Undiscovered Gems Featuring Suzhou Shihua New Material Technology And 2 Other Small Caps With Solid Potential

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record levels, investor sentiment remains buoyed by domestic policy developments and geopolitical events. Despite challenges in manufacturing and tariff concerns, the robust performance of small-cap stocks highlights their potential resilience and appeal in a dynamic economic landscape. In this context, identifying promising small-cap companies can be particularly rewarding for investors seeking growth opportunities. This article will explore three such "undiscovered gems," including Suzhou Shihua New Material Technology, that exhibit solid potential amidst these market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Rimoni Industries | NA | 4.80% | 4.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Suzhou Shihua New Material Technology (SHSE:688093)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Shihua New Material Technology Co., Ltd. is a company engaged in the development and production of advanced materials, with a market capitalization of CN¥5.20 billion.

Operations: Suzhou Shihua primarily generates revenue from the development and production of advanced materials. The company has a market capitalization of CN¥5.20 billion.

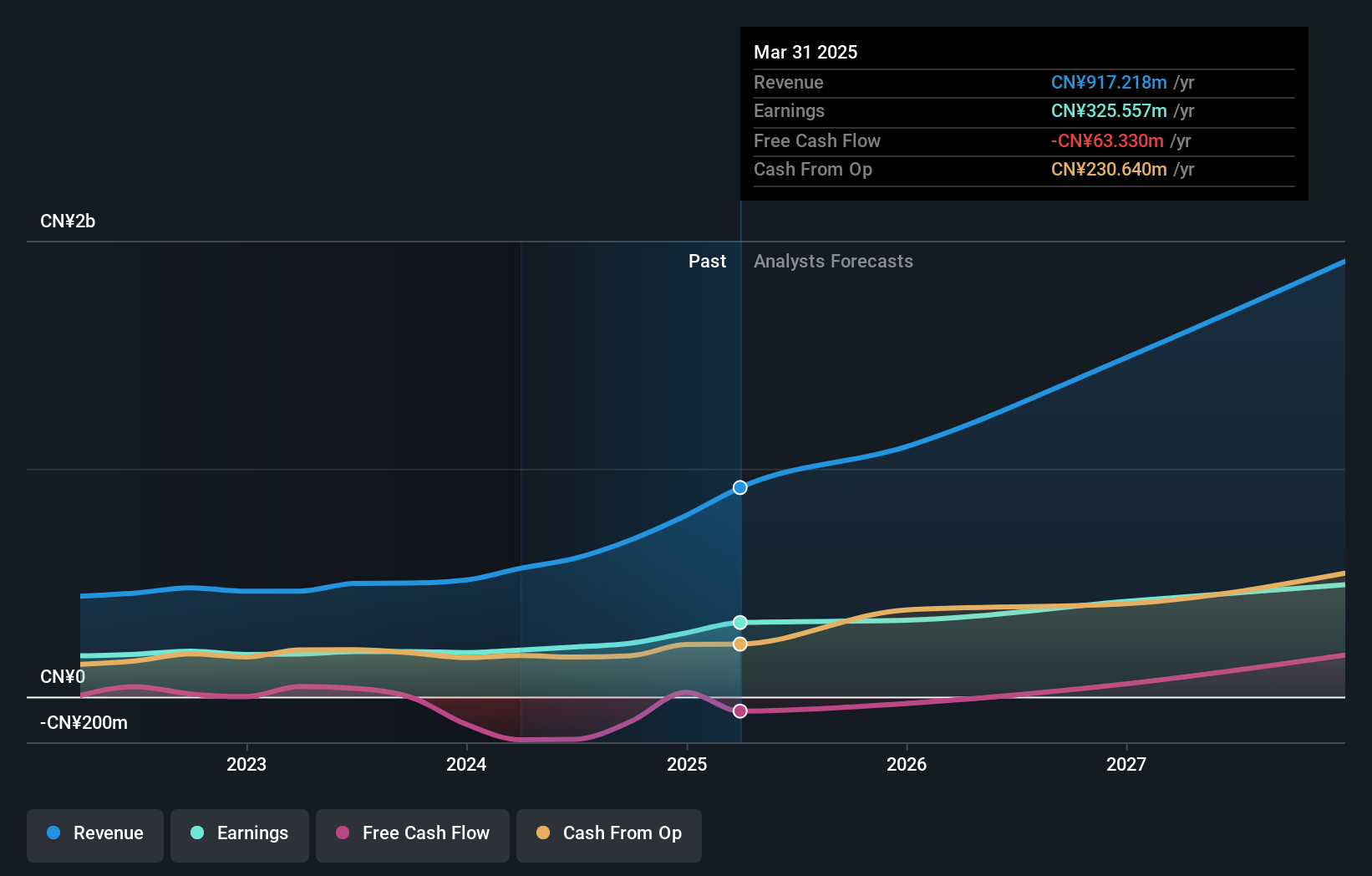

Suzhou Shihua New Material Technology, a nimble player in the chemicals sector, has shown robust earnings growth of 18.4% over the past year, outpacing the industry's -5%. The company reported sales of CNY 566.38 million for the first nine months of 2024, up from CNY 390.28 million a year ago, with net income climbing to CNY 195.55 million from CNY 154.42 million. Trading at about 33.7% below its estimated fair value and being debt-free enhances its appeal in terms of financial health and valuation metrics, despite not being free cash flow positive recently due to significant capital expenditures like -CNY 289M in Q3-2024.

