Stock Analysis

Beijing Dabeinong Technology GroupLtd (SZSE:002385 investor three-year losses grow to 46% as the stock sheds CN¥987m this past week

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Beijing Dabeinong Technology Group Co.,Ltd. (SZSE:002385) shareholders, since the share price is down 46% in the last three years, falling well short of the market decline of around 25%. And the ride hasn't got any smoother in recent times over the last year, with the price 44% lower in that time. The falls have accelerated recently, with the share price down 14% in the last three months.

If the past week is anything to go by, investor sentiment for Beijing Dabeinong Technology GroupLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Beijing Dabeinong Technology GroupLtd

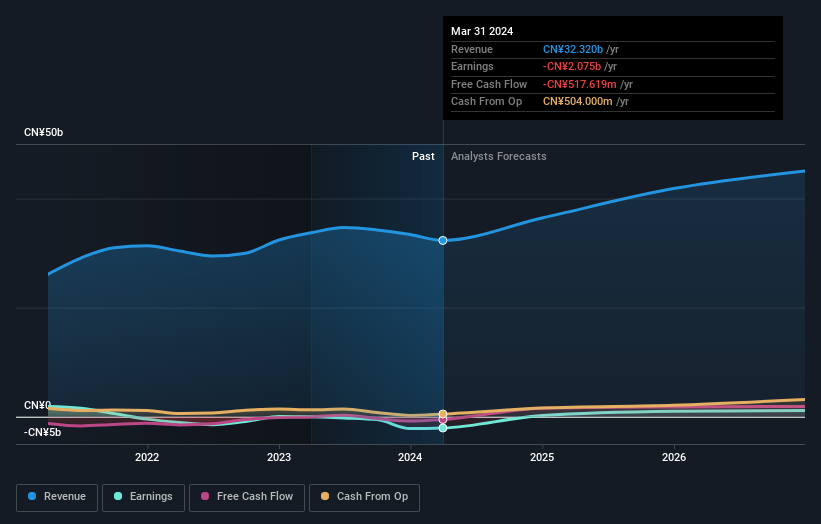

Because Beijing Dabeinong Technology GroupLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Beijing Dabeinong Technology GroupLtd grew revenue at 6.4% per year. That's not a very high growth rate considering it doesn't make profits. The stock dropped 14% during that time. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Beijing Dabeinong Technology GroupLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Beijing Dabeinong Technology GroupLtd shareholders are down 43% for the year. Unfortunately, that's worse than the broader market decline of 15%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Beijing Dabeinong Technology GroupLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Beijing Dabeinong Technology GroupLtd , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Beijing Dabeinong Technology GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Beijing Dabeinong Technology GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002385

Beijing Dabeinong Technology GroupLtd

Beijing Dabeinong Technology Group Co.,Ltd.

Undervalued with moderate growth potential.