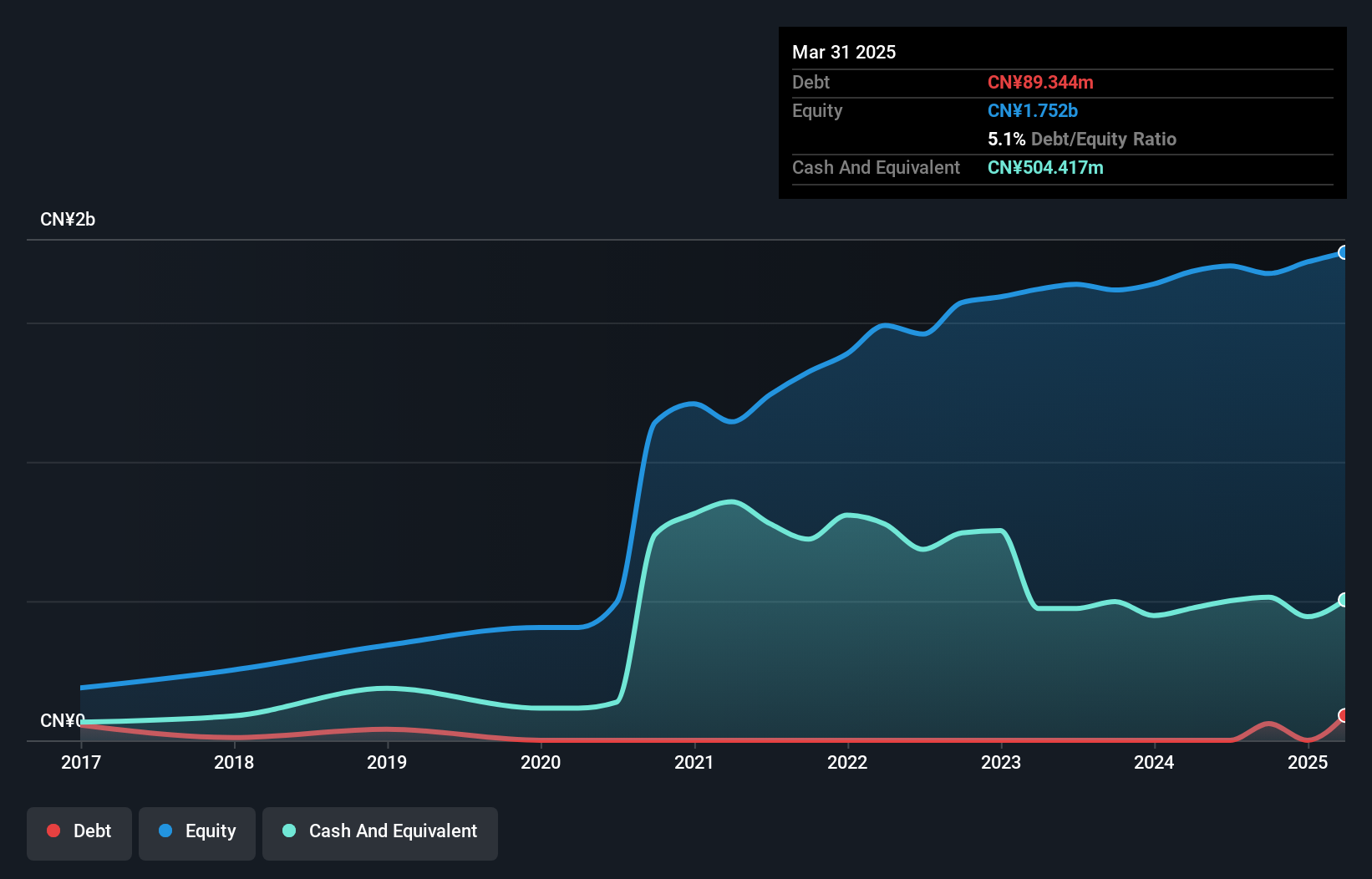

Zhejiang Gongdong Medical Technology (SHSE:605369)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Gongdong Medical Technology Co., Ltd. operates in the medical technology sector and has a market cap of CN¥4.98 billion.