Rastar Environmental Protection Materials (SZSE:300834)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rastar Environmental Protection Materials Co., Ltd. operates in the specialty chemicals industry with a market cap of CN¥4.12 billion.

Operations: The company generates revenue primarily from its specialty chemicals segment, totaling CN¥1.71 billion.

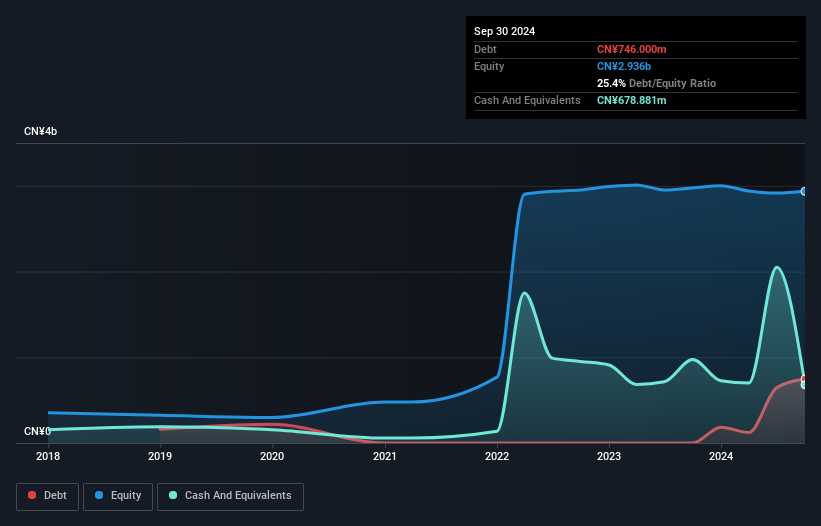

Rastar Environmental Protection Materials showcases a promising profile with its net debt to equity ratio at a satisfactory 2.3%, reflecting prudent financial management. Over the past year, earnings have grown by 5.8%, outpacing the broader Chemicals industry's -5% performance, indicating robust operational strength. Despite a challenging five-year period with earnings dropping by 24.8% annually, recent results show resilience; for the nine months ending September 2024, sales rose to CNY 1,267 million from CNY 1,156 million last year and net income increased to CNY 71 million from CNY 54 million. These figures suggest potential stability and recovery ahead for this small-cap entity in its niche market segment.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★★

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides a range of healthcare services including in-patient, semi-patient, and outpatient care in Germany, with a market cap of €856.81 million.

Operations: RHÖN-KLINIKUM generates revenue through its healthcare services, focusing on in-patient, semi-patient, and outpatient care. The company's financial performance is influenced by its net profit margin trends.