Operations: Gongdong Medical Technology generates its revenue primarily from the medical technology sector, with a market capitalization of CN¥4.98 billion. The company's financial performance can be analyzed through its net profit margin trends, which provide insight into profitability relative to total revenue.

Zhejiang Gongdong Medical Technology, a promising player in the medical equipment sector, reported robust growth with sales reaching CNY 836.03 million for the first nine months of 2024, up from CNY 712.68 million last year. Net income also saw a jump to CNY 141.4 million compared to CNY 88.25 million previously, reflecting its strong market position and operational efficiency. The company completed a share buyback of approximately 1.25 million shares for CNY 36 million, enhancing shareholder value further. With earnings forecasted to grow by nearly 31% annually, it seems poised for continued expansion in its industry niche.

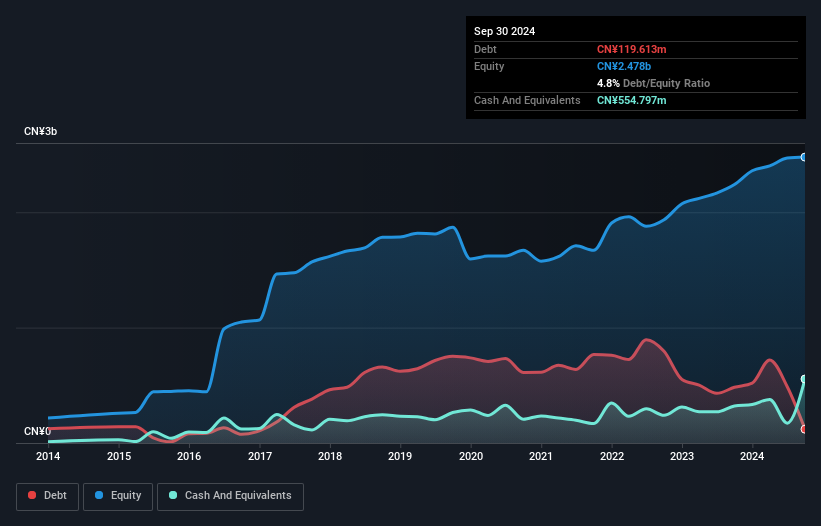

Ningbo BaoSi Energy Equipment (SZSE:300441)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo BaoSi Energy Equipment Co., Ltd. is involved in the research, development, production, and sale of high-end precision mechanical parts and equipment both in China and internationally, with a market cap of CN¥5.63 billion.

Operations: Ningbo BaoSi Energy Equipment Co., Ltd.'s primary revenue stream is from its Screw Compressor Division, generating CN¥1.46 billion. The company's net profit margin presents an interesting trend, reflecting the efficiency of its operations and cost management strategies.

Ningbo BaoSi Energy Equipment stands out with its recent financial achievements, showcasing a robust net income of CNY 703 million for the first nine months of 2024, up from CNY 174 million the previous year. The company's earnings per share also surged to CNY 1.08 from CNY 0.27, reflecting strong profitability. With a price-to-earnings ratio at an attractive 7x compared to the broader CN market's 36x, it seems undervalued relative to peers and industry standards. Despite concerns over free cash flow positivity, its debt-to-equity ratio has impressively reduced from 40% to just under 5% over five years.

- Click here to discover the nuances of Ningbo BaoSi Energy Equipment with our detailed analytical health report.

Learn about Ningbo BaoSi Energy Equipment's historical performance.

Make It Happen

- Click through to start exploring the rest of the 4634 Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Gongdong Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605369

Zhejiang Gongdong Medical Technology

Zhejiang Gongdong Medical Technology Co., Ltd.

High growth potential with excellent balance sheet.