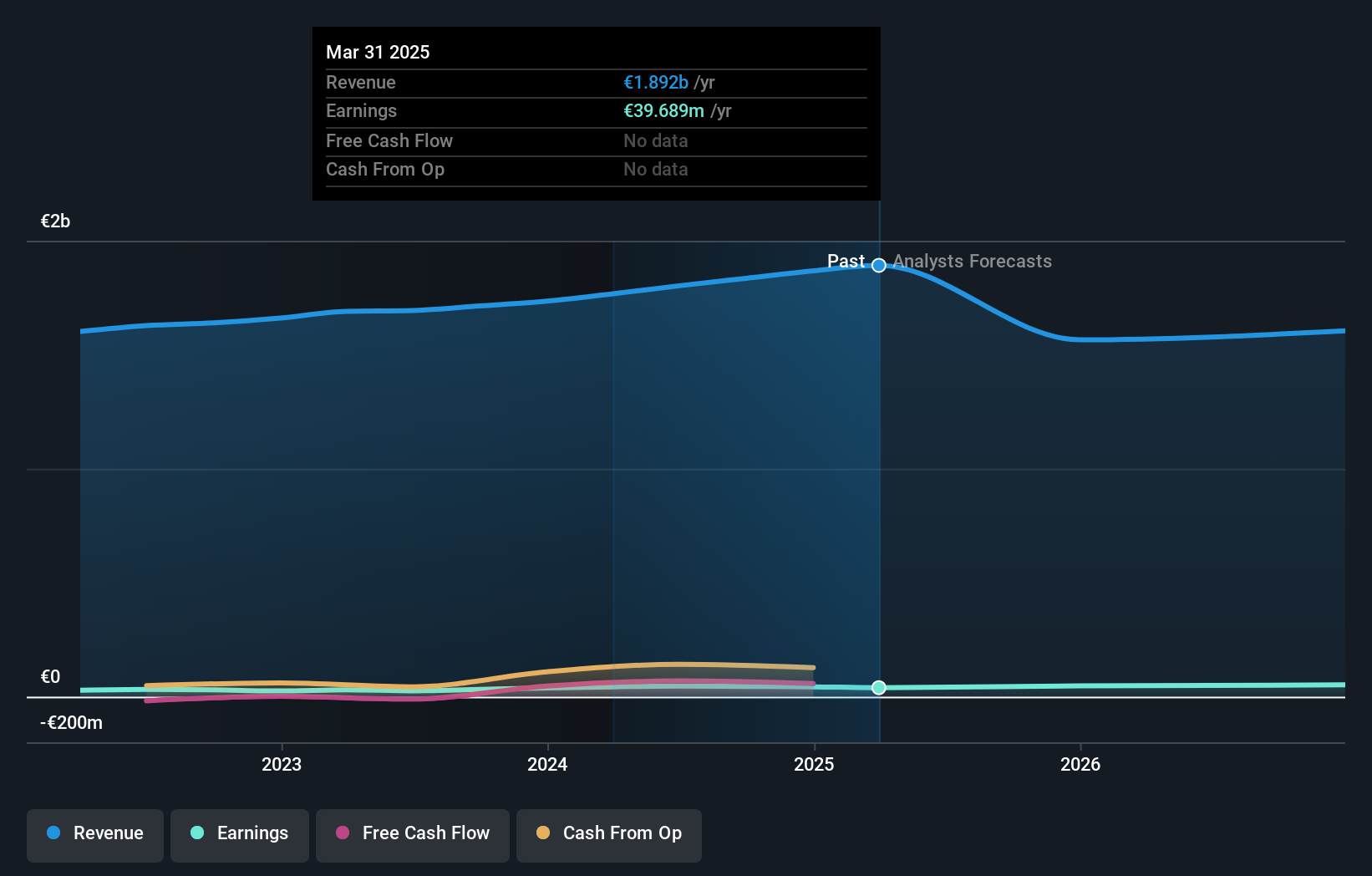

RHÖN-KLINIKUM, a healthcare player, showcases steady earnings growth of 13.9% annually over the past five years. Trading at 15.1% below its estimated fair value, it seems an attractive prospect for investors seeking undervalued opportunities. The company reported revenue of €1.38 billion for the first nine months of 2024, up from €1.28 billion last year, with net income rising to €29.32 million from €23.16 million in the same period last year. Its debt-to-equity ratio has improved from 13.6% to 10.9%, indicating prudent financial management and reduced leverage over time.

- Unlock comprehensive insights into our analysis of RHÖN-KLINIKUM stock in this health report.

Review our historical performance report to gain insights into RHÖN-KLINIKUM's's past performance.

Make It Happen

- Gain an insight into the universe of 4635 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688093

Suzhou Shihua New Material Technology

Suzhou Shihua New Material Technology Co., Ltd.

Flawless balance sheet and undervalued.